Oil outlook: Iran-Israel conflict dominates Oil prices

Oil’s prices were on the rise since our last report, a bullish tendency which intensified on Tuesday, given the missile attack of Iran on Israel. In today’s report we have a look at the state of the US oil market, the situation in the Middle East, the demand side of the international oil market and OPEC’s ministerial meeting. The report is to be concluded with a technical analysis of WTI’s daily chart.

Mixed signals from the US Oil market

There were mixed signals from the US oil market in the past few days. We make a start by noting that the Baker Hughes oil rig count last Friday showed that the number of active oil rigs in the US dropped by 4, reaching 484. The release tended to imply a slack of the US oil market as shutting down of 4 active oil rigs may have been caused by reduced demand. On Tuesday we got the API weekly crude oil inventories figure showed a narrowed drawdown in US oil inventories of almost -1.5 million barrels, if compared to prior reading of -4.339 million barrels. Yet despite narrowing, the drawdown implied that oil production was note able to reach aggregated demand levels thus the US oil market under such circumstances could be considered as tight. On the flip side EIA on Wednesday reported a considerable increase of oil inventories of 3.889 million barrels, implying that oil production surpassed oil demand in the US, implying a slack in the US oil market, which could be perceived as a bearish signal for oil prices. Should we see clearer signs of a slack in the US oil market we may see an adverse effect for oil prices in the coming week.

Chances for a regional conflict in the Middle East increase

Iran’s missile attack on Israel on Tuesday, may have been the main factor behind Tuesday’s strong bullish movement in oil prices. It’s characteristic that the US open on Tuesday was bullish for oil prices bearish as the market started to position itself in anticipation of the attack. The Iranian attack included a high number of missiles fired at military targets in Israel and had minimal casualties. The attack was successful in the sense that Iron Dome was not able to stop a number of missiles from hitting their targets, revealing the relative weakness of Israel’s air defences. Yet at this point, we also have to note that Iran had warned the US about the timing and the size of the attack in advance and it could be well assumed that the information was passed on to the Israelis. Despite the size of the Iranian attack, we view it as moderated, which in turn could be signalling a possible easing of the escalation. Yet Israel is expected now to strike back and the question looms, how hard it will strike back. Iran’s nuclear energy facilities are a possible target yet the US have warned Israel not to hit such sites. Another possible target that is directly linked to the international oil market could be Khark Island. The island is Iran’s main oil exporting hub and should be hit by the Israelis it could create a massive rally for oil prices, as market worries for a shortage of oil supply for the international oil market could emerge. On the flip side, a softer retaliation by Irael could calm the market’s nerves and allow for oil prices to correct lower.

OPEC’s joint ministerial meeting

The other factor in play over the past few days has been OPEC’s ministerial meeting yesterday. The Organisation in its press release emphasized the critical importance of achieving full conformity and compensation, in a sign of oil production tightening. Yet according to Reuters, OPEC has enough spare oil capacity to compensate for a full loss of Iranian supply if Israel knocks out that country's facilities but the producer group would struggle if Iran retaliates by hitting installations of its Gulf neighbours. It should be noted that Iranian exports of oil played an increasingly important role in the International oil market in the past year, despite US sanctions. Overall we see the case for OPEC to have a bullish role in regards to oil prices, yet discussions for a possible easing of oil production cuts by Saudi Arabia, had in the recent past allowed for oil prices to drop.

Demand in the international Oil market

On the demand side of the international oil market we note that further contraction of economic activity in the manufacturing sectors of China and the US, tended to weigh on the outlook of oil demand. It’s characteristic that a continuance of the contraction of economic activity in the prementioned sectors was reported by the relevant PMI figures for the past month. In addition to that the Fed’s intentions to cut rates at a slower pace than market expectations, as indicated by Fed Chairman Powell’s speech on Monday, may place additional strains on economic activity and thus weigh on oil prices.

Technical analysis

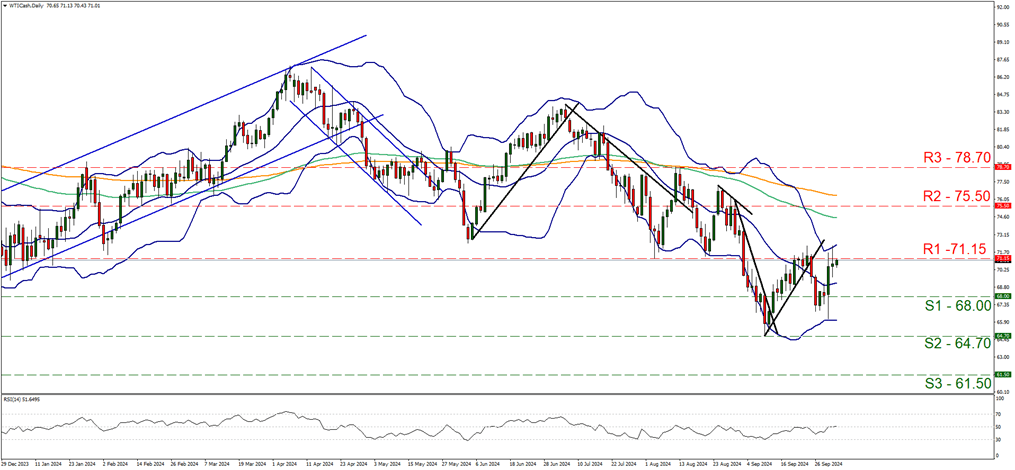

WTI cash daily chart

-

Support: 68.00 (S1), 64.70 (S2), 61.50 (S3).

-

Resistance: 71.15 (R1), 75.50 (R2), 78.70 (R3).

WTI’s price action has been on the rise since our last report and is currently testing the 71.15 (R1) resistance line. It should be noted that the RSI indicator remains stuck at the reading of 50, implying a relative indecisiveness on behalf of market participants for black gold’s price direction. We see the case for further bullish tendencies yet remain rather cautious, maintaining a sideways motion bias for the time being. For a bullish outlook we would require the commodity’s price to break above the 71.15 (R1) resistance line clearly and aim if not reach the 75.50 (R2) resistance level. Should the bears take over, we expect WTI’s price to relent the gains made in the past few days, break the 68.00 (S1) support line, thus opening the gates for the 64.70 (S2) support base.

Author

Peter Iosif, ACA, MBA

IronFX

Mr. Iosif joined IronFX in 2017 as part of the sales force. His high level of competence and expertise enabled him to climb up the company ladder quickly and move to the IronFX Strategy team as a Research Analyst. Mr.