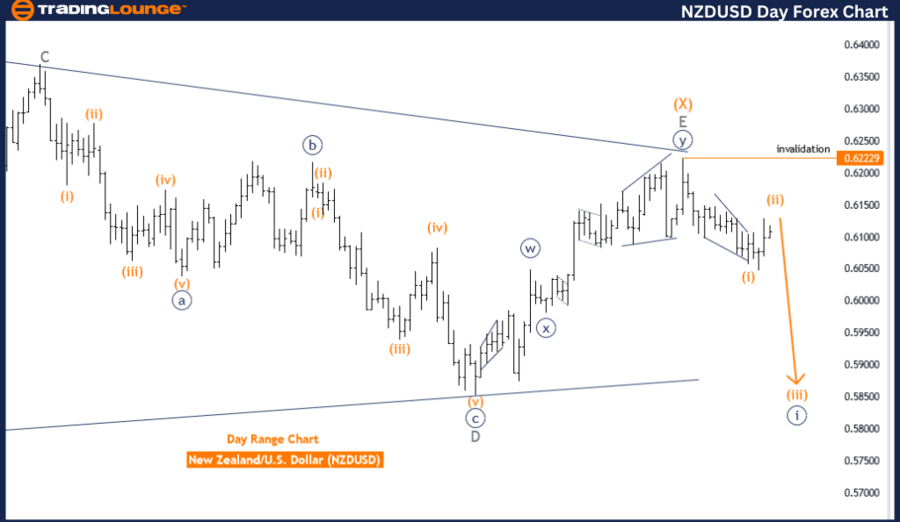

New Zealand Dollar/U.S. Dollar (NZDUSD) Day Chart.

NZD/USD Elliott Wave technical analysis

Function: Trend

Mode: Corrective

Structure: Orange Wave 2

Position: Navy Blue Wave 1

Next lower degree direction: Orange Wave 3

Details:

-

Orange Wave 1 is completed.

-

Orange Wave 2 of Navy Blue Wave 1 is nearing its end.

-

Wave Cancel Invalid Level: 0.62229.

The NZDUSD on the day chart is analyzed using Elliott Wave Theory. The analysis shows a trend, indicating an expected general movement in either an upward or downward direction over the period observed.

Currently, the trend is in a corrective mode, suggesting temporary pullbacks or adjustments against the larger trend direction. The primary focus is on Orange Wave 2, which represents a retracement or consolidation phase within the broader wave sequence.

The market is positioned in Navy Blue Wave 1, marking the initial move of a new wave sequence. The next lower degree direction is Orange Wave 3, which will commence following the completion of the ongoing corrective phase.

Detailed analysis indicates that Orange Wave 1 is now completed. Orange Wave 2 of Navy Blue Wave 1 is currently active, representing a corrective move before the next impulsive wave begins. Orange Wave 2 is nearing its end, signaling an imminent transition to Orange Wave 3.

The wave cancel invalid level is set at 0.62229. This critical threshold acts as a safeguard for the current wave count; if the market surpasses this point, the present wave structure would be invalidated, requiring a re-evaluation of the analysis.

Summary

The NZDUSD on the day chart is in a corrective phase within Orange Wave 2 of Navy Blue Wave 1. With Orange Wave 1 completed, Orange Wave 2 is nearing its conclusion, setting the stage for the subsequent impulsive phase, Orange Wave 3. The wave cancel invalid level is set at 0.62229, beyond which the current wave count would be reconsidered.

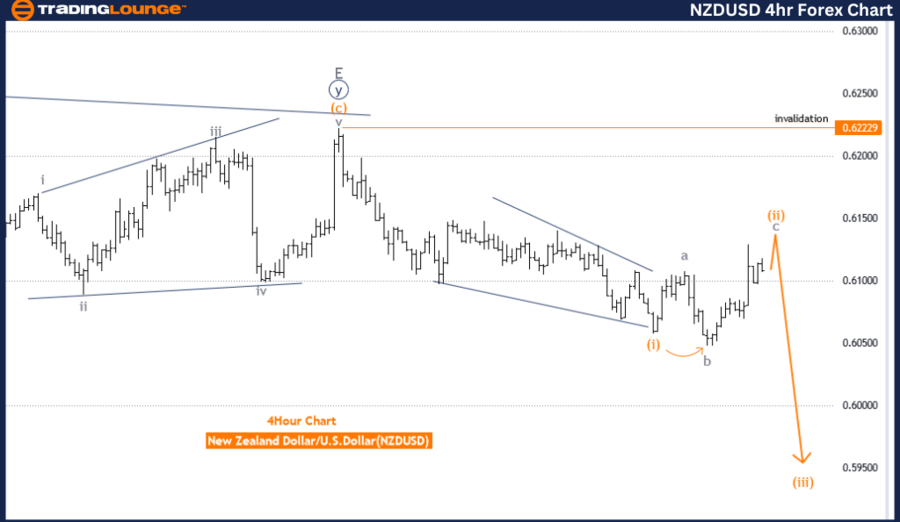

NZD/USD Elliott Wave four-hour chart

Function: Trend.

Mode: Corrective.

Structure: Orange Wave 2.

Position: Navy Blue Wave 1.

Next lower degree direction: Orange Wave 3.

Details:

-

Orange Wave 1 is completed.

-

Orange Wave 2 of Navy Blue Wave 1 is nearing its end.

-

Wave Cancel Invalid Level: 0.62229.

The NZDUSD is analyzed using Elliott Wave Theory on the 4-hour chart. This analysis indicates a trend, suggesting an expected general movement in an upward or downward direction over the observed period.

Currently, the trend is in a corrective mode, indicating temporary pullbacks or adjustments against the larger trend direction. The focus is on Orange Wave 2, representing a retracement or consolidation phase within the broader wave sequence.

The market is positioned in Navy Blue Wave 1, marking the initial move of a new wave sequence. The next lower degree direction is Orange Wave 3, which will commence following the completion of the ongoing corrective phase.

Detailed analysis reveals that Orange Wave 1 is now completed. Orange Wave 2 of Navy Blue Wave 1 is currently active, representing a corrective move before the next impulsive wave begins. Orange Wave 2 is nearing its end, signaling an imminent transition to Orange Wave 3.

The wave cancel invalid level is set at 0.62229. This critical threshold acts as a safeguard for the current wave count; if the market surpasses this point, the present wave structure would be invalidated, requiring a re-evaluation of the analysis.

Summary

The NZDUSD on the 4-hour chart is in a corrective phase within Orange Wave 2 of Navy Blue Wave 1. With Orange Wave 1 completed, Orange Wave 2 is nearing its conclusion, setting the stage for the subsequent impulsive phase, Orange Wave 3. The wave cancel invalid level is set at 0.62229, beyond which the current wave count would be reconsidered.

NZD/USD Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended Content

Editors’ Picks

AUD/USD: Further range bound should not be ruled out

AUD/USD managed to regain the smile and challenged the key 0.6500 hurdle on the back of the knee-jerk in the US Dollar and ahead of key data releases in Australia and the US labour market.

EUR/USD trapped below 1.0600

EUR/USD turned lower once again on Tuesday, grappling with the 1.0500 handle as Fiber flubs a bullish run at 1.0600. Several EU-centric datapoints are releasing on Wednesday, but most of the figures are final prints that are unlikely to move markets, and most investors are pivoting to face US NFP jobs data due at the end of the week.

Gold keeps struggling for direction

Following Monday's retreat, Gold stabilizes and trades in a narrow band below $2,650. The benchmark 10-year US Treasury bond yield stays flat near 4.2% ahead of Fedspeak, making it difficult for XAU/USD to gather directional momentum.

Australia GDP growth set to accelerate slightly in Q3, dashing hopes of imminent RBA rate cut

Australian Gross Domestic Product is foreseen to be up by 1.1% in Q3 compared with the same quarter a year earlier. The Reserve Bank of Australia will likely maintain the OCR on hold until later in 2025. The Australian Dollar advances against its United States rival, sellers waiting for better levels.

The fall of Barnier’s government would be bad news for the French economy

This French political stand-off is just one more negative for the euro. With the eurozone economy facing the threat of tariffs in 2025 and the region lacking any prospect of cohesive fiscal support, the potential fall of the French government merely adds to views that the ECB will have to do the heavy lifting in 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.