No Kamala! Inflation isn't because of “Record” grocery store profits

Kamala Harris blames grocery store profits for price inflation. She has even floated a plan to prohibit food “price gouging” that sounds a lot like price controls.

You have to give Harris credit for smart politicking. The “greedy corporations” trope plays well with a lot of Americans. In fact, I frequently see posts about corporate greed and inflation on social media. Here’s the latest grocery store-specific meme making the rounds.

It sounds plausible, especially if you already distrust corporations. The problem is it’s not true.

Make no mistake; it’s definitely solid fodder for people who don't understand the root causes of price inflation (central bank and government money creation.) And it’s very helpful to government people who don't want you to know they're making your life crappier. But this meme has little to no basis in reality.

Inflation explained

In any discussion about inflation, it’s important to distinguish between price inflation and monetary inflation.

When most people say “inflation,” they mean “prices are going up” – price inflation. All kinds of things can make prices go up – including greedy corporations. But the current bout of rising prices that we’re dealing with has a specific cause that Kamal Harris and the rest of the political class don’t want you to know about.

Monetary inflation (properly defined as the increase of the money supply and credit) causes all prices in the economy to generally rise. In other words, price inflation is a symptom of monetary inflation.

And what causes monetary inflation?

Central banks and governments via fiscal and monetary policy! It’s the money printing!

It's important to understand that monetary inflation not only causes consumer prices to go up (i.e. groceries), but it also inflates asset prices. So, your home value goes up. The price of oil and other commodities goes up. The stock market goes up.

And guess what -- corporate profits go up.

It's not so much that things are getting more expensive. What's really happening is the value of a dollar is decreasing. As the Federal Reserve creates more and more dollars to prop up the federal government’s borrowing and spending, each dollar is worth less. That means it takes more dollars to buy the same amount of stuff. So, companies are enjoying bigger dollar profits, but they aren't better off than they were a couple of years ago.

I don't doubt that in absolute dollar terms, profits are at record levels, so the meme is technically correct. But that doesn’t mean companies are better off. If you inflation-adjust the record profits, they are no longer records.

Think of it this way. If you get a big raise this year, I could say that you are making “record profits” on your labor. But you're probably going to tell me that everything is so much more expensive, so, you aren’t really any better off. Your raise is just another inflationary phenomenon.

Are grocers making "record profits?

A better look at what's going on is a company's profit margin. That's the amount a company keeps after subtracting all direct and indirect costs.

So, are grocery store profit margins at record levels?

Some people have rightly pointed out that grocery store profit margins are historically razor-slim to begin with. They generally run between 0.5 and 3 percent. My wife used to work in the grocery business, and she called it "penny profit." If a grocer sells a can of peas for a dollar, the profit is about 1 cent.

But that's not really the point. The question isn't how high are profits in dollar terms. The question is: are their profit margins expanding? If grocery stores were actually price gouging, then their profit margins would go up.

They aren't.

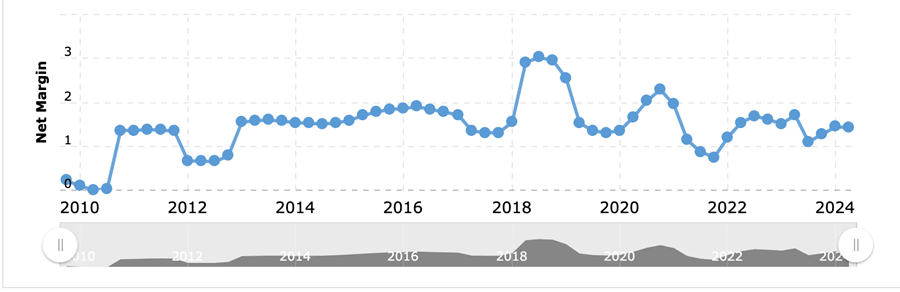

This is Kroger's profit margin over time. As you can see, margins are currently in line with the historical average and below a long stretch during a relatively quiet economic period in the 2010s.

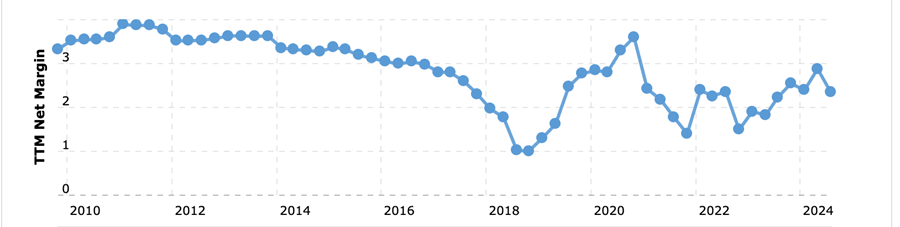

Here's Walmart's profit margin. It runs a little higher than Kroger because it is a hybrid grocer/general retailer. Nevertheless, its profit margin is also currently on the low side of the average.

You'll notice that both big corporations did quite well during the pandemic era when the government closed down most of the small businesses and forced customers to buy everything from big boys. But profit margins dropped as the inflationary pressures from all the money printing and stimulus hit the economy.

The bottom line is corporate bottom lines in the grocery business aren't at record levels in real terms.

So, the real question you should be asking isn’t, “Why are grocery store profits at record highs?" The real question is, “Why is the government constantly stealing the purchasing power of our money and making us poorer?”

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.