NZ Dollar edges lower as inflation expectations fall

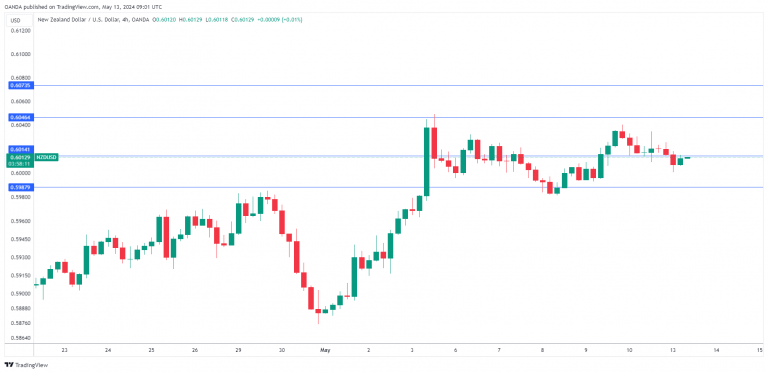

The New Zealand dollar has edged lower on Monday. NZD/USD is down 0.17% on the day, trading at 0.6009 in the European session at the time of writing.

NZ inflation expectations ease to 2.3%

New Zealand’s inflation expectations fell to 2.3% in the second quarter, its lowest point since Q3 2021. This marked a third straight deceleration and the New Zealand dollar responded with modest losses. The steady drop in inflation expectations is an encouraging sign for the Reserve Bank of New Zealand but won’t translate into a rate cut in the near-term.

The New Zealand economy is sputtering and inflation fell to 4% in the first quarter, down from 4.7% in the fourth-quarter of 2023. Inflation is expected to continue falling but it has been stickier than expected and remains above the upper range of the 1-3% target band.

The central bank has shown its willingness to continue a “higher for longer stance” and has maintained the cash rate at 5.25% for six successive times. RBNZ policy makers are reluctant to start lowering rates until there is evidence that inflation will remain sustainable around 2% and that goal may not be achieved until 2025. The money markets expect the RBNZ to start cutting in the fourth quarter. The RBNZ meets next on May 22nd.

Last week, The Organization for Economic Cooperation and Development (OECD) stated that New Zealand’s inflation is “likely to be persistent” and urged the RBNZ not to lower rates until there was “clear evidence that inflation will fall to the middle of the RBNZ’s target range”. The OECD report noted that it was “uncertain” when inflation would fall to the RBNZ’s target range and there was a risk of “further negative global shocks”.

NZD/USD technical

-

NZD/USD is testing support at 0.6014. Below, there is support at 0.5987.

-

0.6046 and 0.6073 are the next resistance lines.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.