Oil (CL) should continue lower to build an impulsive structure [Video]

![Oil (CL) should continue lower to build an impulsive structure [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Energy/Oil/oil-pumps-28152874_XtraLarge.jpg)

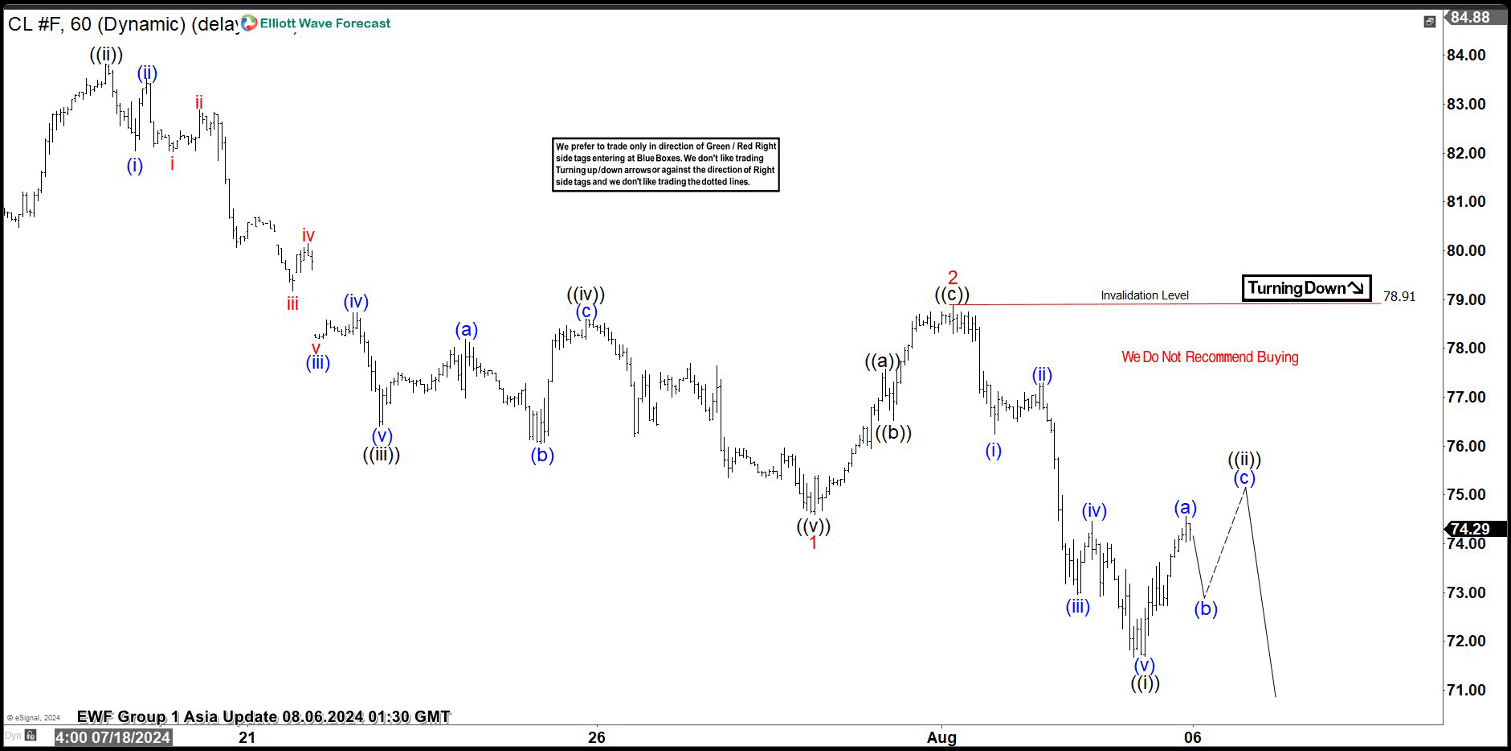

Short term Elliott Wave view in Oil (CL) suggests that cycle from 4.12.2024 high is in progress as a 5 waves impulse Elliott Wave structure. Down from 4.12.2024 high, wave (1) ended at 72.48 and rally in wave (2) ended at 84.55. The commodity has turned lower in wave (3) with internal subdivision as another impulse in lesser degree. Down from wave (2), wave (i) ended at 83.07 and rally in wave (ii) ended at 83.45. Oil then extended lower in wave (iii) towards 81.25 and wave (iv) ended at 82.16. Final leg wave (v) ended at 80.81 which completed wave ((i)) in higher degree. Wave ((ii)) unfolded in an expanded flat structure where wave (a) ended at 83.74. Wave (b) lower ended at 80.22, and rally in wave (c) ended at 83.82 which completed wave ((ii)).

Oil has turned lower in wave ((iii)) ended at 76.40 low. The market built an expanded flat correction as wave ((iv)) finishing at 78.60 high and turned lower again. CL broke below wave ((iii)) to end wave ((v)) of 1 at 74.59 low and also we ended wave 1 of (3). Up from wave 1, the market bounce in a zig zag correction ending wave 2 at 78.88 high and starting wave 3 of (3) to the downside. After 5 swings lower, wave ((i)) of 3 completed at 71.67 low and currently we are calling 3 swings higher to end wave ((ii)) pullback before resuming lower. Therefore, we expect further downside to complete wave ((iii)) of 3. Near term, as far as pivot at 78.88 high stays intact, expect rallies to fail in 3, 7, or 11 swing for further downside.

Oil (CL) 60 minutes Elliott Wave chart

CL Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com