NZDUSD consolidates gains near September’s high [Video]

![NZDUSD consolidates gains near September’s high [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/NZDUSD/ten-new-zealand-dollar-with-coins-9083264_XtraLarge.jpg)

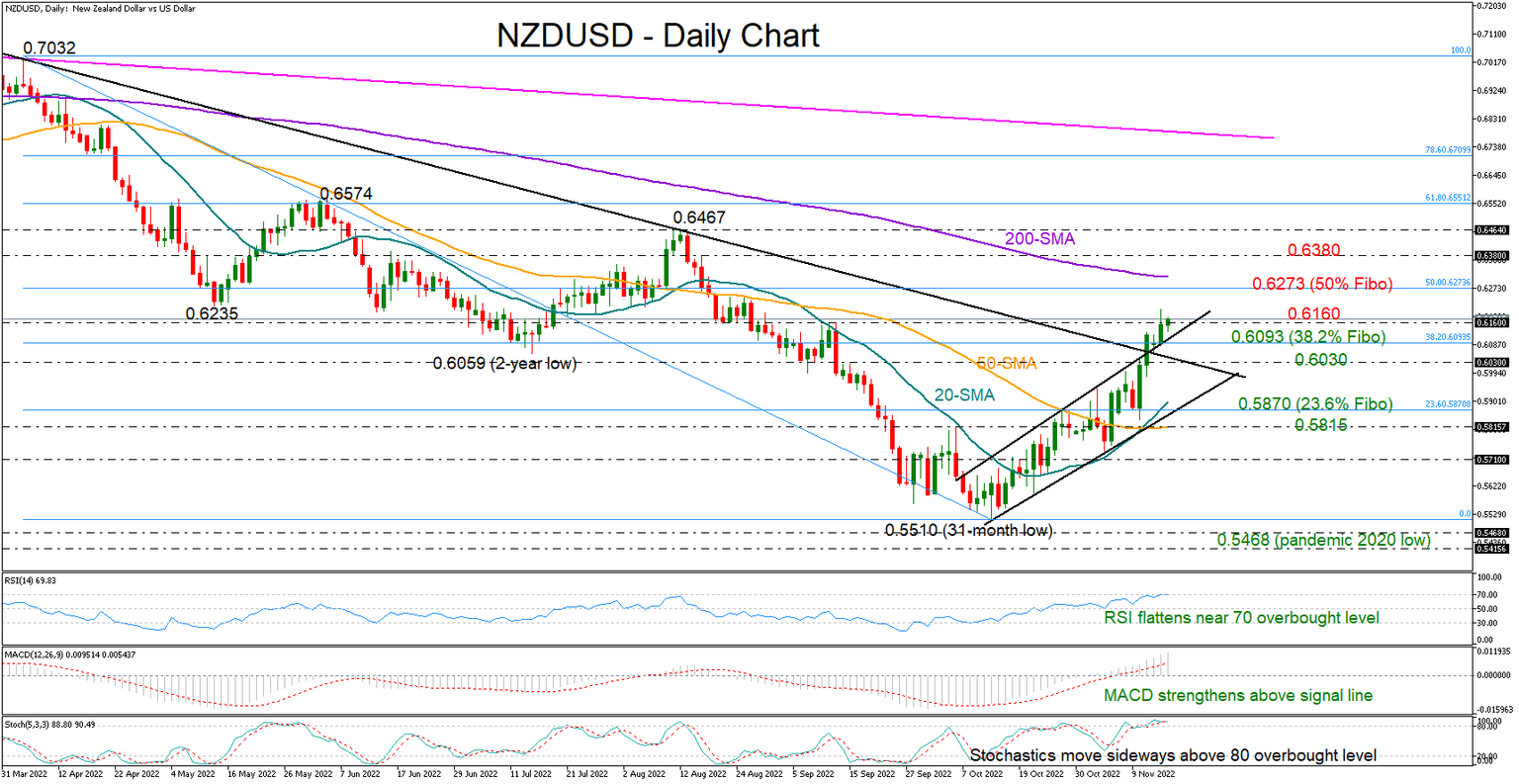

NZDUSD finished Tuesday’s session below September’s high of 0.6160 despite touching the 0.6200 level.

Previously, the pair set a nice foothold around the broken bullish channel at 0.6093, defending its short-term uptrend off 31-month lows. The 38.2% Fibonacci retracement of the 0.7032-0.5510 downleg cemented that floor as well.

But the bears could be just around the corner as the price is struggling to gain fresh positive momentum and the RSI and the stochastics are flagging overbought conditions. Selling interest, however, may remain muted unless the 0.6093-0.6030 base collapses. If that proves to be the case, the price could tumble to test the 20-day simple moving average (SMA) and the channel’s lower boundary currently seen around the 23.6% Fibonacci of 0.5870. A drop below the 50-day SMA and the 0.5815 barrier would neutralize the short-term outlook.

On the upside, a clear close above the 0.6160 resistance could motivate fresh buying up to the 50% Fibonacci of 0.6273. Another extension above the 200-day SMA and the 0.6380 handle could bring the August high of 0.6467 back under the spotlight.

In summary, although the bullish bias is intact in NZDUSD, buyers may stay on the sidelines until the price successfully claims the 0.6160 barricade.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.