Focus on where the puck is going

S2N spotlight

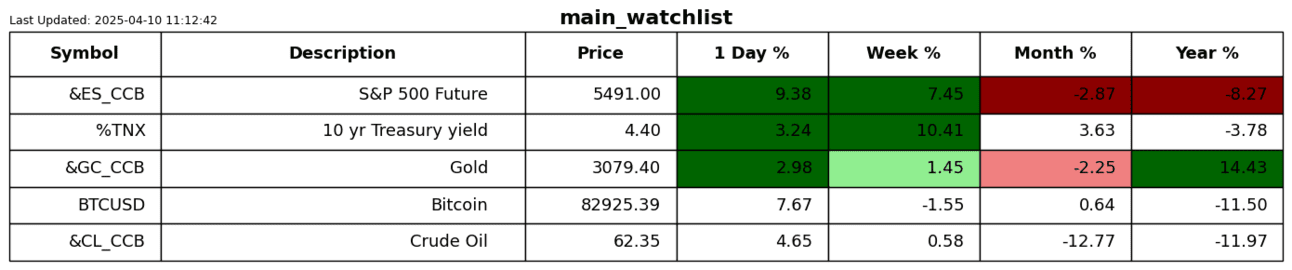

Yesterday was wild. I am sure there are many recent bears that got more squeezed than I did trying on my wedding suit last night.

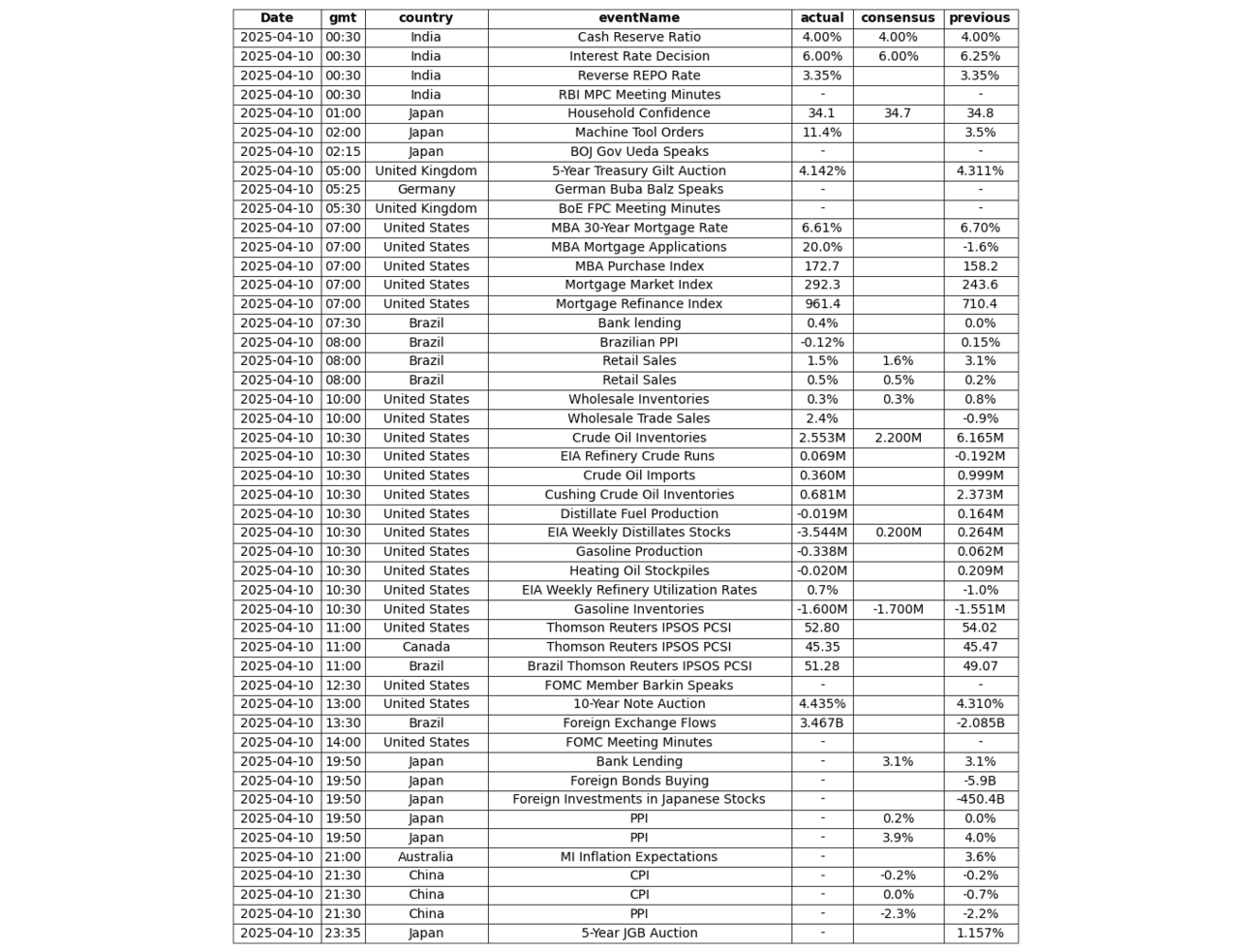

Trading the news these days should come with a compulsory physio treatment package for whiplash. I am standing well back from the ensuing chaos. Trump retaliated with China pushing the tariffs higher still to 125% after they raised tariffs to 84%. Then he did something that was unexpected: he paused for 90 days with the bulk of the other countries.

I have to say that Bill Ackman is pretty dialled in. He has been calling for a 90-day pause to enable proper negotiations, and that is exactly what has just happened. Clearly the president is following his X feed. Trump is no doubt one of the greatest negotiators of all time and must be a bloody good poker player. However, I think it is safe to say that US and China trade is over, which is going to cause a major shock to the global economy. It doesn’t matter how many countries kiss his arse; world trade as we knew it is over.

I have to share one more classic Trump.

On the 19th of February 2025, Defence Secretary Pete Hegseth ordered the military to cut its budget by a dramatic 8%.

On the 8th of April, 2025 (yesterday), President Donald Trump announced.

“We’re going to be approving a budget, and I’m proud to say, actually, the biggest one we’ve ever done for the military,” he said. “$1 trillion. Nobody has seen anything like it.

“We are getting a very, very powerful military. We have things under order now.”

That is a 12% increase on the current budget. I guess Pete never got the memo.

S2N observations

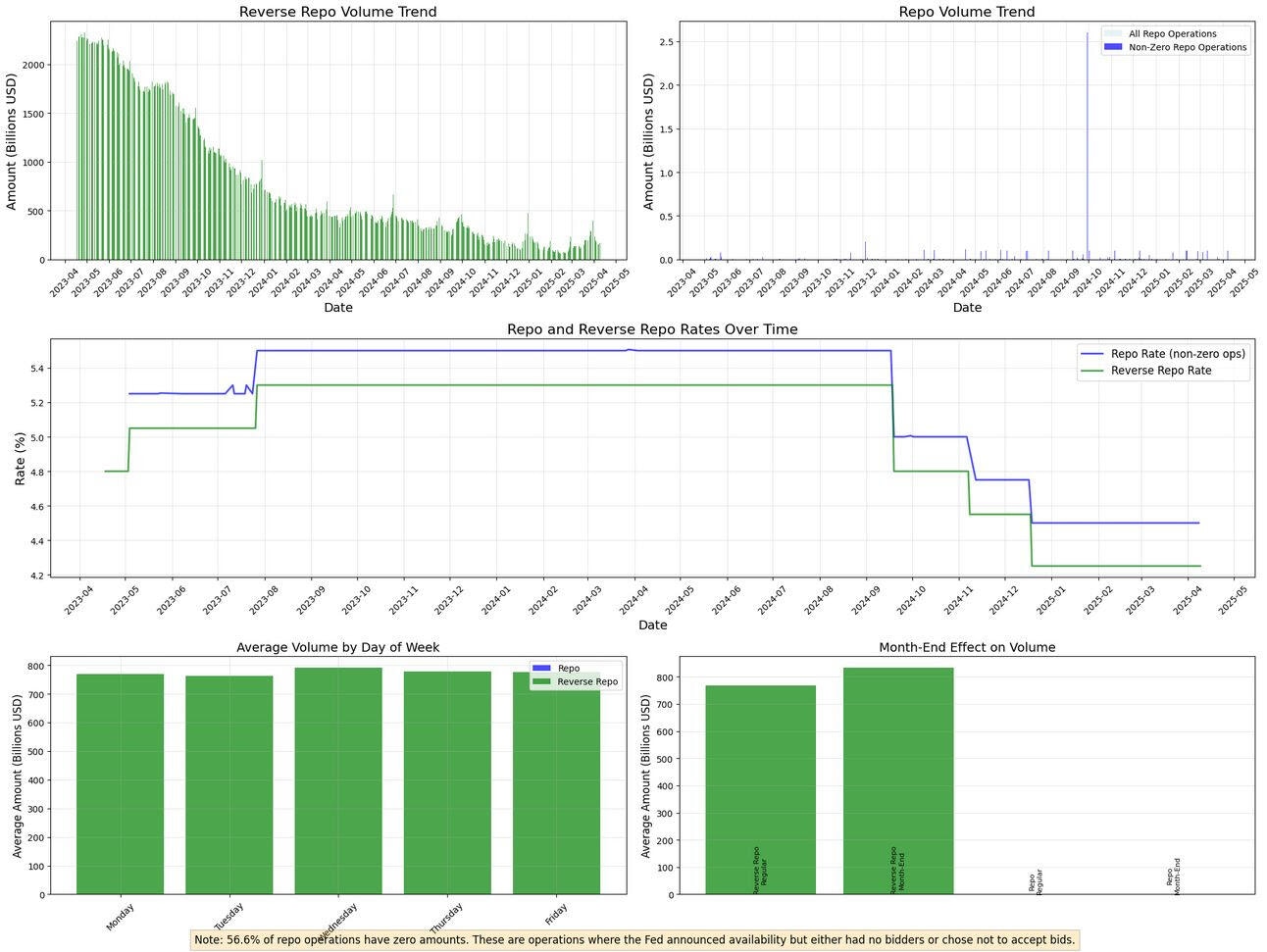

It seemed like everyone was speaking about basis trade yesterday. I am glad I was one of the first ones. I spent hours today working with the New York Fed’s data. I believe we are going to see early signs of trouble from the inner workings of the money machine.

The BOE mentioned yesterday that they were seeing a number of broker-dealers experiencing some liquidity issues from the margin calls being triggered by the wild swings. I think a crack in the system is imminent; you cannot have the kinds of moves we are seeing at the moment in such a highly leveraged world without something blowing up.

I am going to need to spend a lot more time refining my analysis, but here is a little hors’ d'oeuvre.

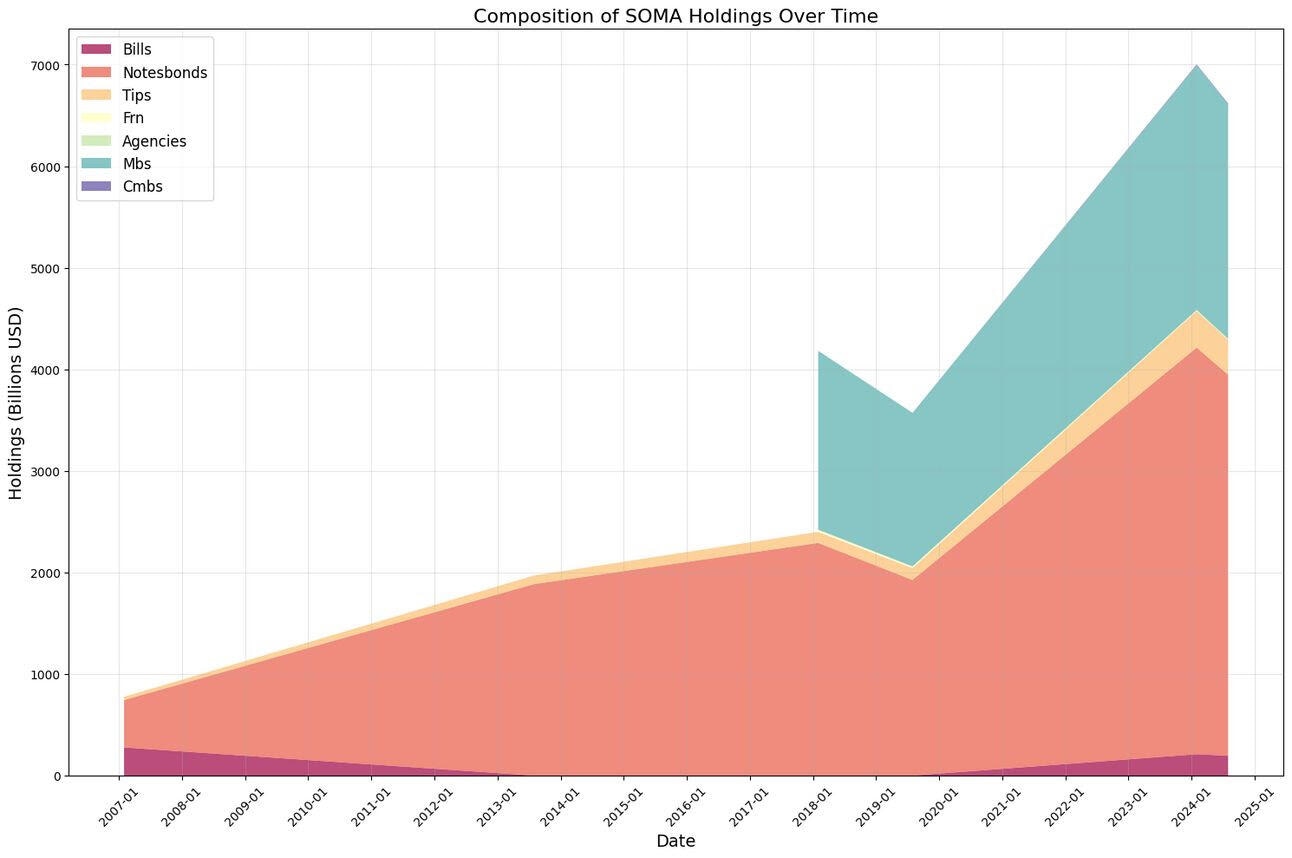

SOMA stands for "System Open Market Account," which is the Federal Reserve's portfolio of assets acquired through open market operations. I have marked the different QE and QT programmes.

The MBS API endpoint has only got data going back to 2018. It was only during the GFC in 2009 that the Fed started purchasing mortgage-backed securities as part of QE. I am still including the chart so you can see the quality of the Fed’s balance sheet this way.

In case you don’t know, the BOJ (Bank of Japan) owns around 7% of the Japanese stock market and about 70% of the ETFs in circulation. In other words, the BOJ is the Fed on steroids.

All I can say with this chart is that there is nothing to see. We are looking for blue, and I see no blue, which in this case is a good thing.

S2N screener alert

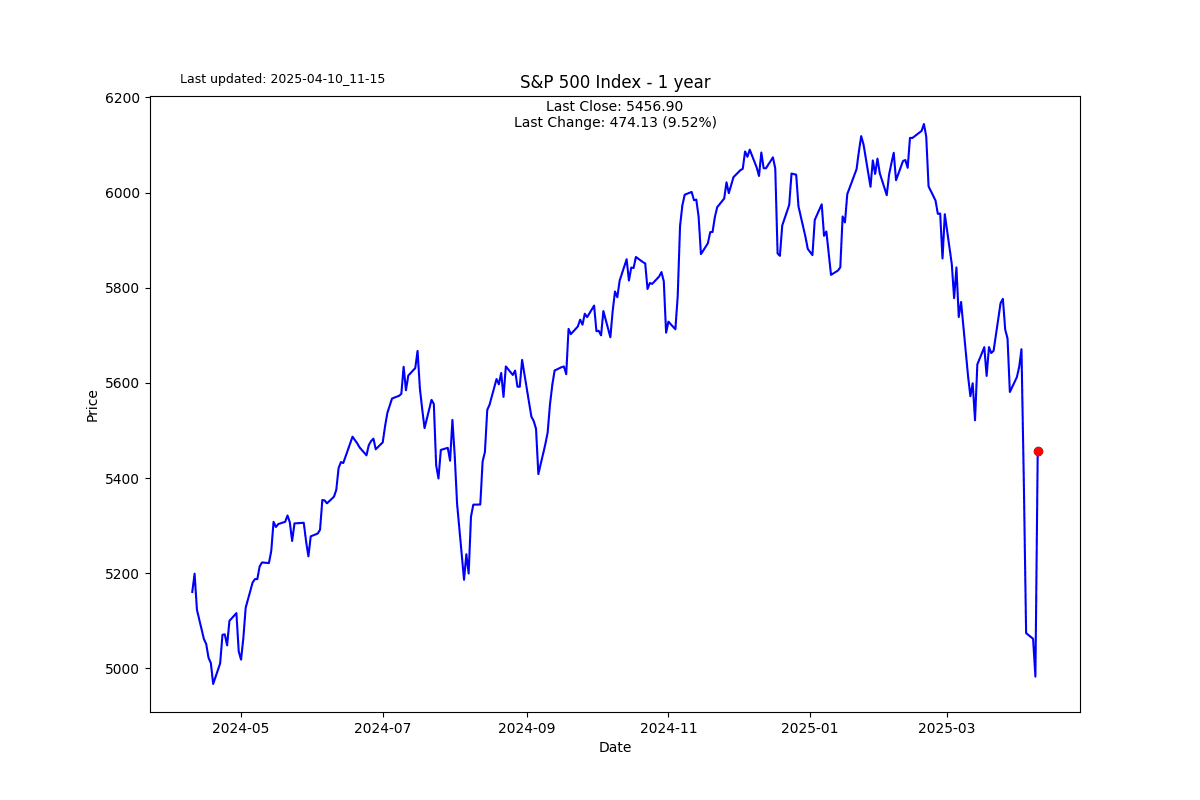

A move this big has only happened once before in the S&P 500.

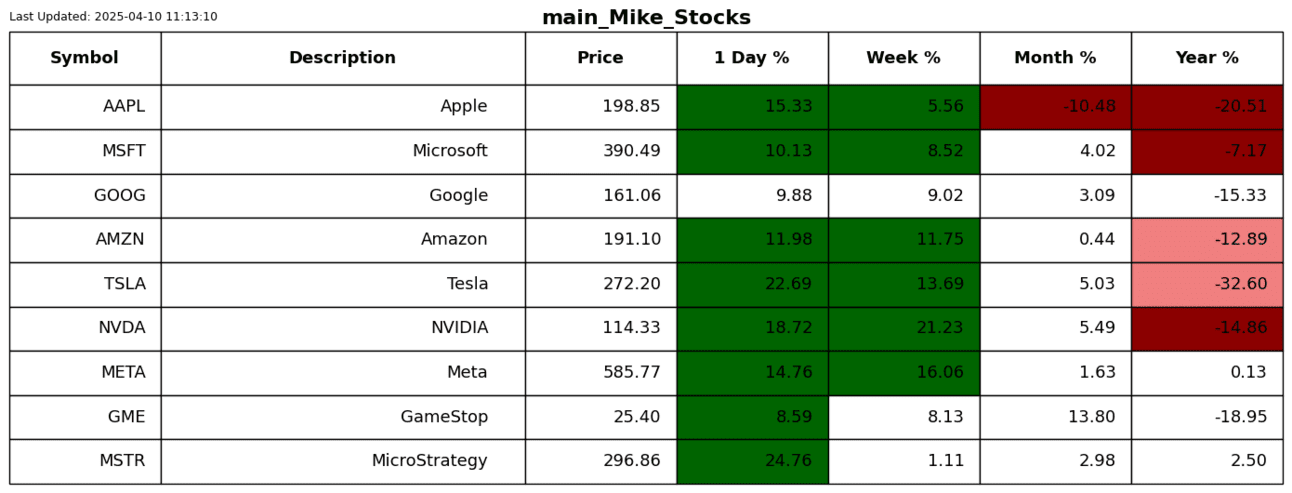

Tesla had its second-biggest Z-score day.

I guess I have to eat some humble pie with MicroStrategy. This round I will give to Saylor.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.