- US job growth has probably accelerated considerably in March.

- Some of the increase is priced into the dollar, but not all of it.

- Low liquidity conditions on Good Friday may accelerate the greenback's gains.

Now hiring – while it may take time to get some 9.5 million Americans back to work, many companies are looking for new workers. For currency traders, the question is how much of that is priced into the dollar? Perhaps not enough.

Here are five reasons why it could be even higher, pushing the dollar up.

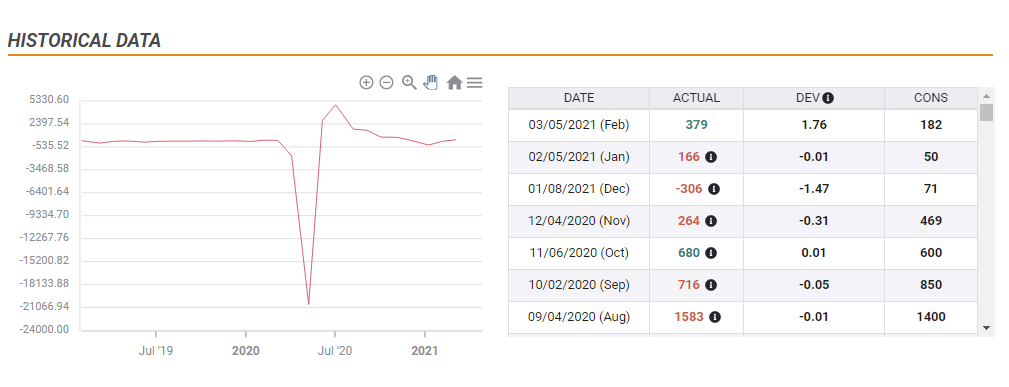

1) Last month's beat

Are economists up to speed March's Nonfarm Payrolls report is set to show an increase of 630,000 jobs, the best read since October and after beating estimates in February with 379,000, on top of upward revisions.

Source: FXStreet

After three months of misses, economists may have lowered their estimates, and could be underestimating the pace of the recovery.

2) Stimulus: new and old

The $600 dollar stimulus checks approved late last year pushed personal income higher in January and continued propagating through the economy during February and March. In the middle of last month, Congress approved a new covid relief package, this time including payments of $1,400.

Even if the impact of the new money will only be felt, later on, the drive toward pushing a large new fiscal plan probably raised confidence and encouraged hiring.

3) Vaccine ramping up

The goal of offering immunization to every American by May 1 seems feasible as more and more states have already achieved that milestone. At the current pace, doses will reach the arms of half of the US by May 9.

In Israel, cases began falling sharply around the time they reached 50% of the population. With 1.75 million people getting their first shot in America every day, optimism is another source of hiring.

Source: New York Times

4) Rapid reopening

Texas Governor Greg Abbot canceled all restrictions and was the first to burst out the door – as if it were a saloon in the wild west. While some states are suffering an increase in cases, the quick return to normal has also contributed to additional jobs being created – at least in the services sector.

Bars and restaurants are filling up once again, and that is the source of many jobs that cannot be automated.

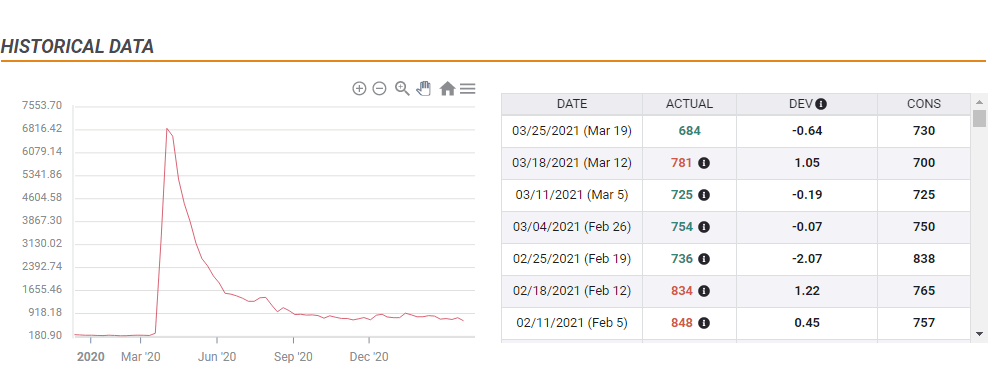

5) Jobless claims at new lows

Early indicators of a hiring spree have been seen in the flip side of employment – unemployment. Weekly jobless claims dropped to 684,000 in the week ending March 19, the lowest since the spring of last year. Continuing applications have also been trending lower.

While the correlation between weekly claims and the Nonfarm Payrolls has not always been consistent, it is a better indicator than ADP's jobs report.

Source: FXStreet

All in all, there is room for substantial job growth, but how much is priced in?

Dollar reaction

As mentioned, the economic calendar is pointing to an increase of 630,000 positions, which would be a significant increase from last month. Any figure above that would already be a surprise that is not priced in.

As the Federal Reserve disregards the Unemployment Rate but focuses on bringing people back to work, revisions to data for the past two months are also critical. If the US gained only 600,000 positions but if another 100,000 or more added to the tallies for February and January, it would also serve as an upbeat development.

While some of the elevated increase is priced in, it is essential to note that the timing of the release – Good Friday. All of Europe and also other parts of the world are enjoying the Easter holiday, which means that trading volume will likely be extremely low. Under these circumstances, price action will likely be wild.

For the dollar, a small NFP beat could turn into a massive rally – just due to low liquidity.

Conclusion

March's US jobs report will likely mark the beginning of accelerated recovery. Part of that is already reflected in the dollar's value, but probably not all of it, given the five reasons described above. Exceptionally low liquidity may trigger substantial moves.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD struggles to hold above 1.0400 as mood sours

EUR/USD stays on the back foot and trades near 1.0400 following the earlier recovery attempt. The holiday mood kicked in, keeping action limited across the FX board, while a cautious risk mood helped the US Dollar hold its ground and forced the pair to stretch lower.

GBP/USD approaches 1.2500 on renewed USD strength

GBP/USD loses its traction and trades near 1.2500 in the second half of the day on Monday. The US Dollar (USD) benefits from safe-haven flows and weighs on the pair as trading conditions remain thin heading into the Christmas holiday.

Gold hovers around $2,610 in quiet pre-holiday trading

Gold struggles to build on Friday's gains and trades modestly lower on the day near $2,620. The benchmark 10-year US Treasury bond yield edges slightly higher above 4.5%, making it difficult for XAU/USD to gather bullish momentum.

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin hovers around $95,000 on Monday after losing the progress made during Friday’s relief rally. The largest cryptocurrency hit a new all-time high at $108,353 on Tuesday but this was followed by a steep correction after the US Fed signaled fewer interest-rate cuts than previously anticipated for 2025.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.