WTI outlook: Oil prices on the rise

Oil prices seem to have been energised by some bullish tendencies since our last report. In the current report we are to discuss the conditions characterising the US oil market currently, as well as factors affecting oil demand and supply in the international oil market. We are to complete the fundamentals included in the report with a technical analysis of WTI’s chart.

US Oil market tightens

We make a start by noting that the US oil market shows signs of tightening. On Friday we note the halting of the rise of the number of active oil rigs in the US, which tends to be a negative sign for oil prices. It’s characteristic that the US Baker Hughes oil rig count dropped by one. Overall the indicator’s readings have reached a plateau which may imply that demand in the US oil market may have reached a halt. Yet the situation was reversed in the coming week as US oil inventories dropped substantially. It’s characteristic that API reported an unexpected decrease of US oil inventories by -3.341 million barrels. Similarly EIA also reported a drop of US oil inventories, a drop even wider than API, this time by -4.6 million barrels. The drawdowns reported by the two oil agencies tend to highlight how oil production levels in the US were unable to catch up with aggregated oil demand, implying a relative tightness in the US oil market, an element considered as bullish for oil prices.

International geopolitical challenges and OPEC’s intentions

Hopes of the market for a ceasefire agreement in Ukraine and the agreement for safe passage in the Black Sea tend to weigh on oil prices. Yet we tend to maintain our doubts about the viability of such a ceasefire, as Russia seems to be unwilling to abide. Should we see the ceasefire agreement falling through we expect to see a possible bullish effect on oil prices, while the agreement as such may have been allready largely priced in by oil traders thus possibly having a low bearish impact on oil prices. On the other hand the war in Gaza is ongoing allowing for some nervousness to be present among oil traders. An escalation is possible and such a scenario may have a bullish effect on oil prices, yet the options for the Palestinians are very few and noes sems so good, thus an easing may occur that may weigh on oil prices. Yet the issue has allready grown oil traders tired, thus only an exceptional development on the issue could have an impact on oil prices. Last but not least we note, US President Trump’s announcement, that the US is to impose tariffs on countries buying oil from Venezuela. It’s characteristic that reports highlight that Indian refineries have allready started not accepting supplies from Venezuela. Thus the US tariffs could tighten the supply of the international oil market thus may have a bullish effect on oil prices. As for OPEC, headlines highlight the oil producer’s organisation intentions to increase oil production levels, news that tend to have a bearish effect on oil prices. The warning by Russia’s central bank of a possible scenario were the US and OPEC could flood the international oil market, maintaining thus oil prices at low levels for a prolonged period. Albeit the scenario mentioned earlier being remote its indicative of the possible bearish effect an oil production hike of OPEC members could have on oil prices.

Oil demand levels

Oil demand levels are substantially influenced by economic activity in the manufacturing sectors of the US and China. In the coming week, we note the release of China’s NBS and Caixin manufacturing PMI figures as well as from the US the ISM manufacturing PMI figure for the same month. Should the indicators’ readings rise beyond expectations, the releases could support oil prices as they could foreshadow higher levels of oil demand. On the other hand the US tariffs policy, with the latest highlight being US President Trump’s Announcement for a 25% tariffs on US imports of automotives. The tariffs are to be applied on passenger cars and light trucks and are to come into effect from the 3rd of April onwards. Countries most affected are to be Germany, Japan, Korea and Mexico and the new tariffs are to be on top of duties allready introduced for steel and aluminum products. In general, the US tariffs are expected to slow down economic activity at a global level, possibly having adverse effects on oil prices. Overall though we tend to highlight more the supply side of the international oil market as the demand is expected to be increased yet there seems to be ample of supply in on the international oil market despite some ups and downs.

Technical analysis

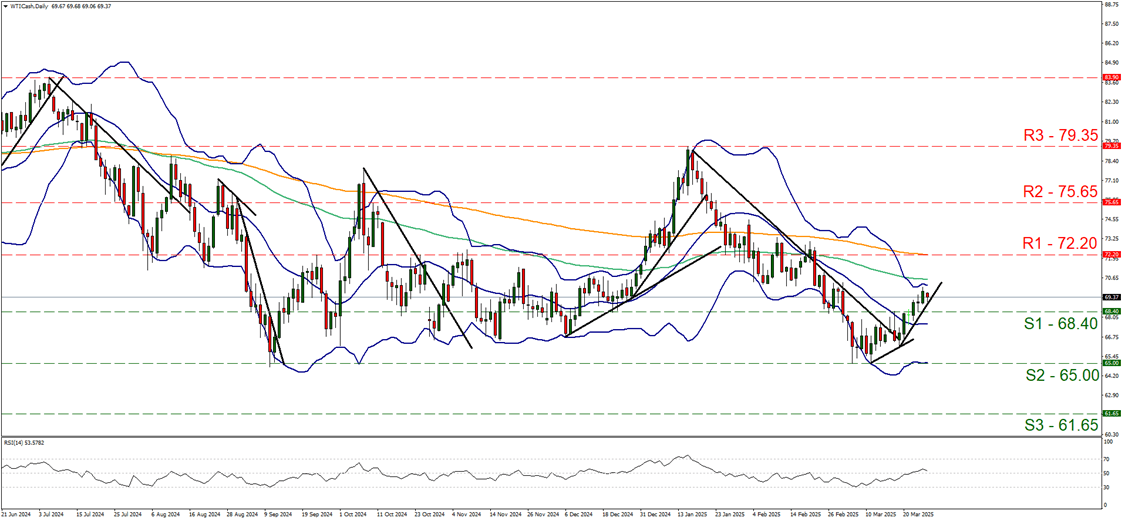

WTI cash daily chart

-

Support: 68.40 (S1), 65.00 (S2), 61.65 (S3).

-

Resistance: 72.20 (R1), 75.65 (R2), 79.35 (R3).

WTI’s price has been on the rise since our last report, breaking the 68.40 (S1) resistance line, now turned to support. The upward motion seems to be supported by an upward trendline incepted since the 19th of March and as long it remains intact we intend to maintain our bullish outlook. On the other hand though, we also note that the RSI indicator has failed to substantially rise above the reading of 50, implying some doubts on behalf of trader to push the price action of WTI higher. Should the bulls maintain control over the commodity’s price action we may see it breaching the 72.20 (R1) resistance line and start aiming for the 75.65 (R2) resistance level. Should the bears take over, we may see WTI’s price action breaking initially the prementioned upward trendline, in a first signal of an interruption of the upward motion and continue lower to break the 68.40 (S1) support line clearly and start aiming for the 65.00 (S2) support base.

Author

Peter Iosif, ACA, MBA

IronFX

Mr. Iosif joined IronFX in 2017 as part of the sales force. His high level of competence and expertise enabled him to climb up the company ladder quickly and move to the IronFX Strategy team as a Research Analyst. Mr.