Novavax ($NVAX) riding the waves

Continuing along the theme of Corona Virus stocks, this week Novavax Inc. is next up in line. Novavax has gone parabolic with the COVID-19 spreading worldwide as with the other names I have covered. It also remains very technical, and I think there could a few more swings up before a longer term top is realized. Lets take a look at what they do as a company:

Novavax, Inc. is a clinical-stage biotechnology company committed to delivering novel products to prevent a broad range of infectious diseases. Using innovative proprietary recombinant nanoparticle vaccine technology, we produce vaccine candidates to efficiently and effectively respond to both known and emerging disease threats. Our vaccine candidates are genetically engineered three-dimensional nanostructures that incorporate recombinant proteins critical to disease pathogenesis.

Novavax has had an impressive rally so far this year. Also, the structure of this stock looks a lot better than many other plays I have covered in the COVID-19 related fields. With that said, the Elliott Wave view seems to be counting technically clean. Let’s take a look below at the 4H view.

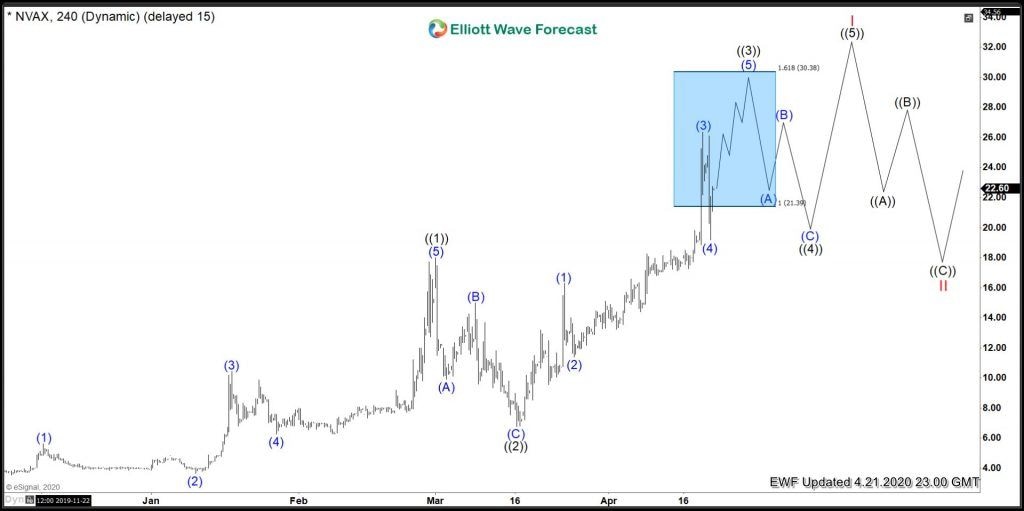

Novavax 4H Elliott Wave View

Novavax set all time lows in November 2019 at 3.54. From there Novavax had a clean 5 waves advance shown in blue, for a wave ((1)) top at 17.71. From there wave ((2)) is set at 6.77 and a wave ((3)) advance is currently underway. Prices have reached the equal legs extreme area of ((1))-((2)) as shown above, in a blue box. This is an area where sellers may enter for a pullback in 3, 7 or 11 waves. Prices entered the box and found resistance to pullback in a blue (4) of ((3)).

Prices still have a bit more upside in wave ((3)) to complete the sequence before a pullback in wave ((4)) is expected. It’s a bit late in the cycle to start chasing new longs, but the target for ((3)) is the 161.8% extension at 30.38. After a wave ((4)) has played out in 3,7 or 11 waves, there is room for a wave ((5)) of Red I to complete the sequence.

Author

Wave Pattern Traders Team

Wave Pattern Traders

Specialists in the use of Elliott Wave, Market Analysis, Fractals & Fibonacci.