October CPI: Sticky as expected

Summary

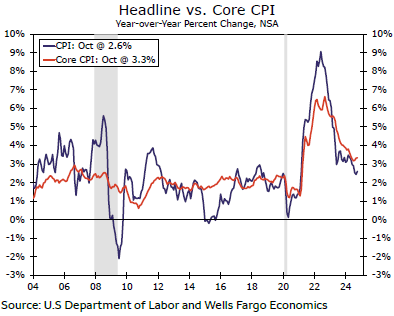

The October CPI report held few surprises but highlighted that progress on inflation has started to stall. Consumer prices rose 0.2% last month, pushing the year-over-year change up to 2.6%. Excluding food and energy, inflation also has proved sticky in recent months. The core CPI rose 0.3% for a third straight month, with the three-month annualized rate of 3.6% running faster than the 12-month rate of 3.3%. Outside of autos, core goods prices fell, but the moderation in core services inflation remains painfully slow.

We believe the FOMC is still on track to reduce the federal funds rate by another 25 bps at its December 17-18 meeting. The cumulative progress on inflation, cooling of the labor market and still-tight monetary policy likely will push the FOMC to cut rates one more time before the end of the year. That said, the inflation data over the past few months have not shown much additional progress, and the election outcome has raised new questions about the path ahead for price growth. In addition, recession risks seem to have diminished somewhat relative to the summer months. As a result, we think the time is fast approaching when the FOMC will signal that the pace of rate cuts will slow further, perhaps to an every-other-meeting pace starting in 2025.

Author

Wells Fargo Research Team

Wells Fargo