With the US elections being over, Trump getting elected and the Fed having released its interest rate decision, we take a look at what next week has in store for the markets. On the monetary front a number of policymakers from various central banks are scheduled to speak at some point or the other and BoJ is to release the summary of opinions for the October meeting on Monday. As for financial releases we get on Monday Japan’s current account balance for September as well as Norway’s and the Czech Republic’s CPI rates for October. On Tuesday we get UK’s September employment data, Germany’s November ZEW indicator and Canada’s September Building Permits. On Wednesday we note the release of Japan’s October corporate goods price and highlight the US CPI rates for the same month. On Thursday we get Australia employment data for October, Sweden’s CPI rates for the same month, Eurozone’s revised GDP rate for Q3 and from the US we get the weekly initial jobless claims figure and October’s PPI rates. On Friday we get Japan’s GDP rate for Q3, China’s industrial output for October, UK’s GDP rate for Q3 and the US retail sales for October.

USD – Trump’s election shifts USD fundamentals

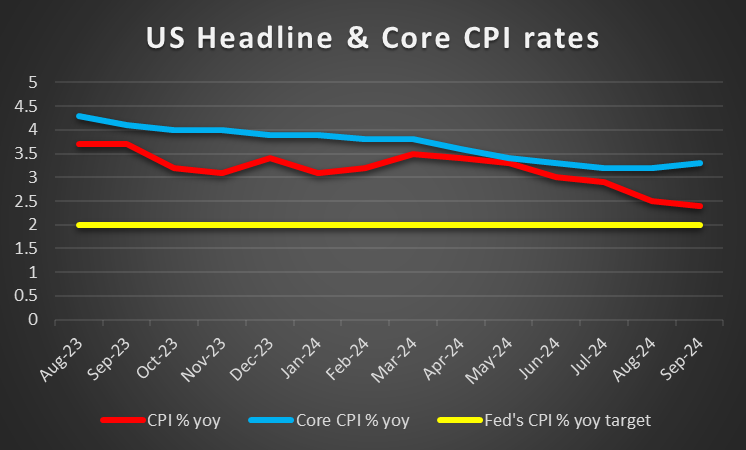

On the monetary front for the USD, the Fed cut rates as expected yet may have been more hawkish than expected in its forward guidance. In its accompanying statement, the bank removed the line stating that "the Committee has gained greater confidence that inflation is moving sustainably toward 2 percent“. The removal may be interpreted as a signal that we may see renewed inflationary pressures, causing the bank to slow down its rate-cutting path. Yet Fed Chairman Powell seemed to dismiss such an assumption in his press conference. Furthermore, we highlight that the bank seems determined to defend its independence from the newly elected US President, as the Fed Chairman clearly stated that he would not resign if asked for by Donald Trump. The release of the Fed’s interest rate decision yesterday may have been interesting, yet the main event for the USD in the past few days was the US elections. Trump triumphantly got elected for another four years and its characteristic of Trump’s comeback that he also won the popular vote, flipped a number of swing states and even Pennsylvania which was considered as the key swing state may not have been necessary for Trump the get elected in the end as he got a wide majority in the electoral college. Yet on a political level, the importance of Trump’s election relies also on the fact that Republicans secured a majority in the US Senate and are nearing a majority also in the House of Parliament, while the US Supreme Court may be characterised by a conservative majority. So practically Donald Trump may have control indirectly over the US administrative, legislative and judicial body, providing him with superpowers. Voter expectations include Trump going hard on immigration and possibly being conservative on a social level. On an economic level, we may see an easing of corporate taxation and generally a more pro-business orientation by the new US Government in the internal economy. Externally we expect Trump to slap tariffs on China, possibly Mexico and the EU, but also on other countries, enhancing isolationistic tendencies in the US economy in an effort to repatriate US businesses that have emigrated production facilities abroad. Overall we see the case for election of Donald Trump as President for the USD to be supportive, while also cryptocurrencies and US stockmarkets may get some support.

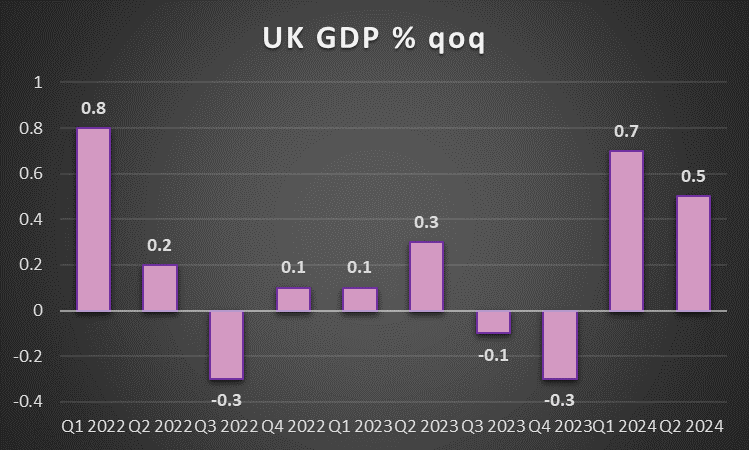

GBP – Q3 GDP rate and other UK data ahead

For pound traders we note that BoE delivered the much awaited 25 basis points rate cut, while signalled also some hesitancy for more cuts stating that a “gradual approach” is appropriate when easing its monetary policy. . The decision tended to support the pound on a monetary policy level. In the coming week, we expect releases of financial data to be the main market mover for the sterling. We make a start with UK’s employment data for September on Tuesday and should the release show that the UK employment market remained tight, we may see the pound getting some support as BoE’s doubts for more rate cuts to come, may be enhanced a bit. On Friday we highlight the release of the GDP rate for Q3 and should the growth rate accelerate, we may see the pound getting additional support as the spectre of a possible recession could be lifted. On a monetary level after BoE’s interest rate decision, we highlight BoE Governor Bailey’s speech on Thursday for further clues regarding the banks’ intentions. Should his speech include further hints towards a slower rate cutting path we may see the pound gaining and vice versa.

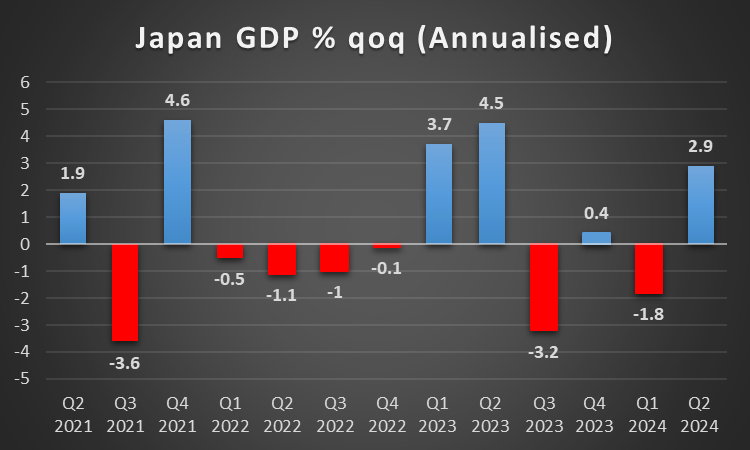

JPY – JPY slipping dangerously low

JPY weakened this week against the USD, with the pair entering dangerously low territory. It’s characteristic that Japan’s key diplomat watching over JPY’s course Atsushi Mimura, highlighted yesterday Japan’s readiness to react, supporting the Japanese currency, should it come to very low levels. He characterised JPY’s move against the USD as being "one-sided and drastic," and that Japanese authorities were "closely watching developments on the currency market, including those driven by speculators, with utmost urgency." He also added that "We are ready to take appropriate actions against excess moves,", as per Reuters. Hence the possibility of BoJ intervening to JPY’s rescue increases in direct proportion with the weakening of the Yen. On a deeper monetary level, we may see JPY being supported should uncertainty in the markets escalate in the coming week, given JPY’s dual nature as a safe haven and a national currency. On a monetary level we would be interested in the release of BoJ’s October meeting summary of opinions. Should the document highlight BoJ Policymaker’s determination towards normalising the bank’s monetary policy despite the political headwinds, we may see JPY being supported.

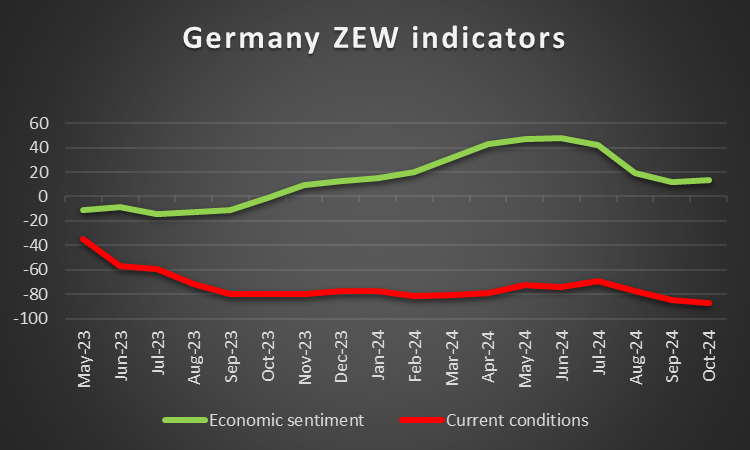

EUR – Political instability in Germany may weigh on the EUR

The political, thus also the fundamental, outlook of the EU seems to become more and more hazy. The election of Donald Trump as the next President of the US tends to weigh on the EUR as the new US President is expected to impose tariffs on EU exports to the US. Furthermore, Trump seems to favour a quick end in the Ukraine-Russian war, which tends to imply a possible wider win of Russia, leaving the Europeans alone to deal with the repercussions of the issue. Finally there is political uncertainty ahead for Germany, as the coalition forming the German government has been dissolved. Germany’s Chancellor Olaf Scholz, practically fired finance minister Lindner, who was also leading the Liberals in Germany, the one of the three parties forming the “traffic lights” coalition government. There was a hope for a minority government to continue governing Germany, which would be tolerated by the centre right Christian Democratic Party (CDU), yet that possibility seems to be slim if it exists at all. Hence we may see Germany heading to new elections, way earlier than originally planned in September, with the possibility of a hung Parliament increasing after the local elections in East German states earlier in the fall. Hence we may see the overall situation weighing on the EUR over the coming week.

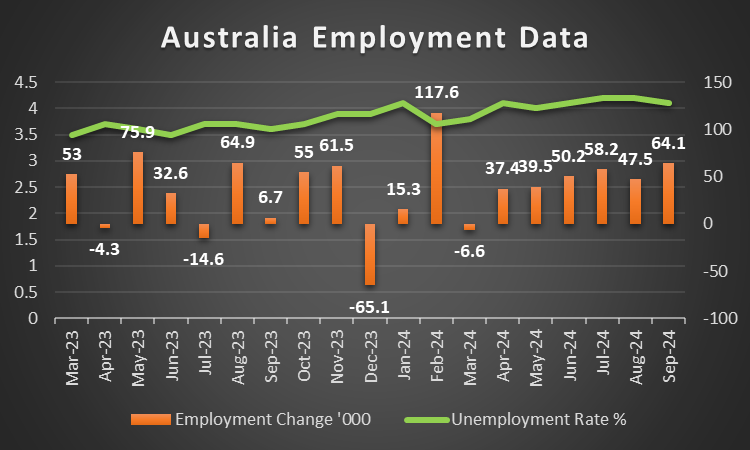

AUD – Australia’s October Employment data to move the Aussie

In the coming week, we expect Aussie traders to keep a close eye on the release of Australia’s employment data for October on Wednesday and Thursday. Q3’s wage price index is to be released first and a possible acceleration of the rate could support AUD, yet the main dish is due out on Thursday. Should we see the unemployment rate and the employment change figure pointing towards a tight Australian employment market we may see the Aussie getting some support, as it could enhance RBA’s hawkishness. Yet on a monetary level, we highlight the panel participation of RBA Governor Bullock, at the ASIC annual Forum, in Sydney on Thursday and should the RBA Governor maintain a hawkish tone, implying that rates are to remain high for longer, we may see the Aussie getting some support. Yet Aussie traders may keep also an eye out for any developments in China, given the close Sino-Australian economic ties. On Friday we highlight the release of China’s industrial output, urban investment and retail sales growth rates all being for October. A possible acceleration of the rates could imply on the supply side off the Chinese economy a rebound ad on the demand side some resilience, both of which could have a beneficial effect on AUD as it could be interpreted as a possible increase of Australian exports of raw materials towards China.

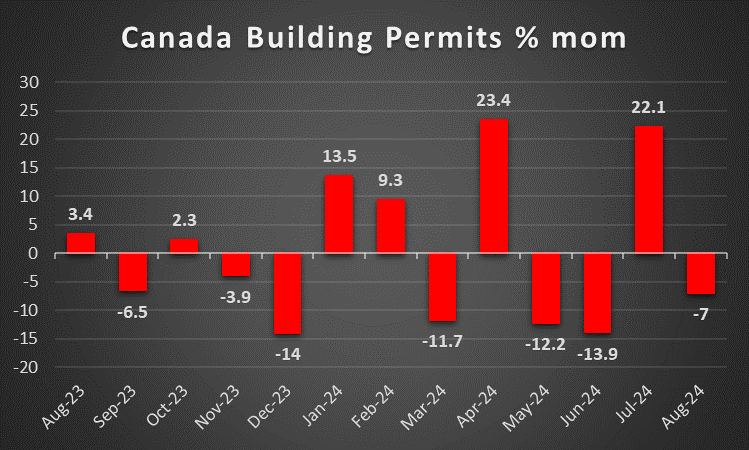

CAD – Fundamentals to lead the Loonie

With the Canadian October employment data still to be released, we open a window at what next week has in store for the Loonie. Financial data to be released seem to be limited to second tier financial data such as September’s Building Permits and manufacturing sales and a possible acceleration of the rates could provide some support for the Loonie. On the monetary front the calendar seems to be empty, thus we turn our attention to other fundamentals which could lead the CAD. One field of interest could be the path of oil prices which tended to rise slightly over the past few days. Yet should oil prices renew their bullish tendencies in the coming week we may see the Loonie getting some support, given Canada’s status as a major oil producing economy. On political level, the election of Trump as US President does not bode well for the Loonie, as Trump and Canadian President Trudeau were note in the best of terms in Trumps first presidential term and Canada may be on the top of the list of countries that Donald Trump plans to impose tariffs upon their products. Hence the political outlook may be providing headwinds for the CAD.

General comment

As a closing comment we expect overall volatility in the FX market to ease, given that the frequency and gravity of the events included in the calendar eases in comparison with the past week. Also we may see the USD relenting some of the initiative in the FX Market over to other currencies. As for US stockmarkets, we note the substantial support provided by the election of Trump as the new US President. Equity market participants tend to have high hopes for further cuts in corporation tax rates and at the same time further deregulation in the markets but also the economy as a whole that may expand business opportunities, share buyback schemes and profitability. Also the earnings season is ongoing and we highlight in the coming week the earnings releases of Home Depot on Tuesday, Disney on Thursday and Alibaba on Friday which could stir market interest and make headlines. As for gold we notice that there have been some signs a revival of the negative correlation of the USD with Gold and if actually so in the coming week we may see gold’s price gaining should the USD retreat and vice versa.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Our services include products that are traded on margin and carry a risk of losing all your initial deposit. Before deciding on trading on margin products you should consider your investment objectives, risk tolerance and your level of experience on these products. Margin products may not be suitable for everyone. You should ensure that you understand the risks involved and seek independent financial advice, if necessary. Please consider our Risk Disclosure. IronFX is a trade name of Notesco Limited. Notesco Limited is registered in Bermuda with registration number 51491 and registered address of Nineteen, Second Floor #19 Queen Street, Hamilton HM 11, Bermuda. The group also includes CIFOI Limited with registered office at 28 Irish Town, GX11 1AA, Gibraltar.

Recommended Content

Editors’ Picks

EUR/USD Gains look limited by 1.1570 Premium

EUR/USD trades well on the defensive for the second day in a row, revisinting the mid-1.1300s on the back of the continuation of the upside impulse in the US dollar. The move followed firmer US PMI data and news indicating the White House may be considering tariff cuts on Chinese imports.

GBP/USD deflates to the sub-1.3300 area, USD bulls prevail

GBP/USD remained on the back foot Wednesday, slipping below the 1.3300 level as the Greenback gained further traction. The Dollar’s solid performance was supported by strong US data and fading concerns over a renewed escalation in the US–China trade dispute.

Gold corrected extreme conditions, struggles around $3,300

Gold extended its decline on Wednesday, slipping below the $3,300 mark per troy ounce in response to reports from the media suggesting the Trump administration is weighing tariff reductions on Chinese goods, a news that revived hopes of easing trade tensions and reduced demand for the yellow metal as a safe-haven asset.

Bitcoin bullish momentum builds as premium exceeds 9% for first time in three months

Bitcoin price is extending its gains, trading above $94,000 at the time of writing on Wednesday, following a two-day rally of 9.75% so far this week. BTC rally gathers momentum as trade war fears ease, following US President Donald Trump’s downplaying of tensions with China.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.