Oil and Copper under the spotlight

A new growth scare? Why is everyone so downbeat? The Fed is thinking of a panicky 50bps cut. Keir Starmer wants to tell us it’s all pain and no gain. Well I say no to the doomsters and the gloomsters...it’s surely not that bad.

The oil market and the copper market say otherwise, however. Is this the start of fresh ISM-into-NFP growth scare like we had last month? Do we see some vol spikes and markets repricing for more Fed cuts…seems to be that way. Last time it reversed as soon as it happened but we are into a seasonally difficult stretch for the market bulls.

There was a lot of defensive positioning angst coming into the US ISM manufacturing PMI, and I am not sure when it landed it really did anything to steer things in another direction. In fact just everything that was down extended losses further, suggesting markets are taking this as a strong bearish signal into this week’s key NFP report. It’s also coming off the back of a soft German and China mfg dataset.

The PMI came in at 47.2 vs 46.8 prior and 47.5 expected. The employment sub index ticked up from a three-year low to 46.0 from 43.4 a month ago. Prices index rose to 54.0 vs 52.0 expected. Construction spending -0.3%, unchanged from last month and below the estimated +0.1%.

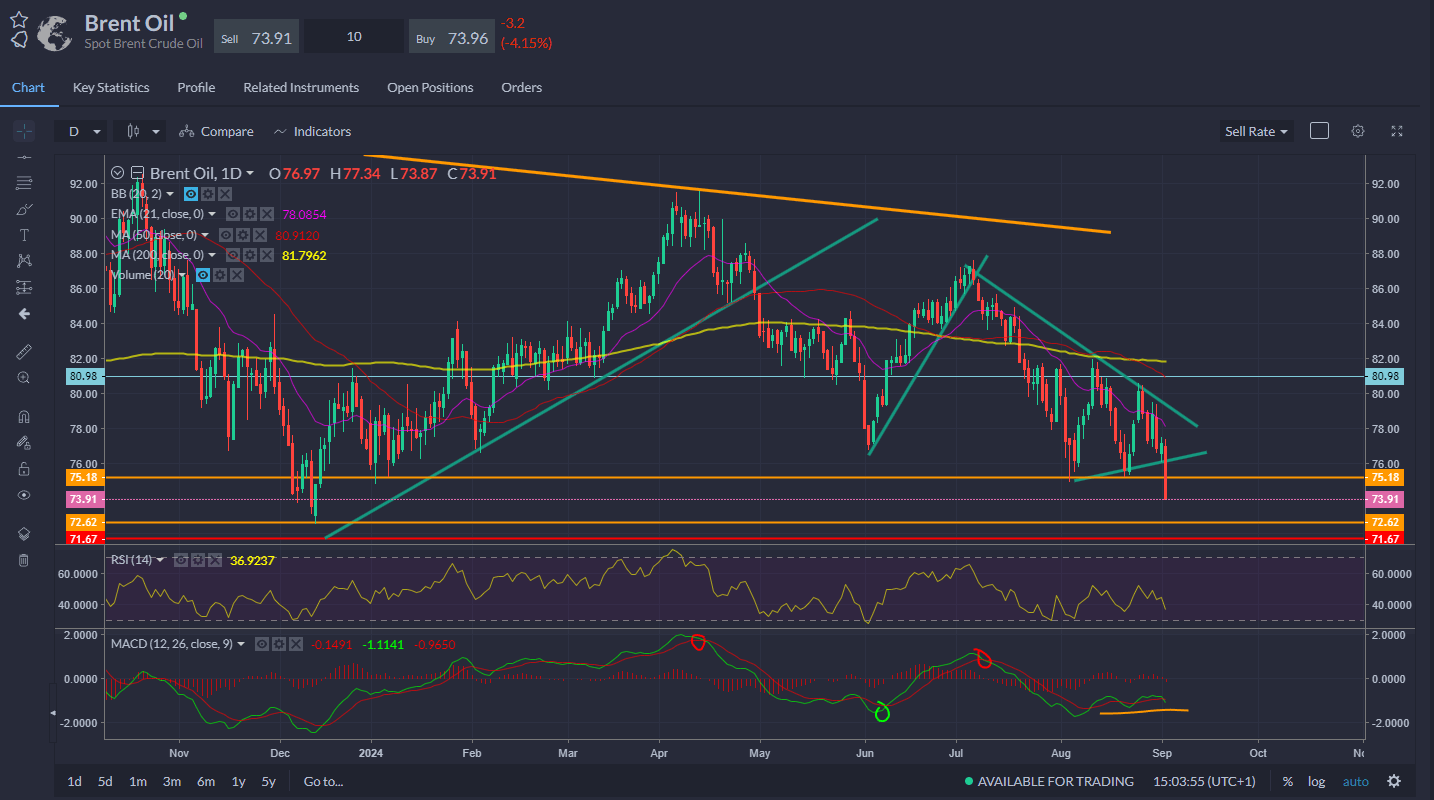

It’s not the best start to September for just about everything. Oil cracked at the bottom of the recent range to hit its lowest level the Dec ‘23 trough on a double whammy of growth fears and reports of some of the lost Libyan output restarting. Spot Brent broke down at $75 support, whilst spot WTI cracked at the $71.30/40 area that formed the recent bottoms on the last big Fib support before we are into the May ‘23 lows around $67.50, the 50% retracement of the post-Covid rally. Much below that we are into 3-year lows.

Brent broke at big support earlier and then fell through the $74 support on the ISM data

WTI also fell further on the ISM

Copper meanwhile broke down at the 200-day SMA to hit its lowest in 2 weeks. The doctor is in the house.

European stock markets reversed earlier gains to turn sharply negative as the mood turned broadly risk-off and positioning was strictly defensive. The FTSE 100, weighed down by the oil heavyweights, dived around 0.62% to 8,312, whilst the DAX retreated from near 19k to 18,840. Post-ISM they extended declines, with the FTSE 100 last down 0.9% to 8,289, weighed down by heavy losses for basic resources in particular. The DAX extended its decline to a full percent on the session.

Wall Street opened lower to kick off the what’s historically the worst month for the S&P 500 and kicked on lower still post-ISM. The VIX rose to a one-week high.

NVDA fell more than 5% to a three-week low with tech getting a bit of a clobbering early on in the US session. DJIA –1.07%, SPX –1.16% and Nasdaq –1.54% as of send time.

Treasury yields turned south as bonds caught some haven bid, the 10yr dipping 6bps to 3.845% after rising for five straight days and then extending the decline post-ISM to more than 8bps. September is usually a big month for supply so we are anticipating further volatility.

Loretta Mester, ex of the Cleveland Fed, said there will be a discussion at the next Fed meeting on whether they want to start with a 25 or 50 basis point cut...I think this is sending the wrong message about the economy. It’s too gloomy...surely.

Sense that maybe big players are just taking the market down a peg or two into the uncertain September-Election period…but oil and copper are speaking about wider trouble.

Plenty of defensive positioning in FX too as the yen rallied about 1% against the USD, with USDJPY to 145.33 from 147.2, rebounding off the 21-day EMA. The Swissy also rallied.

Author

Neil Wilson

Markets.com

Neil is the chief market analyst for Markets.com, covering a broad range of topics across FX, equities and commodities. He joined in 2018 after two years working as senior market analyst for ETX Capital.