Oil markets wicked ripper

The price of US crude oil has impressively surged, surpassing the $90 per barrel mark, which is the highest point since November. This significant increase is attributed to the intentional output reductions by major oil-producing countries such as Saudi Arabia and Russia, which have coincided with record-breaking global consumption levels. However, the International Energy Agency (IEA) has warned about the ongoing supply cuts made by these two OPEC+ leaders. The IEA's assessment predicts a "significant supply shortfall," which poses a considerable threat to ongoing price volatility. This report was released just a day after OPEC announced that the market is facing a deficit of over 3 million barrels per day in the upcoming quarter, potentially resulting in the most substantial supply shortage in over a decade.

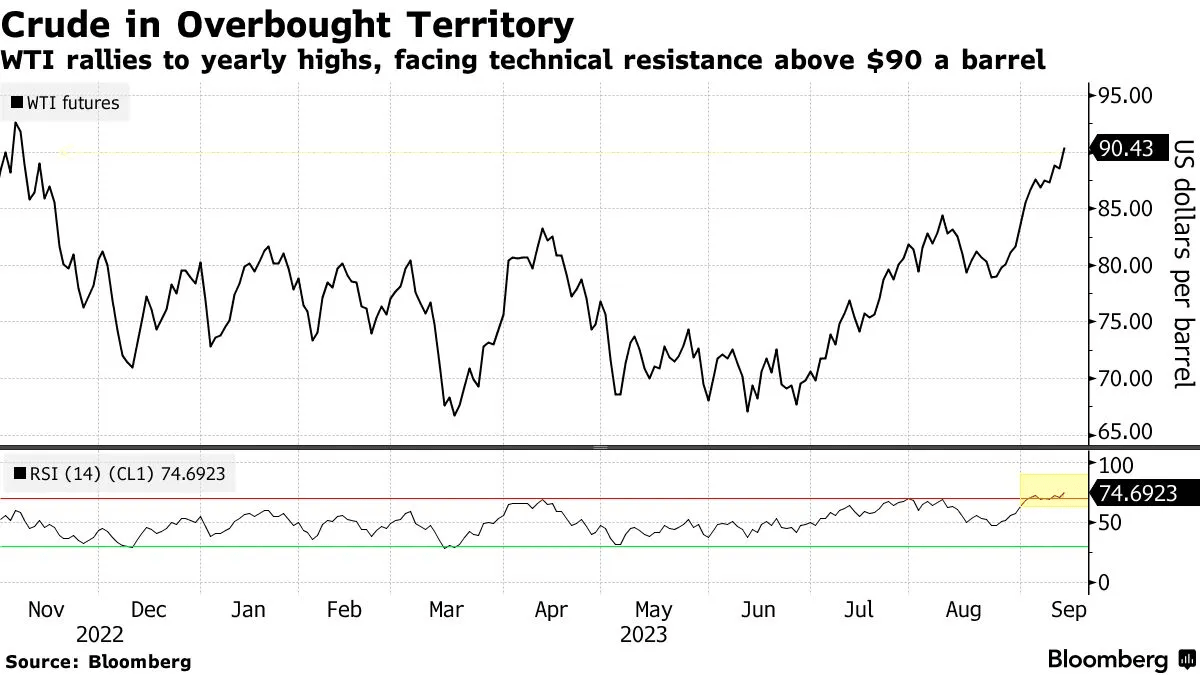

Oil’s wicked ripper is showing few signs of abating just yet. Still, if you believe such stuff implied by the graph below, chart traders may cautiously anticipate a possible pullback in the market. Technical indicators, including the relative strength index, signify that futures are approaching overbought territory, adding to the rationale for this anticipation.

Currently, there are clear indications of short-term strength in the market. Some physical grades are fetching substantial premiums over their benchmarks, a sign that refiners are eagerly acquiring barrels. Additionally, fuels are trading well above crude prices as processors strive to meet the robust demand from end-users, further underscoring the market's scarcity premium.

It's worth noting that heavy fuels, which can be more readily produced from denser Russian and Middle Eastern crudes compared to U.S. shale oil, have seen even sharper price increases than crude and gasoline. According to the Labor Department's report from Thursday, energy prices charged by suppliers surged approximately 11% in August. This surge encompassed notable price hikes in gasoline, which rose by 20%, jet fuel with a 24% increase, and diesel fuel with a substantial 41% rise.

Jet fuel prices have experienced the most significant increase, with prices surging by over 50% on the Gulf Coast since early May. This surge is primarily driven by a substantial rise in Chinese travel demand after Beijing's relaxation of pandemic-related travel restrictions.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.