Non-Farm Payrolls: Greenback comeback or cementing a second double Fed cut? Three scenarios

- Economists expect a gain of 175,000 jobs in February after a leap in January.

- Non-Farm Payrolls will likely impact the Fed's next rate decision.

- The figures are set to provide a strong finish to a turbulent week dominated by the coronavirus outbreak.

The "king of forex indicators" is competing for market impact with something else that resembles a crown – the coronavirus. Nevertheless, the Non-Farm Payrolls report – like the disease – both effect the Federal Reserve and the dollar.

Upbeat US jobs situation

America is hiring at a satisfactory pace. In January, the world's largest economy gained 225,000 jobs – better than expected and an impressive increase also in absolute. Despite a few hiccups, the labor market has been robust in recent years.

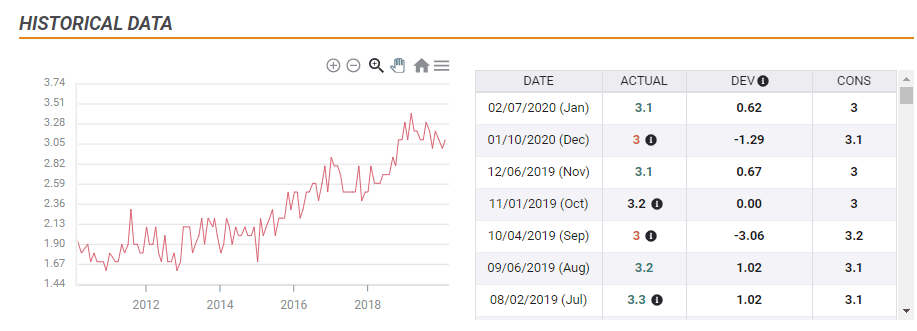

The Federal Reserve cut rates three times in 2019 due to low inflation and trade concerns – not the pace of hiring nor wages. Salaries have been rising around 3% yearly, above the averages of previous years.

While the uptrend is clear to see in the chart below, inflation remains tame. Nevertheless, such levels support higher prices down the line or at least do not warrant rate cuts.

The economic calendar is showing that markets expected an increase of 175,000 jobs and for wage growth to decelerate from 3.1% to 3% modestly.

The ADP private-sector jobs report and the employment component of the ISM Non-Manufacturing Purchasing Managers' Index were both satisfactory, meaning market estimates have likely remained unchanged.

Focus on the Fed

The Federal Reserve slashed interest rates by 50 basis points – double the standard move – and in an unscheduled event. The emergency move came just three days ahead of NFP release, and with the focus being on the virus, the jobs report may seem secondary.

However, investors are already looking toward the scheduled Fed meeting on March 18 – just 12 days after the Non-Farm Payrolls release. At the time of writing, markets are fully pricing a reduction of 25 basis points and around 70% of a 50bp cut.

The employment data has, therefore, the power to shift expectations between 25 to 50 points – and that makes a difference for the dollar.

Three scenarios

1) As expected: If the headline figure is somewhere between 150,000 to 200,00 and wages between 2.9% to 3.1%, speculation could continue. Investors are likely to extend existing trends and return to focusing on coronavirus headlines.

2) Worse than expected: A disappointing increase of fewer than 150,000 positions or a slowdown in earnings to 2.8% or below could send the dollar down as markets would begin pricing a double-dose rate cut. The Fed would have another justification to slash borrowing costs. The greenback and gold could fall in such a scenario.

3) Better than expected: Another blockbuster jump in jobs – above 200,000 – or wage growth at 3.2% yearly or higher could trigger a dollar and gold rally. The central bank could consider keeping its powder dry and settling for only one rate cut later this month.

Conclusion

While the world is focused on coronavirus headlines, the Non-Farm Payrolls will likely make a difference for the Fed – the difference between a minimal 25bp rate cut another double-dose 50bp one. The dollar, gold, and other assets have room to rock.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.