Odds of “No Winner” in the Democratic Primary Top 1 In 4

The most recent "Brokered Conventions" were Adlai Stevenson (of the 1952 Democratic Party) and Dwight Eisenhower (of the 1952 Republican Party).

The term simply means that no one enters the convention with a majority of votes.

Arguably, "contested" is a better term.

Six Things

On January 13, I penned Six Things That Make a Brokered Democratic Convention More Likely

I concluded "I suspect the odds right now are at least 15% and perhaps way higher."

A close friend commented that I was crazy and there will never be another brokered conclusion.

Odds Update - At Least 25%

Last night on the Iowa Caucus debacle, I mentally upped my odds all the way to 25%.

For discussion of the Iowa debacle, please see We Have Numbers! (62% of them) Buttigieg in the Delegate Lead.

Amazingly, we still do not have final numbers.

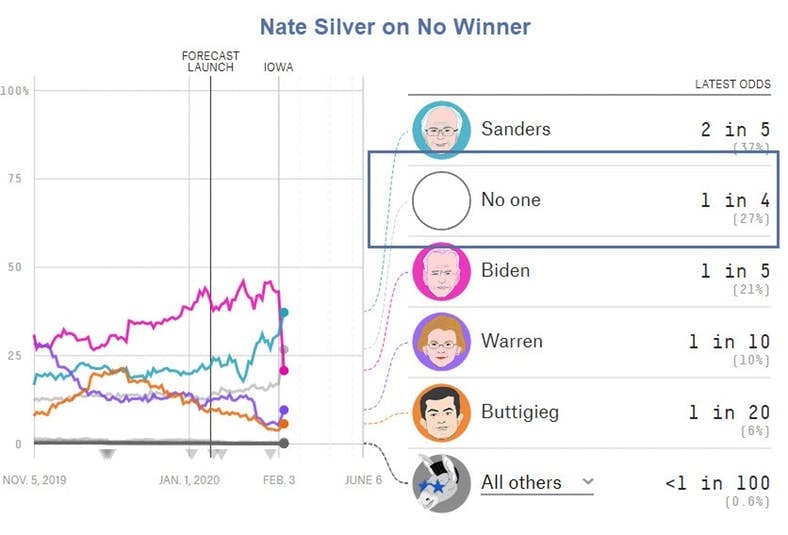

Nate Silver Comes Up With 27%

The lead chart is from Nate Silver's post Who Will Win The 2020 Democratic Primary?

Silver posted the chart without commentary. He did not explain his rationale. However, I did find some of his methodology last night in his post Buttigieg And/Or Sanders Are Going To Win Iowa. What Happens Next?

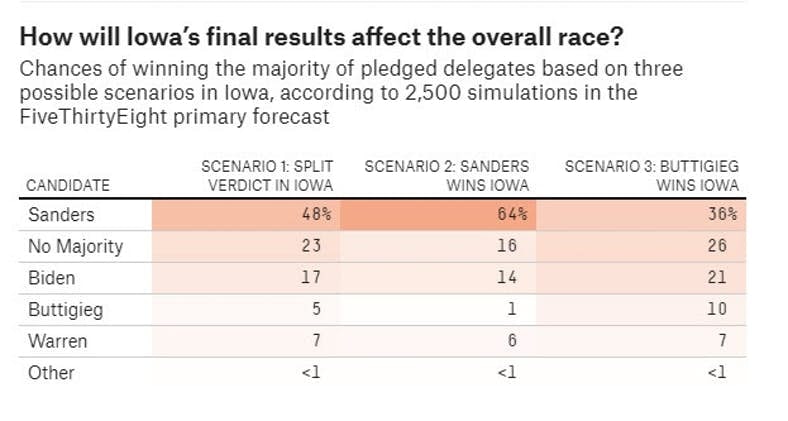

Silver is looking at past history while concluding "Sanders’s chances would be 64 percent if he’s deemed the winner of Iowa, but only 36 percent if Buttigieg is instead. Buttigieg’s majority chances, on the other hand, would be 10 percent if he wins Iowa — again, keep in mind how much ground he has to make up in more diverse states — but just 1 percent if Sanders wins outright."

Time For Rational Thought Not a Model

Silver relies far too much on his model even though I agree with his conclusion of no winner, now at 27%.

I find it absurd to believe that Sanders odds of winning outright would jump from 36% to 64% had only Sanders got another 1% of the Iowa caucus vote.

Instead let's recap, and update what I said on January 13.

Six Things That Make a Brokered Democratic Convention More Likely

- The superdelegates do not get to vote in the first round this year unless a candidate has a majority. Unlike 2016 when they all went to Hillary, this year they don’t vote until round 2 unless it is already decided.

- California is now part of Super Tuesday. In 2016, the California primary was held on June 7. This year, the survivor bias bandwagon effect will be significantly reduced and possibly eliminated.

- Following NH there will be two debates, and likely 4 candidates minimum at each.

- This will likely not be a two-way races headed into Super-Tuesday. Elizabeth Warren may have little overall chance, but she does have a chance of getting 15% in many states.

- Progressive Split: Bernie Sanders are battling each other for the Progressives. Bernie will get most of this vote, but Warren will likely have have enough money to stay in until the end if she wants.

- Bloomberg and Steyer may target a couple of states hard: Texas, Colorado perhaps? They may each pull 15% in a couple of them.

Changes Since Jan 13

- No Change

- No Change

- There will likely be 6 candidates on stage in Nevada. Bloomberg and Klobuchar are near givens now thanks to DNC debate rule changes.

- No Change - This certainly will not be a two-way race headed into Super Tuesday. This was uncertain on Jan 13.

- In addition to Sanders and Warren splitting the progressive vote, there will be at least three candidates vying for the moderate vote. This is a new development, and a bad one for Biden.

- No Change

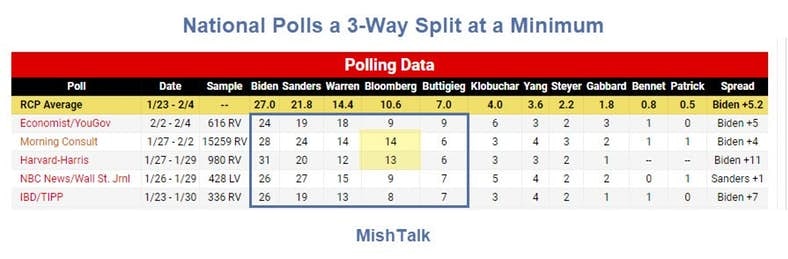

National Polls

This will not be decided at the national level. But a rules change for the Nevada debate before Super Tuesday will likely put Bloomberg and Klobuchar on the stage.

For discussion, please see Bernie Supporters Scream "Rigged System" Over Debate Rule Changes.

South Carolina

Had the DNC rule change included South Carolina as well, Steyer may have been on the stage in Nevada.

This will likely benefit Biden but we need more recent polls to confirm.

Regardless, Biden polls far better among blacks than Bernie or Warren.

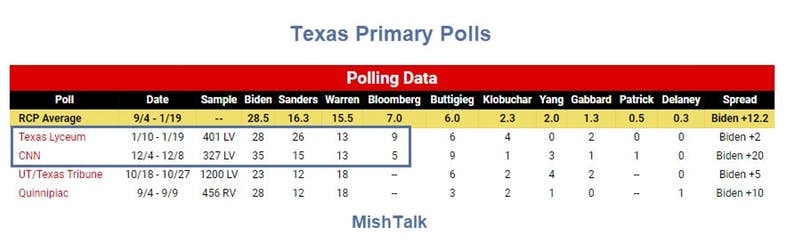

Texas

These polls are horribly stale.

Yet, one observation is worth noting. Bloomberg went from 0% to 9%. This will may votes from Biden, but not necessarily do anything for Sanders.

If Warren can top 15%, that will certainly hurt Sanders.

At the moment, Texas is a big wild card. Biden could win most of the delegates but perhaps he only gets 25% of them.

In contrast, Bernie is highly unlikely to get more than 30% of Texas delegates in my opinion.

I await new polls to analyze further.

California

In contrast to Texas, these polls are all worth discussing even though they are a bit stale.

In a liberal state like California, Buttigieg, openly gay, just might get a big bounce after Iowa. But it might also collapse after South Carolina.

Arguably more likely, Warren can hold 15%. She is raising enough money to matter.

If so, we have a 3-way split.

Where the Rubber Meets the Road

California is where the rubber meets the road.

If a candidate does not have enough momentum after Super Tuesday, it likely won't happen.

This is about a 25% chance by my seat of the pants calculation, and I may be way too low.

A Nate Silver model arrived at the nearly same conclusion, but that's happenstance.

I highly respect Nate Silver, but his model does not factor in conditions. And the current conditions have never occurred before in history.

Bear in mind that a 25% chance means just that.

Those who later pound their chests and proclaim "I told you so" if it does not happen do not understand either elections or math.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc