2018 was an exciting year for oil prices. The climbed up the stairs throughout most of the year only to come down through the elevator shaft later on.

2019 may be somewhat less exciting and could endure lower prices. Demand is likely to dwindle down amid a global slowdown. Supply is set to remain abundant due to the main actors' reluctance to cut production. And the range may be limited by the quick shifts in production that US shale producers have mastered.

2018 - up, up, and down

Throughout most of the year, prices increased. The pickup in global and US growth in the second quarter is one decisive factor. Another was a successful cut in production by OPEC, led by Saudi Arabia, and non-OPEC countries, led by Russia.

Yet the tipping point for demand to beat supply was the cancelation of the Iran deal, known as JCPOA. The US intent to impose sanctions and even cut Iranian exports to zero sent petrol prices higher.

Things changed in the second half of the year. Global growth slowed down due to the ongoing rate hikes by the Fed, Trump's trade war, hiccups in the German car industry, Brexit concerns, among other reasons.

Another factor was the slippage of the OPEC / Non-OPEC deals, with lower discipline among members. Russia reached record post-Soviet production with 11.3 million barrels per day.

All in all, supply growth outpaced expectations by around 2.5 mppd, against an outpace of 2 mpbd forecast in July.

And once again, Trump and Iran were the tipping points. The President issued a waiver on buying oil from Iran for eight countries, watering down the sanctions.

Oil prices plunged and were not helped by a messy OPEC decision in November.

What's next?

2019 - A year of suffering?

Demand is expected to fall. The International Energy Agency (IEA), cut its demand forecast for OPEC oil by 300,000 bpd in 2019. Given current economic trends, this is unsurprising. Global growth is projected to slow from 3.7% to 3.5%.

OPEC also states that global growth trends have become more fragile. Oil demand is projected to rise by 1.29 mbpd according to OPEC, down some 160,000 lower than previously estimated.

The more significant shifts may be in supply. According to OPEC once again, non-OPEC supply is projected to grow by 2.16 mpbd next year, a small upward revision. IEA forecasts for supply have not changed much.

The three big players in oil production are Russia, Saudi Arabia, and the US. They all produce at similar levels and are responsible for around 40% of global output.

US shale is the big swing player. The production in the Permian Basin, North Dakota, and other places suffered from some bottlenecks due to increased supply. Once these bottlenecks are resolved, US production is set to surpass 12 mpbd.

After the historic crash in oil prices in late 2014, the US industry adapted. While some companies went bust, productivity improved to meet lower prices and output emerged from the lows and reached new records. According to the Energy Information Association (EIA), the US became a net exporter of crude and other oil products for the first time since at least 1991.

All in all, the picture for 2019, according to what we know now, is not too shiny for the black gold.

Lower volatility?

And it may not be that great for traders too. As US dominance in oil output grows, so will the impact of the flexibility in its production. Shale production using fracking is much more flexible than the large-scale installations used in Saudi Arabia, Russia, and other countries.

When prices rise, more rigs come online to meet demand, consequently depressing prices. When prices fall, the non-profitable platforms are shut down quickly, lowering supply and hence pushing prices back up. This flexibility in production is set to limit volatility.

Volatility could be impacted by the value of the US Dollar. In the past, the greenback and the black gold had an inverse correlation. In 2018, this correlation was patchy at best. A return of the relationship could have an impact on the volatility, perhaps extending it by a bit. A deteriorating global environment can push the safe-haven USD higher alongside a drop in oil prices.

Upside surprises to consider

While lower prices and lower volatility remain our base case scenario, there is always room for surprises in oil markets. A significant chunk of the black gold still comes from unstable countries.

Here are some factors to consider:

- Venezuelan production is falling together with the country's economic crash. Things could get worse if the country's political situation further deteriorates. Chaos in the South American Country could halt output altogether and push prices higher.

- Iran and Saudi Arabia; The two regional powers are fighting proxy wars in Syria and Yemen but have never clashed directly. For oil prices to rise, it would only take a blockade of the Straights of Hormuz, leading to the Persian Gulf, to send prices shooting higher.

- Libya, Nigeria, and Iraq have seen disruptions in output, that have been part of the ebb and flow of oil day traders but did not affect the bigger picture in the longer term. A more permanent disruption could change things.

- Canadian oil: The Western Canada Select (WCS) price has been trading far lower than the benchmark American West Texas Intermediate due to bottlenecks in shipping Canadian oil from Alberta's tar sands to ports in the Gulf of Mexico. The regional government in Edmonton surprised with a decision to cut output. The move has only had an impact on WCS. A more significant output cut could reverberate around the world.

- And there is always US President Donald Trump. He currently urges OPEC to keep the taps open as he wants lower oil prices for the American consumer. He may change his mind and decide that helping the local energy industry is more important. Or he may close the net on Iran. If the waiver on buying Iranian oil is removed, prices could move higher once again.

WTI Crude Technical Analysis

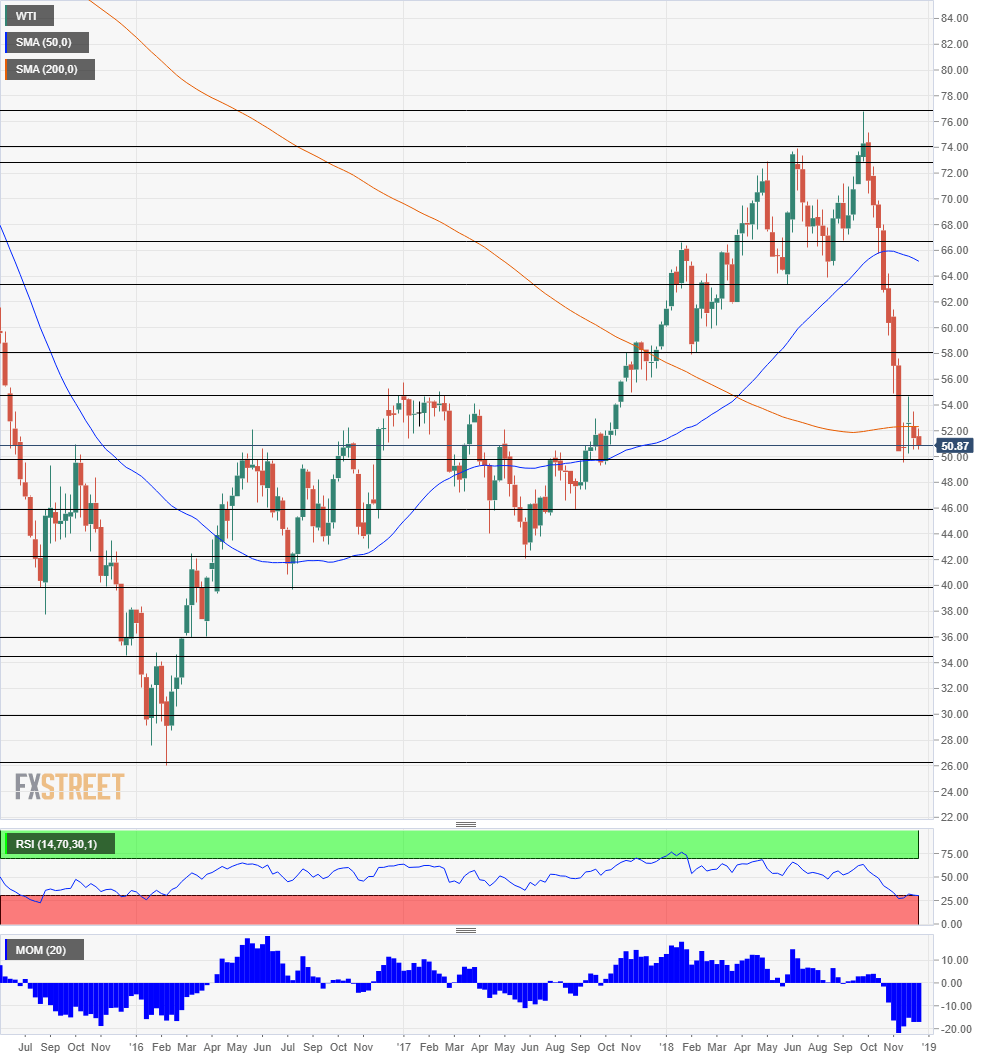

We use the weekly chart in order to see the big picture.

WTI fell below the 50 Simple Moving Average on the weekly chart. On the other hand, the sharp full sent the Relative Strength Index to just below 30, indicating oversold conditions. Momentum is pointing down.

All in all, the trend is for further falls, but perhaps after a correction according to the charts.

Here are the levels to watch from top to bottom. $76.80 was the high point of 2018. $74 capped WTI in late June. $72.80 capped the price in late May.

Significantly lower, $66.70 was a high point in January. $63.50 was a low point in June. $58.10 provided support in February.

$54.70 capped petrol prices in late November. $49.60 was the low point of the year, recorded close to its end.

The next levels are already from 2017. $46 was a low point in September. $42.30 was a low point in June 2017.

We are now back to 2016 with $39.70 as a low point in June of that year. $36.15 was a swing low in April 2016.

$34.50 was a swing low in late 2015. The round number of $30 is a critical low. The January 2016 low of $26.40 is the bottom of the barrel.

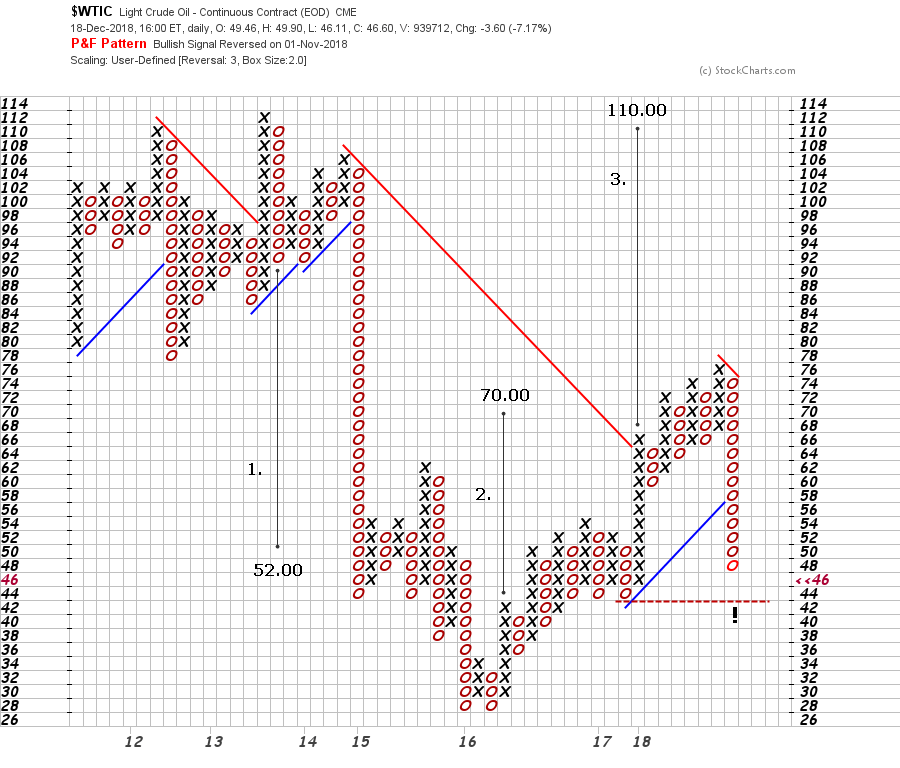

Oil Point & Figure Chart

In the oil market, we are faced with two price ranges: one the 100s and the other in the 50s separated by a strong down move carved at the end of 2015. From the top of 2013, a vertical downside count was established towards 52.00 which was filled in less than a year. On the opposite side, from the bottoms of 2016, a recovery from 30.00 to 42.00 suggested a potential move toward 70.00, achieved at the beginning of 2018. Now we deal with a potential upside projection to the upper range again (count 3.) unless the current column of Os breaks below the 44.00 level, in which case additional weakness would be expected.

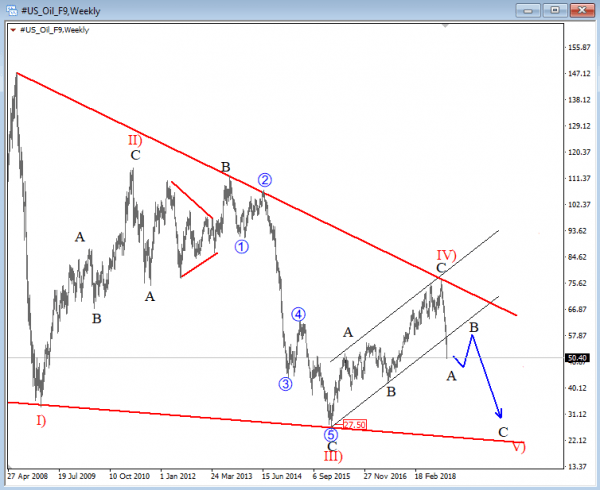

Oil Elliot Wave Analysis

CRUDE OIL is unfolding a bigger, bearish wedged structure that suggests more weaknes based on a sharp turn away from the upper red line at the end of 2018. Notice that recovery from 27.50 is in three waves, so whole corrective can be fully retraced, ideally that will happen with upcoming fifth wave back to 27.00 area.

Conclusion

Oil prices are unlikely to recover in 2019 but remain depressed due to lower demand and a supply glut. Volatility is also expected to be limited, mostly due to the flexibility of the US shale industry. There is always room for upside surprises, coming mostly from geoplitical instability.

Forecast Poll 2019

| Bullish | 16.6% |

|---|---|

| Bearish | 22.2% |

| Sideways | 61.1% |

| Average Forecast Price | 51.52 |

| EXPERTS | 1 YEAR |

|---|---|

| FXOpen team | 49.00 Sideways |

| Dmitriy Gurkovskiy | 34.50 Bearish |

| Brad Alexander | 55.00 Sideways |

| ForexGDP Team | 100.00 Bullish |

| Dmitry Lukashov | 78.00 Bullish |

| Chris Weston | 55.00 Sideways |

| Stoyan Mihaylov | 27.00 Bearish |

| Gregor Horvat | 37.00 Sideways |

| Joseph Trevisani | 60.00 Bullish |

| Ed Ponsi | 45.00 Sideways |

| HotForex Team | 55.00 Sideways |

| George Hallmey | 50.00 Sideways |

| Gianluca Privitera | 30.00 Bearish |

| Alberto Muñoz | 35.00 Bearish |

| Yohay Elam | 55.00 Sideways |

| Walid Salah El Din | 55.00 Sideways |

| OctaFx Analyst Team | 52.00 Sideways |

| Jeff Langin | 55.00 Sideways |

RELATED FORECAST 2019

EUR/USD: At the starting line of a long and bumpy road

GBP/USD: Imprisoned by Brexit darkness Sterling is set to chart a check mark

USD/JPY: A barometer of global growth and markets

AUD/USD: Collateral damage from the US-China trade war

USD/CAD: CAD comeback on the cards

USD/MXN: Volatility set to remain elevated

Gold: Focus on US real interest rates

Oil: Dwindling demand and substantial supply likely to pressure petrol

The United States Economy and Politics: The return to a bipolar world

The European Union Economy and Politics: Conflict at home

China and International Trade: The crossroads of a great power

Dollar Index: A stumble is not a fall

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD remains near 1.0400 post-US PCE

The US Dollar’s inconclusive price action allows some recovery in EUR/USD, keeping the pair around the 1.0400 region following the release of PCE inflation data for the month of January.

Gold slumps to fresh multi-week lows below $2,840

Gold stays under bearish pressure and trades at its lowest level in three weeks below $2,840. The uncertainty surrounding the Trump administration's trade policy and month-end flows seem to be weighing on XAU/USD, which remains on track to snap an eight-week winning streak.

GBP/USD clings to gains just above 1.2600 after PCE data

GBP/USD remains positively oriented in the 1.2600 neighbourhood as the Greenback is navigating a vacillating range following the PCE inflation release.

The week ahead – US Payrolls, ECB rate meeting, ITV results – W/c 3rd March

Having seen the Federal Reserve keep rates on hold last month the US labour market continues to show remarkable resilience, despite seeing a slowdown in hiring in January, after a blow out December number.

Weekly focus – Tariff fears are back on the agenda

While the timing of the EU measures remains still uncertain, Trump surprised markets on Thursday by signalling that the 25% tariffs on Canada and Mexico will be enacted when the one-month delay runs out next Tuesday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

by

by