NVDA reversing islands

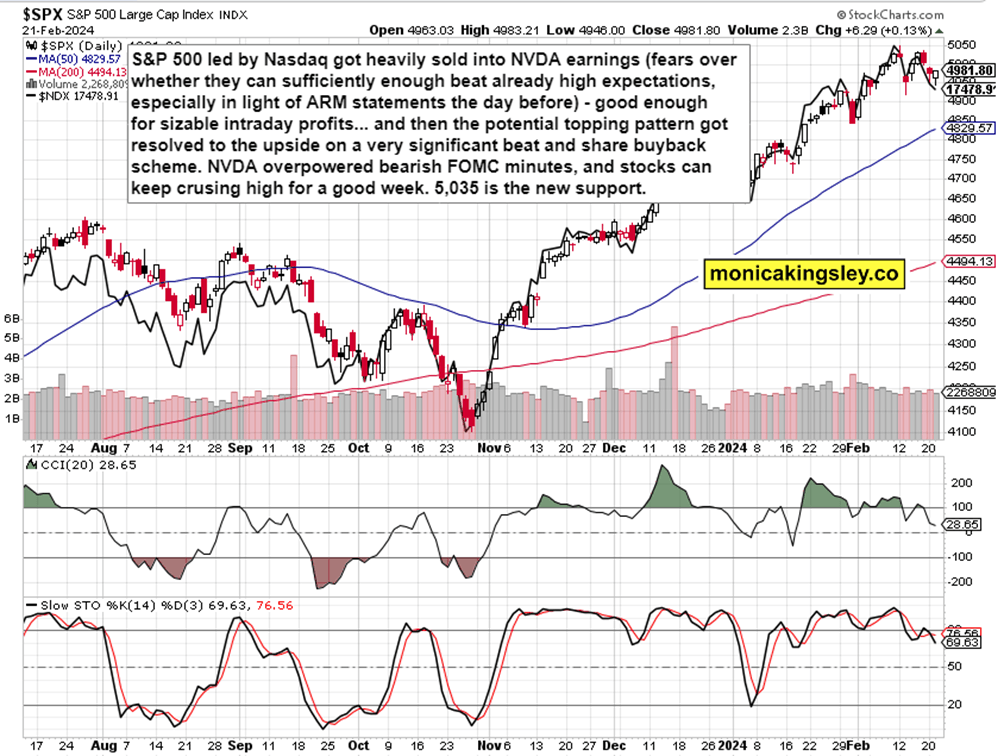

Budding S&P 500 island reversal that wasn‘t completed – the degree of positive earnings surprise was such that pre-earnings buying off the intraday lows – finely caught in the intraday channel for easiest 154 NDX points gain – overcame both 5,005 and 5,015 resistance levels with utmost ease. The worry wasn‘t whether they would pale, but whether the market would be satisfied with the level of shining, and it was.

Thus, no tentative reversal that had the power to go for 4,880s with ease so as to suher in a much awaited correction – this plan had been cancelled, and 5,035 is a new support that wouldn‘t be reached today. Bearish FOMC minutes or high yelds are forgotten, and the same goes for ARM late session weakness the day before. Digestion of aftermarket gains is the name of today‘s game.

Gold as well held really well through the FOMC minutes, and both the yellow and black gold would need to repel meek selling pressure during today‘s regular session, with copper being relatively least vulnerable.

Let‘s move right into the charts – today‘s full scale article contains 3 of them, featuring S&P 500, precious metals and oil.

Tired of seeing those red boxes instead of way more valuable information? Try the premium services based on what and how you trade.

S&P 500 and Nasdaq

5,065 is to provide some resistance later today, but the buyers can push through this level. Some weak opening selling in the first half of the session followed by the bid again returning after New York lunch time, is roughly what I‘m looking for. The 5,027 – 5,035 zone would absorb all selling this week if sellers get support enough from (no landing favoring) unemployment claims or some weaker than expected bond auction. Tight range trading with a bullish bias is more likely though.

Crude Oil

Crude oil would move into $81 - $82 zone even if it was rejected in $78.30s today. Range-bound for now, but the series of higher lows on 4 hour chart, is there as much as the rising EMA (54) to absorb the selling.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.