October’s US employment report in focus

The week is slowly drawing to a close as we open a window at what next week has in store for the markets, yet before that we note the release on Saturday, China’s NBS manufacturing PMI figure for November. On Monday, we get Australia’s October building approvals, China’s Caixin manufacturing PMI figure for November, UK’s nationwide house prices for November and the US ISM manufacturing PMI figure for November. On Tuesday we November’s CPI rates for Turkey and Switzerland as well as the US JOLTS Job Openings for October. On Wednesday we get Australia’s GDP rate for Q3 and from the US the ADP national employment figure and the ISM non-manufacturing PMI figure both for November, while on the monetary front, ECB President Lagarde and Fed Chairman Powell are scheduled to speak. On Thursday we get Australia’s trade data, Germany’s industrial orders and Canada’s trade data all for October and from the US the weekly initial jobless claims figure. Finally on a busy Friday, we note the release of Japan’s All household spending for October, Germany’s industrial output also for October, UK’s Halifax House prices for November, Eurozone’s revised GDP rate for Q3, Canada’s employment data for November and from the US the preliminary University of Michigan consumer sentiment for December, while the crown of financial releases for the week is expected to be the US employment report for November.

USD – October’s US employment report to rock the USD

For the USD on a fundamental level, we note the Trump effect as the key driver for its direction, despite Donald trump not having assumed office yet. Trump’s pick for the Treasury Secretary, Scott Bessent, 62, hedge fund manager, may have been the main headline over Trump’s picks in his new Government, in the past week. The nominee seems to be a more mainstream choice, less controversial and Wall Street likes him. He is considered a good ally in Trump’s ideas for further deregulation of the markets and easing corporate taxation, yet it’s also going to be interesting to see his potential influence in Trump’s intentions to slap tariffs on US imports. We note that Bessent was reported to be a supporter of a stronger USD, thus in turn may prove to be also a supporter for tariffs on US imports. Overall we see the case for the pick of Bessent to ease the markets’ worries for Trump’s economic policies, thus could create some safe haven outflows for the USD. On the other hand, the announcement by Trump that on the first day in office we will be applying 25% tariffs on imports from Mexico and Canada and charging also additional 10% tariffs on imports from China could renew market worries and thus support gold’s price. We may see Trump’s tariff threats having a wider effect on the markets in the coming days and play a supportive role for the USD.

On monetary level, the market’s expectations for the Fed to proceed with a 25 basis points rate cut in the December meeting are still present and could weigh on the USD. The bank’s intentions though tend to remain somewhat unclear. the release of the Fed’s November meeting minutes tends to highlight the bank’s cautious approach towards cutting rates further. On the one hand the bank’s policymakers seemed to agree that inflation is easing sustainably towards the bank’s 2% target, yet at the same time also noted that growth remains solid and the US employment market conditions have eased, while there may be also increased uncertainty about the path of the US economy. Overall, should we see Fed policymakers reiterating this hesitation to cut rates extensively as supportive for the greenback on a monetary level. To this end we note that Fed Chair Powell is interviewed at the DealBook/Summit next Wednesday.

On a macroeconomic level, we note the acceleration of the PCE rates for October both at a headline and core level, implying a relative resilience of inflationary pressures in the US economy. Furthermore, the revised GDP rate for Q3 verified the growth of the US economy. The releases were the last big test for the USD ahead of the release of October’s employment report with NFP figure. Should the release show a tighter than expected employment market we may see the USD gaining and vice versa. Overall we expect up until the release other employment data as well as the ISM PMI figures to generate substantial interest among USD traders.

Analyst’s opinion (USD)

“We expect that the USD may be more supported in the next week as we expect the discussions for Trump’s intentions to slam tariffs on US imports to be rejuvenated. On a monetary level, further comments of Fed Policymakers about a possible slower pace of rate cutting may support the USD. Yet the main determinant of USD’s direction may prove to be the release of October’s employment report next Friday.”

GBP – Fundamentals to lead Pound traders

GBP is about to end the week stronger against the USD and EUR but not the JPY. On a fundamental level, we note the strain in the US-UK relationships, with latest example being the worries that the US President elect Trump may cancel the deal for the return of the Chagos Archipelagos to Mauritius. Further more we still note substantial discontent among the population for the UK government. Both issues tend to weigh on the pound.

On a monetary level, the market’s expectations for the bank to remain on hold in the December meeting and resume rate cutting in February. It’s characteristic that BoE Deputy Governor Clare Lombardelli noted that despite inflation easing significantly over the past two years, wage inflation is cooling at a slower pace suggesting that it may be “too early” to expect that inflationary pressures have been set under control. Overall the bank’s unwillingness to cut rates, tends to contradict market expectations for some other central banks’ intentions and thus may be more on the supportive side for the sterling.

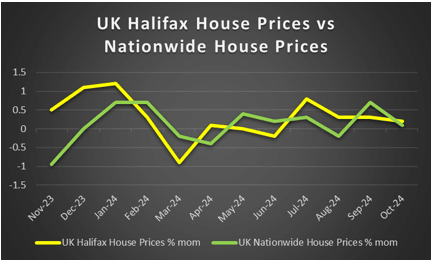

On a macroeconomic level, the more pessimistic outlook of UK’s retailers for November as indicated by the CBI distributive trades indicator and expect in the coming week for interest in financial data to pick a bit up. In the coming week, we note the release of the Nationwide House prices and the Halifax House Prices both for November, while also the final PMI figures for the same month may generate some interest.

Analyst’s opinion (GBP)

“Overall we expect fundamentals to lead the pound in the coming week. On monetary level, as mentioned above BoE’s hesitation to cut rates may be supportive for the pound yet it’s pretty much priced in by the market, so should there be not major surprises we do not expect any major market reaction for the pound in regards to the pound’s direction. On a Fundamental level the worries for the UK Government remain and tend to weigh yet we expect the pound to be more of a follower rather than take the initiative in the FX market with possibly interest being subdued in the coming week.”

JPY – BoJ’s intentions continue to lead the JPY

JPY is about to end the week stronger than the EUR,GBP and USD in a sign of wider strength in the FX market. On a fundamental level, we note the safe haven qualities of the Japanese currency, hence should we see market uncertainty being enhanced we may see the JPY getting some support and vice versa. On a local level, we note that the budget session is beginning in Japan and the current minority Liberal government needs some support from the opposition party for the budget to pass. So there seems to be some uncertainty on a political level that could weigh on JPY. On an even deeper fundamental level, we note that as BoJ intends to continue hiking rates, the borrowing cost of the Japanese Government is about to rise, given also the outsized National Debt of Japan.

On a monetary level, BoJ’s intentions in the past few days was maybe the key factor behind the JPY’s direction. We expect this tendency to be continued in the coming week and should we see more signals for more rate cuts to come we may see the JPY getting more support. For the time being interest is focused on BoJ’s next meeting on the 19th of December. For the time being the market seems to be marginally pricing in the bank to proceed with a 25 basis points rate hike. We note that next Thursday BoJ board member Nakamura is scheduled to speak in Hiroshima and may provide more clues regarding the banks’ intentions.

On a macroeconomic level, the most interesting release in the past week for Japan, may have been today’s Tokyo CPI rates for November. The rates accelerated highlighting the persistence of inflationary pressures in the Japanese megacity, raising the odds for the same on a nationwide level. Furthermore the preliminary industrial output for October also accelerated implying an improvement of economic activity in the sector while the retail sales growth rate also accelerated, implying an improvement on the demand side of the Japanese economy.

Analyst’s opinion (JPY)

“In general we highlight BoJ’s intentions as the main factor behind JPY’s direction. Any further indications enhancing the market’s expectations for BoJ to hike rates in the December meeting could add more support for the Japanese currency in the coming week.”

EUR – Political uncertainty deepens for the Eurozone

The EUR is about to end the week stronger against the USD yet loses ground against the GBP and JPY. Our worries on a fundamental level tend to deepen for the Eurozone as on addition to the political uncertainty in Germany, given the 25th of February elections, also the French Government does not seem to fare off so well. First of all the Barnier Government in France does not seem to enjoy the support of half the French, in a negative sign. Yet it’s also budget season for politicians currently and that also unsurprisingly applies for France as well. It seems that Barnier’s coalition Government may not get the necessary votes to pass the budget. The French Government seems prepared to make concessions to the far right to get the necessary votes, yet political analysts speculate that a no confidence vote is also quite possible, which in turn may lead to new elections. We expect political uncertainty and should it be enhanced in the coming week to weigh on the common currency on a fundamental level.

On a monetary level, ECB board member Schnabel’s lonely dissenting voice was heard yesterday. She stated that she sees little room for further rate cuts highlighting that monetary policy easing may not be the answer to structural problems, while in a more optimistic note stated that the Euro Zone is not heading towards a recession. Overall, the statements forced the market to readjust its expectations for the rate-cutting intentions of the ECB supporting the common currency. Yet ECB’s policymaker and head of France’s central bank Villeroy de Galhau, stated that the bank may have to move beyond neutral levels, to stimulate Eurozone’s economy. The statement was in stark contrast with ECB Board Member Schnabel’s comments earlier this week, highlighting the dovish side of the bank. Should we see additional dovish comments by ECB policymakers in the coming week, we may see them weighing on the EUR. On an even more dovish tone, the market seems to be pricing in a rate cut in the December meeting and a double rate cut in the January meeting. In the coming week, we ECB President Christine Lagarde’s speech at the ECON Hearing before the Committee on Economic and Monetary Affairs (ECON) of the European Parliament in Brussels.

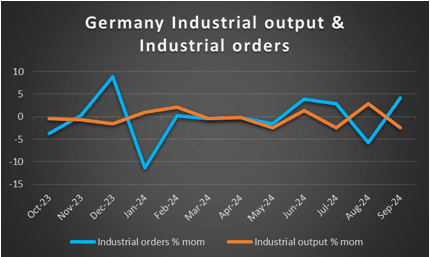

On a macro level we highlight the release of Eurozones’ preliminary HICP rate for November today, which accelerated as expected both on a headline and core level. The release may contradict the markets’ expectations for extensive rate cuts by the ECB, yet we also note that the ECB was allready expecting this resilience of inflationary pressures in the Eurozone. On the flip side growth seems to remain at relatively low levels and near the end of the coming week, we note the release of Eurozone’s final GDP rate for Q3, while throughout the week we get the final PMI figures for November. We intend to focus on Germany as the economic powerhouse of the region which at the same time seems to face the deepest troubles among member states, and also note the release of October’s industrial output and orders growth rates.

Analyst’s opinion (EUR)

“Overall, it still is a hard case to provide a narrative supporting the EUR bulls right now, despite the rise of EUR/USD in the past few days. We see the case for the common currency to remain on the weakening side for the time being as on a fundamental, monetary and macroeconomic level, the bears seem to be favoured.”

AUD – Australia’s Q3 GDP rate to move the Aussie

AUD is about to end the week in the reds against the USD despite the overall weakening of the greenback in the week. We note that on a fundamental level, the Aussie could be influenced by the market’s sentiment given that it is considered as a riskier asset given its commodity nature. On the domestic side the ban of social media accounts for under 16 year olds made a sensation, yet we do not expect it to have an impact on the Aussie in the FX market. Aussie traders may keep an eye out for the US-Sino relationships and any tensions. Given the close economic ties of Australia and China. For example the recent announcement by US President elect Donald Trump that his plans to impose a 10% tariff on imports to the US may have been on the bearish side for the Aussie on a fundamental level. Further more we maintain our worries for the rebound of the chinese economy and highlight the release of China’s NBS and Caixin manufacturing PMI figures tomorrow and on Monday’s Asian session, respectively. Should the indicators show a distinctive increase of economic activity in the sector we may also see the Aussie getting some support as it could enhance hopes for more exports of raw materials from Australia to China.

On a monetary level, the Aussie may remain supported on a monetary level, as RBA is expected to remain on hold in its December meeting. Despite their being a chance for a rate cut in the February meeting market expectations are for the RBA to remain on hold in that meeting as well. Giving the intentions of other central banks for easing their monetary policy it’s understandable that the interest rate differential outlook of RBA to favour the Aussie. We note that in Monday’s Asian session, RBA’s Deputy Governor of Domestic Markets, David Jacobs, is scheduled to speak and may shed more light on RBA’s intentions.

On a macroeconomic level, we note for Aussie traders the release of a slew of data on Monday’s Asian session, including the building permits and retail sales growth rates for October, yet the main release is expected to be the GDP rate for Q3 next Wednesday. The rate is expected to accelerate and if actually so, or even accelerate beyond market expectations AUD could get some support as it would imply that the Australian economy expanded at a faster pace than in Q2, rightening the outlook for the Australian economy somewhat.

Analyst’s opinion (AUD)

“In the coming week Aussie traders are expected to focus on the release of the GDP rate for Q3, yet we tend to maintain also some worries for China’s economic recovery which could sway Aussie trader’s attention. Also a more positive, risk oriented market sentiment could provide some support for AUD.”

CAD – November’s employment data to rock the Loonie

CAD is about to end the week stronger than the USD, yet as these lines are written Canada’s GDP rate for Q3 is still to be released and could alter the Loonie’s direction. On a fundamental level we note the risk appetite of the market as a possible factor that could affect the Loonie’s direction. Yet the main issue that may have rocked Loonie traders this week may have been the intentions of US President elect Donald Trump to impose a 25% tariff on US imports from Canada. We expect that should the issue gain further importance it could weigh potentially on the CAD. On a deeper fundamental level, we note that the path of oil prices could also influence the Loonie’s direction, given Canada’s status as a major oil producing economy. For the time being the path of oil prices seems indifferent yet should rumors about OPEC extending its oil production cuts be enhanced, we may see oil prices rising and thus also providing some support for the Loonie. Another issue possibly affecting oil prices would be the fragile ceasefire between Israel and Lebanon. Should the ceasefire be maintained we may see the confidence of oil traders for the supply side of the international oil market being enhanced thus weighing on oil prices.

On a monetary level we still se the case for BoC to remain substantially dovish and the market currently expects the bank to proceed with a 25 basis points rate cut in the December meeting. It’s characteristic of the market’s dovish expectations that the currently CAD OIS imply a probability of 75% for a 25 basis points rate cut with the rest suggesting that a 50 basis points rate cut is also possible. In any case another three rate cuts seem to have been priced in by the market until the end of spring next year. We view the BoC ‘s intentions as dovish and expect them to weigh on the CAD in the coming week, especially should there be more signals towards such a direction.

On a macro level, in the coming week, we may see increased interest for the release of Canada’s October trade data on Thursday, yet the main release is expected to be November’s employment data next Friday. Should the data show a tighter Canadian employment market with a rising employment change figure and a dropping unemployment rate, we may see the Loonie getting some support.

Analyst’s opinion (CAD)

“We see the case for Canada’s November employment data to be monopolising the interest of Loonie traders, yet given that they are due out at the end of the week, we may see CAD traders also having a look at the fundamentals surrounding the Loonie. Hence how risk averse the market sentiment actually is, the path of oil prices and the markets’ dovish expectations for BoC’s intentions could play a role in the Loonie’s direction as well.”

General comment

As a closing comment we see the case for the USD to strengthen its grip on the FX Market in the coming week. The Greenback is expected to maintain its leading role yet at some point specific currencies may find a chance to form their own, independent course. As for US stockmarkets we note that the earnings season has practically ended yet interest is still alive given that after the Thanks giving holiday and Black Friday the holiday season is kicking off and could generate substantial increase in revenue especially for retail companies, whether may they be brock-and-mortar or e-based. As for gold, we note that the precious metal’s price seems about to mark the widest monthly drop since September last year. The negative correlation of gold with the USD seems to have been interrupted over the past few days, given that both the USD and gold are about to end the week in the reds.

Author

Peter Iosif, ACA, MBA

IronFX

Mr. Iosif joined IronFX in 2017 as part of the sales force. His high level of competence and expertise enabled him to climb up the company ladder quickly and move to the IronFX Strategy team as a Research Analyst. Mr.