Nike informs Mike

S2N observations

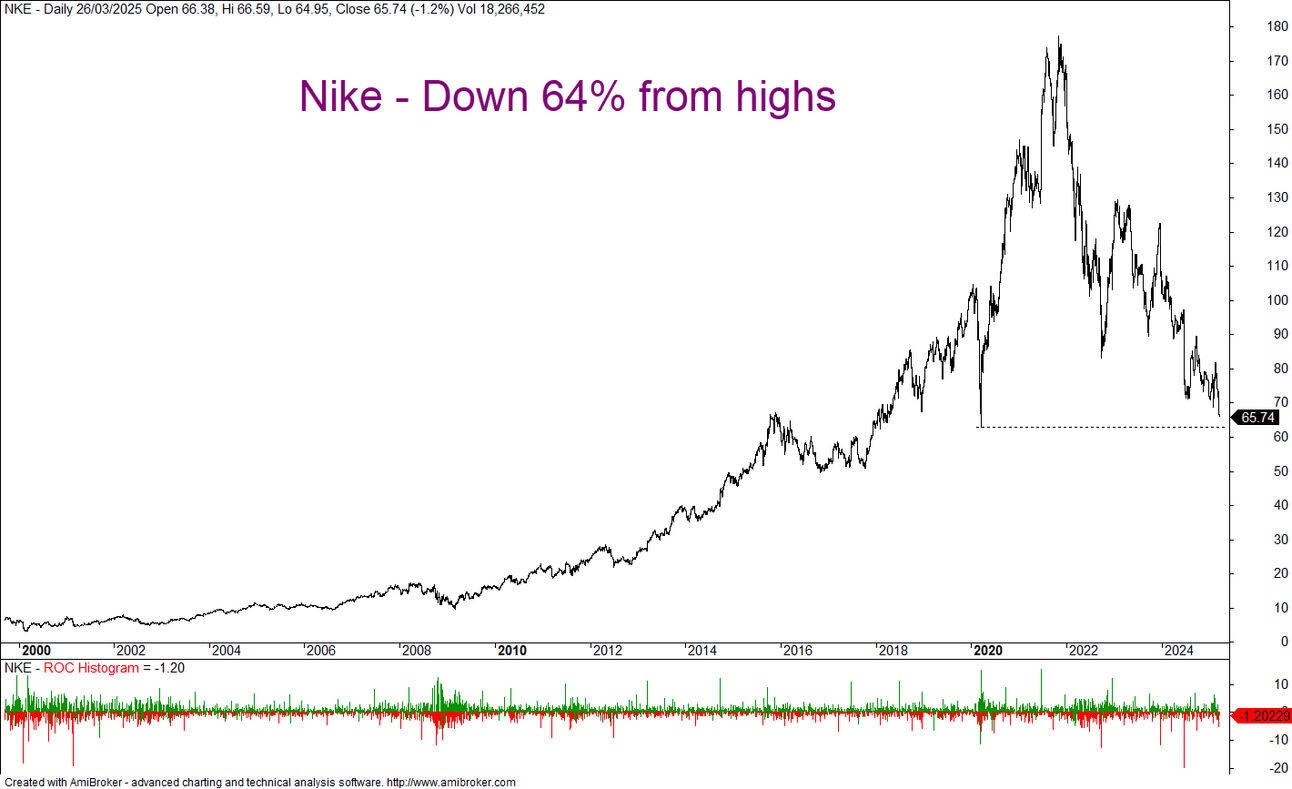

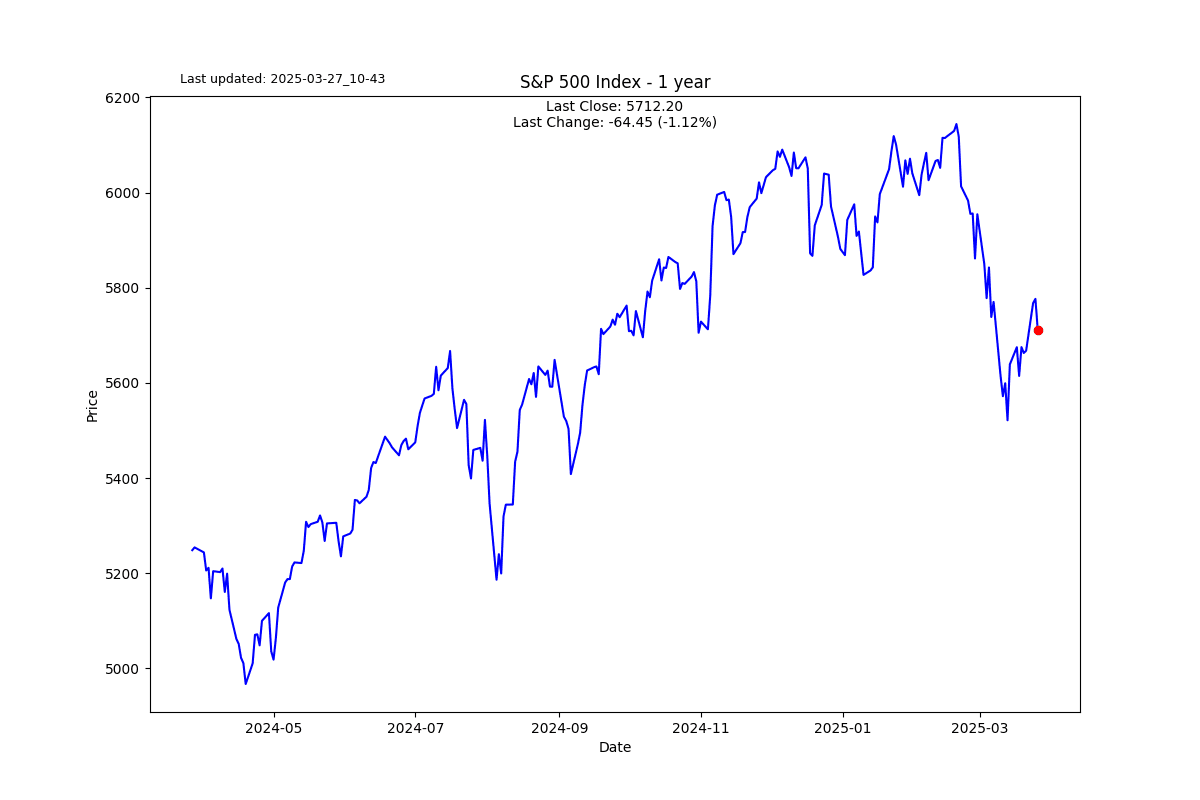

I am not sure why, but today I decided to look at Nike’s price chart. I was really surprised to see it is down 64% from its recent highs. Nike is still a cool brand; at least I think it is. The consumer must be really struggling if the stock is doing this badly.

I have come up with a new logo for Nike.

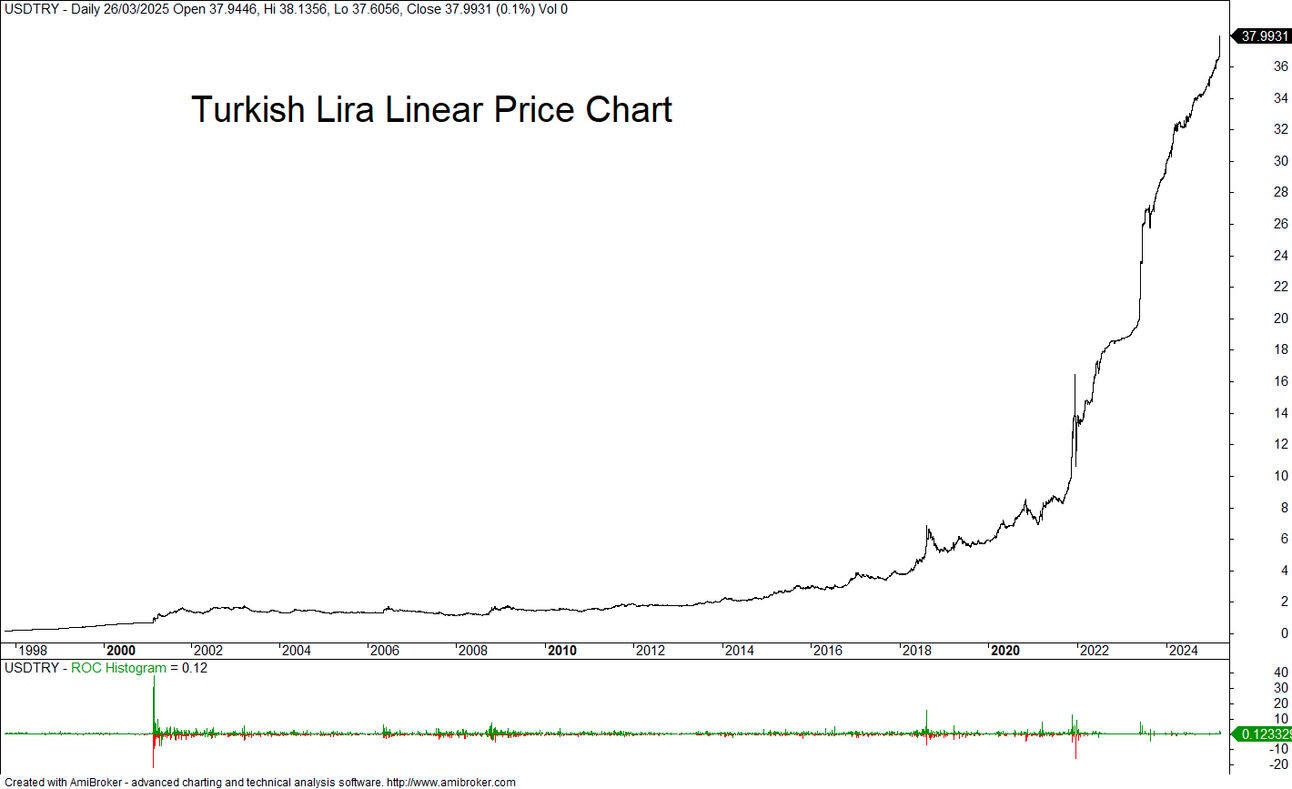

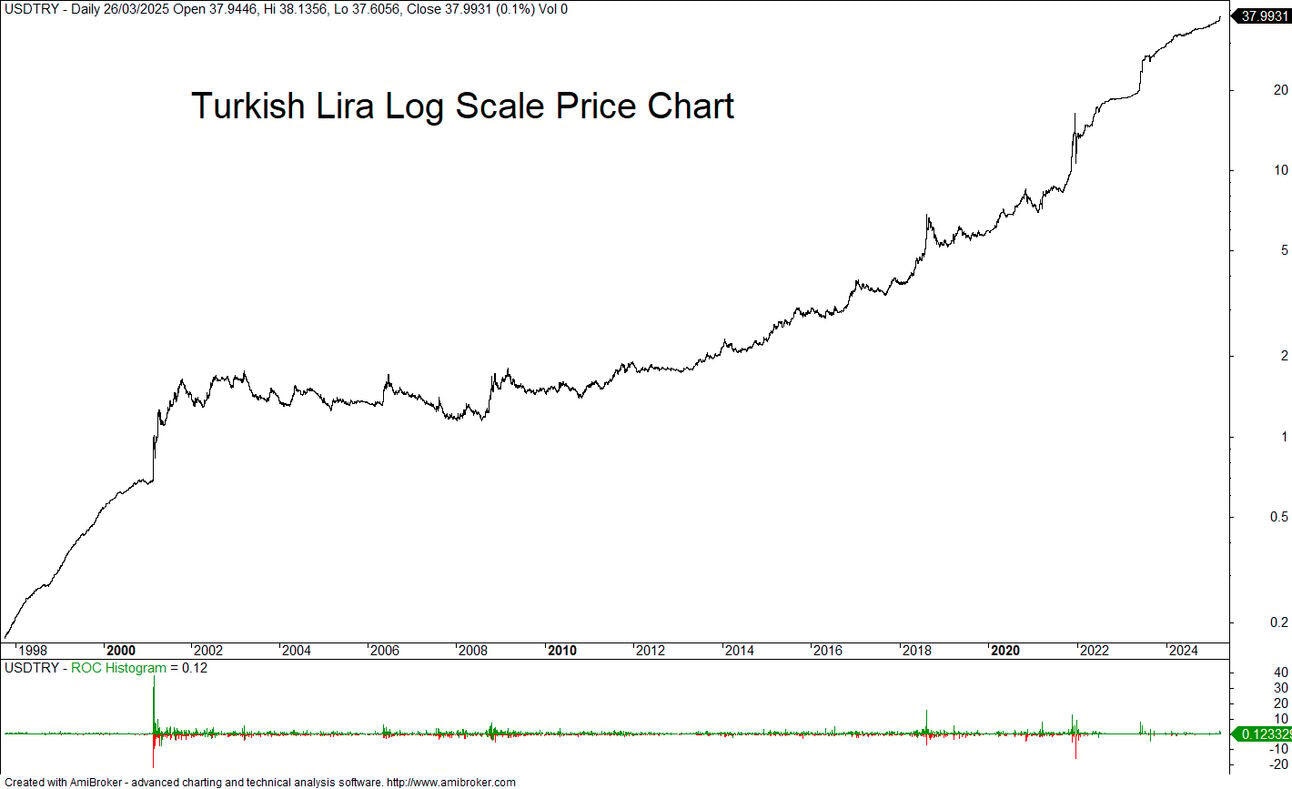

I mentioned a few days ago the trouble Turkey is in. I share 2 versions of its currency chart. I am sharing the traditional format, which is how many lira for a dollar. So the higher it goes up, the weaker it is.

For a bit of shock value, I share the linear price chart.

Most people’s brains are not wired to do the arithmetic, so here is a log scale of the weakening currency. Either way you look at it, the Turkish Lira has lost 98.68 of its value in the last 25 years. Recep Tayyip Erdoğan has been in power for 22 of those years. Enough said.

By the way, I read the full transcripts of the Signal saga. Despite the fact that they completely screwed up on protocol, I was unimpressed with the tone of the texts. It felt so tentative with everyone so scared to upset anyone. It also seems like JD Vance is the most assertice VP I have seen in many years. Just my views.

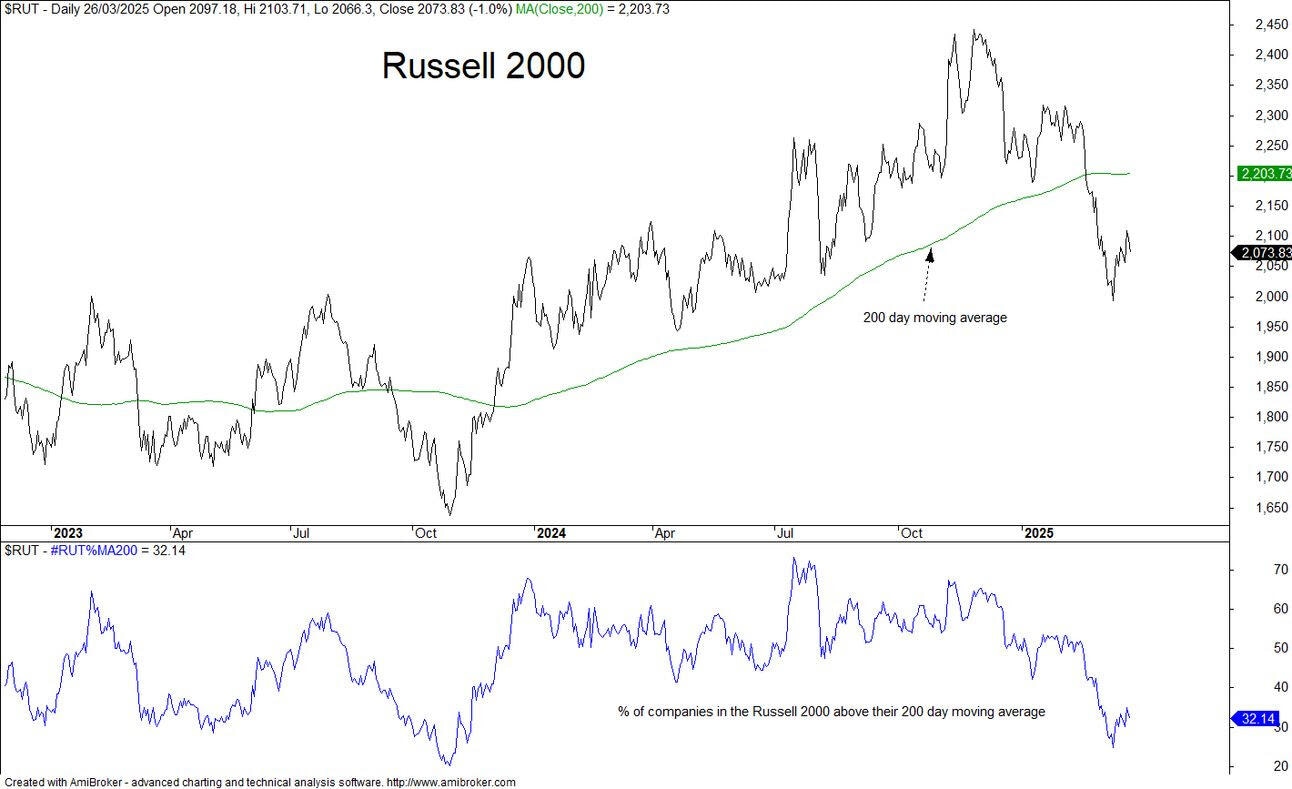

The Russell 2000, a broader view of the marketplace, is certainly weaker than some of the larger cap indices.

S2N screener alert

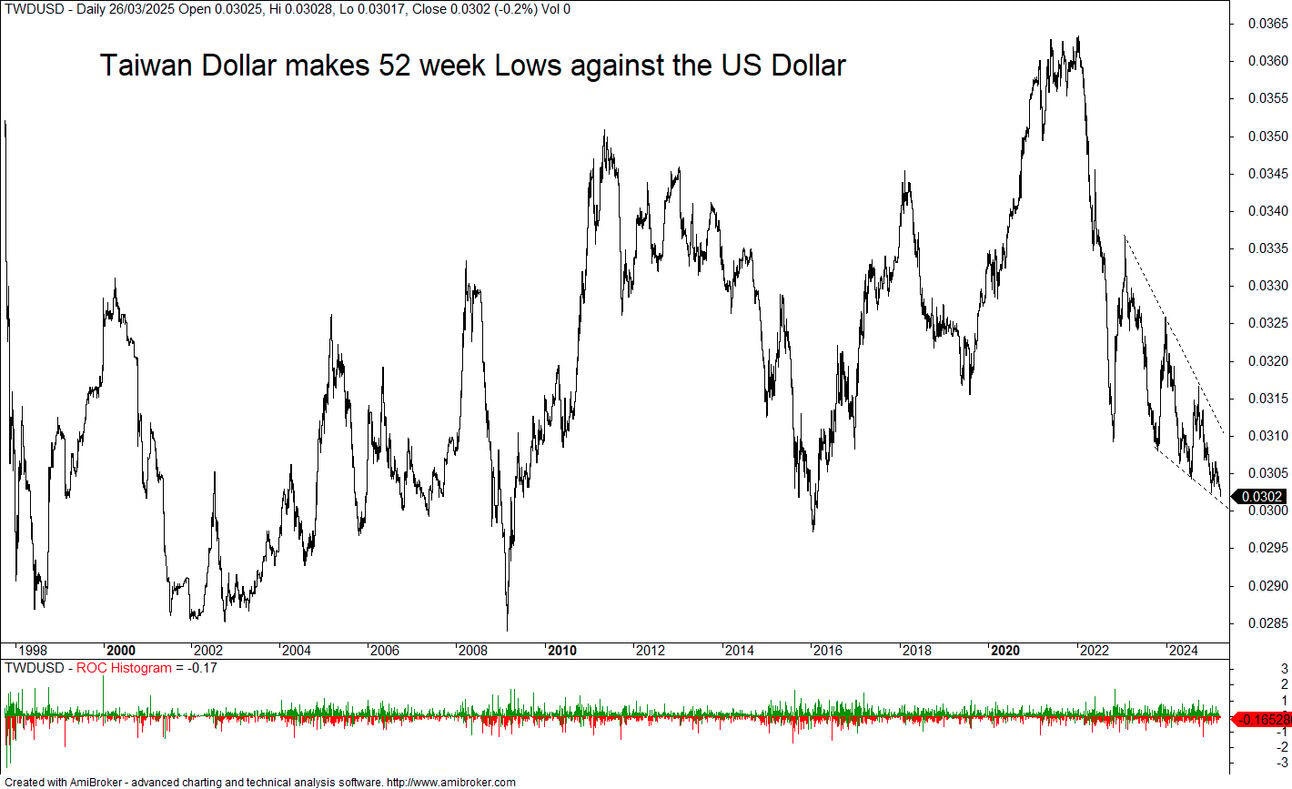

The Taiwanese Dollar made a 52-week low against the US Dollar. No doubt the mainland flexing is not good for a sovereign currency.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.