Oil Markets Special: OPEC June Preview

OPEC+ will meet on Thursday and it is widely expected that the organization will increase their output. The Organization of the Petroleum Exporting Countries and its allies are showing their hawkish side amid rising growth expectations.

Meanwhile, crude oil production in the United States continues to recover rather slowly from the COVID-19-induced crisis. At the same time, oil producers don´t have to fear Iranian oil flooding the market anytime soon as negotiations to revive the nuclear deal continue to drag on, with both Tehran and Washington D.C. taking a harder stance.

There are some doubts whether OPEC+ will stick to their original plan of holding their output levels through March 2022. Demand is rising quicker than anticipated, and the global economic recovery remains on track. Nevertheless, the organization has reasons not to rush with increasing supply. The recent spike in new COVID-19 cases around the globe – primarily driven by the Delta variant – is a reminder that the pandemic is far from over, and that the uncertainty remains high.

What impact will this have on the Oil price?

OPEC+ is likely to announce an output hike of 500Mbbls/d in August, which would be in line with expectations, and continue to support Oil prices. A smaller increase would represent a bullish surprise and could trigger a price spike. On the other hand, an output hike significantly larger than the 500Mbbls/d expected may bring Oil prices under pressure and cause a sell-off.

What are the Charts signaling?

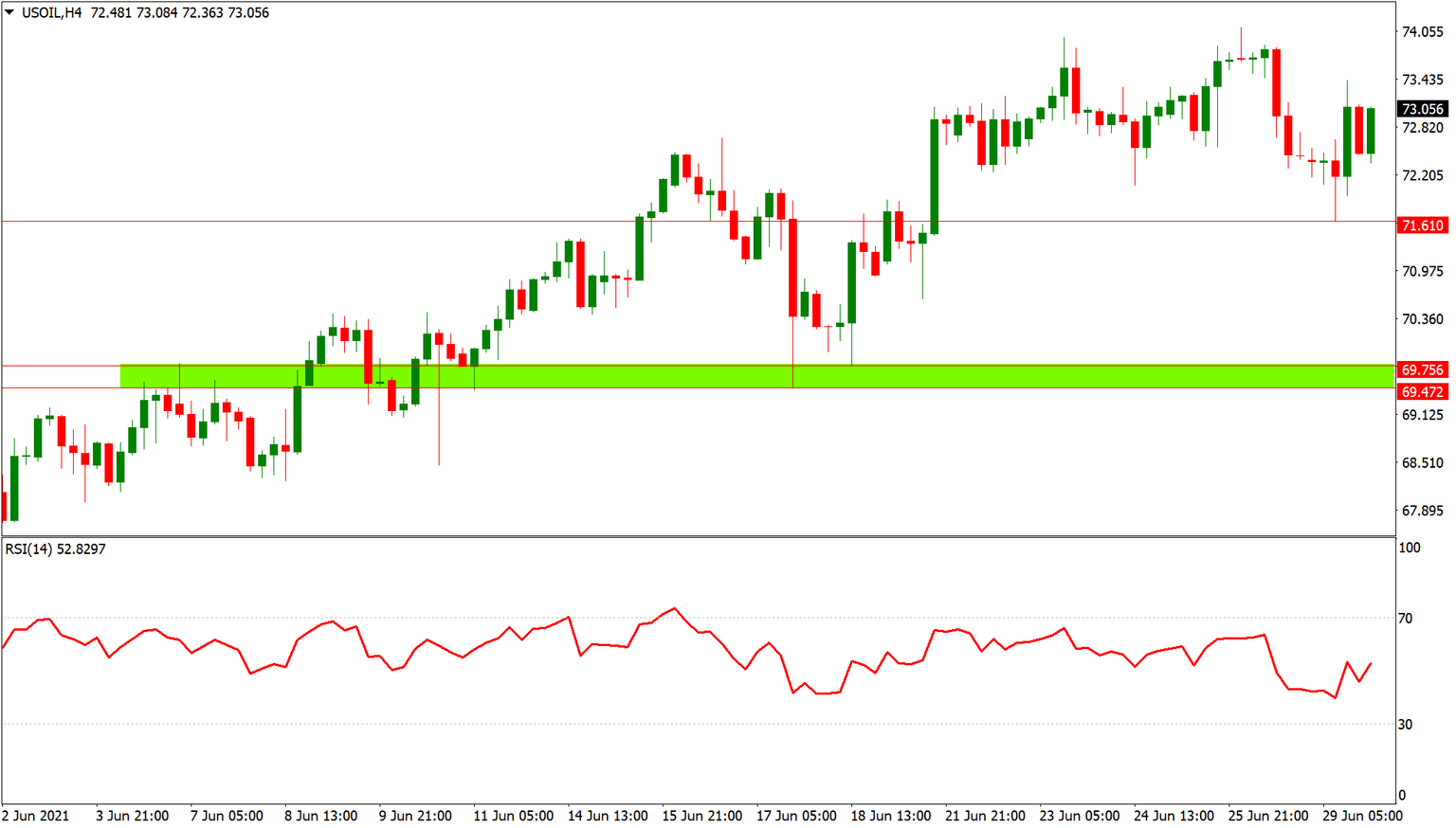

The key level to watch in USOIL is $76.80. A clear break above this level would be a significant achievement for Oil bulls and could pave the way for an extension of the rally towards $90.88 and eventually the psychologically important $100 level. The broad uptrend remains intact, and bulls have the upper hand as long as USOIL stays above $57.

Meanwhile, support is noted at $71.61. Should this level fail to hold, we could see a deeper correction towards the $69.47-76 support zone, where buyers are likely to emerge in larger numbers.

Author

Milan Cutkovic joined AxiTrader in 2014 and has over five years of experience in trading and market analysis. He was one of the first traders in the AxiSelect program, which enables traders to develop their trading career.