NZD/USD Keeps Sailing South

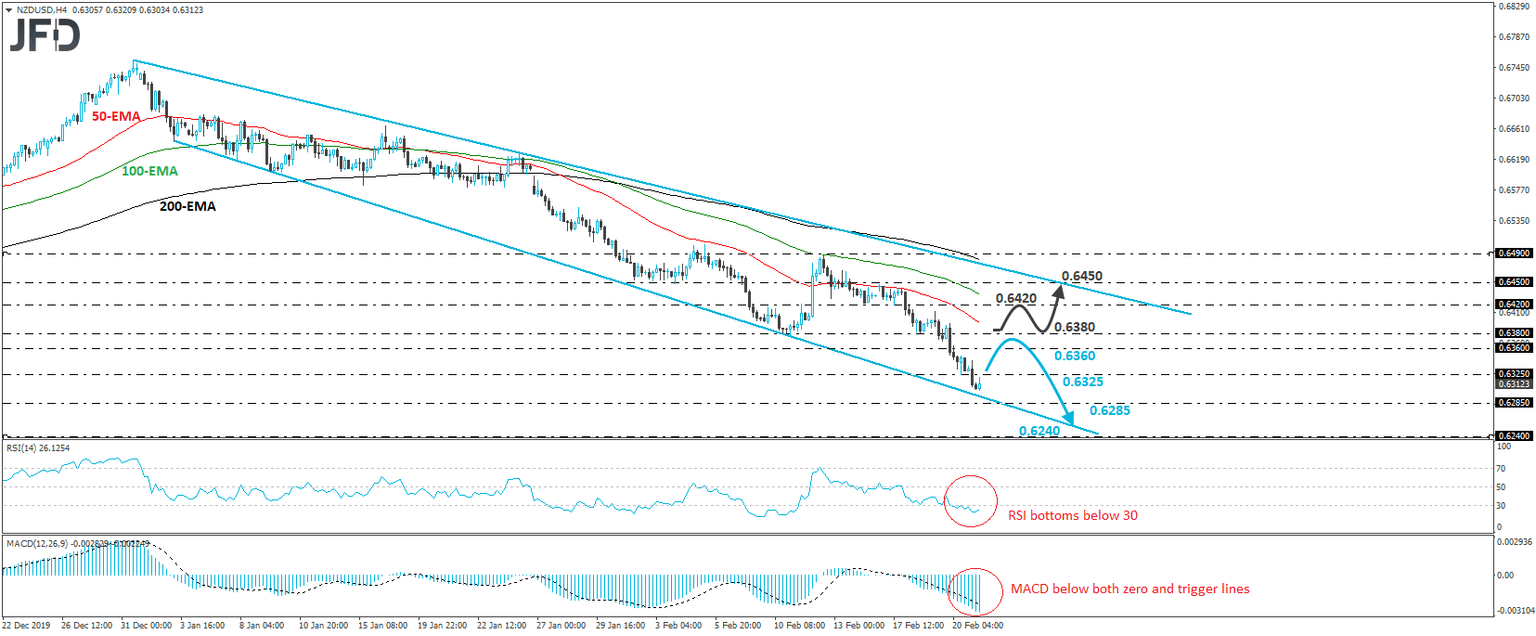

NZD/USD continued tumbling on Friday, breaking below the 0.6325 support (now turned into resistance) barrier, marked by the low of November 12th. Overall, the pair has been printing lower highs and lower lows below a tentative downtrend line drawn from the high of December 31st, which keeps the near-term picture negative. However, bearing in mind that the rate found some support near the return line taken from the low of January 3rd, we would stay careful of a possible corrective bounce before the bears decide to shoot again.

A clear break back above 0.6325 may confirm the case for a small bounce and may allow the recovery to continue towards the 0.6360 or 0.6380 levels, defined as resistance by the inside swing lows of November 14th and February 11th respectively. The bears may regain control from near those levels and may pull the trigger targeting the low of October 17th, at around 0.6285. If they are not willing to hit the brakes near that barrier either, we could see them aiming for the return line again, or the low of October 16th, at around 0.6240.

Taking a look at our short-term oscillators, we see that the RSI lies below 30, but turned up today, while the MACD, although below both its zero and trigger lines, shows signs of slowing down. It could also bottom soon. Both indicators suggest that the strong downside speed may start decelerating and support our view for a small bounce before the next negative leg.

In order to start examining the case for a somewhat larger correction, we would like to see a strong move above 0.6380. Such a move may pave the way towards the 0.6420 zone, the break of which may target the downtrend line taken from the high of December 31st. That said, we would still see decent chances from the bears to jump back in from near that line. In order to totally abandon the bearish case, we would like to see a clear close above 0.6450.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Author

JFD Team

JFD