NFP preview: US jobs report and market impact on the DXY

-

The NFP report will provide insights into the health of the US labor market and may influence the Federal Reserve's interest rate decisions.

-

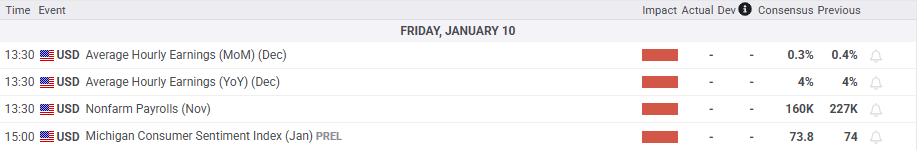

The consensus forecast is 160,000 jobs added, with the unemployment rate expected to hold steady at 4.2% and average hourly earnings at 4.1% YoY.

-

The Federal Reserve is closely monitoring wage growth as a key indicator of inflation, which could impact their policy decisions.

-

US Dollar Index is trading at two-year highs, and the NFP report could act as a catalyst for further gains or a potential pullback.

The U.S. Nonfarm Payroll (NFP) report will give traders, analysts, and economists important clues about the strength of the U.S. job market. This report will also help predict what the Federal Reserve might do with interest rates in the coming months.

On Wednesday we got a glimpse into the meeting minutes of the Feds December meeting which showed policymakers concerns around inflation and the potential impact of President Elect Donald Trump's proposed tariff hikes.

Not a surprise as this was discussed in our December NFP Preview. Since the December meeting it has become clear that market participants expect slower moves from the Federal Reserve as uncertainty remains a key factor.

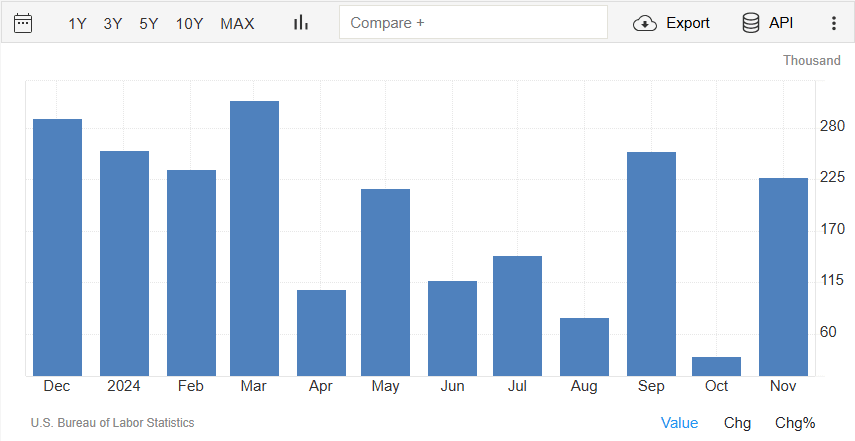

US Nonfarm Payrolls data

Source: TradingEconomics

Looking back: The current state of the US job market

To understand the potential implications of January's NFP report, it's critical to first review the most recent data and broader trends in the labor market.

November-December job market recap

The December job report showed both good and bad news for the U.S. job market. November was strong, with 227000 jobs added, beating the 200000 expected. Jobs went up in health care (54,000), leisure and hospitality (53,000), government (33,000), and social assistance (19,000). Transportation equipment manufacturing also added 32,000 jobs because workers who were on strike returned to work.

However, retail lost 28,000 jobs, and there wasn’t much change in industries like mining, construction, wholesale trade, transportation, information, finance, and professional services.

Unemployment rate, participation metrics and average hourly earnings

The unemployment rate went up to 4.2% in November from a previous 4.1%. However, given the concern shown by the Fed meeting minutes around inflation, the average hourly earnings print may hold a lot of weight.

As things stand the expectation is for a print of 4% YoY in December which would be in line with the November print.

The US Labor Market became pivotal in the back end of 2024 as the Fed were concerned about a potential rise in unemployment following some downward revisions. However since then, data has been solid barring the interruptions by the Boeing strike and Hurricane Helene.

Moving into the New Year and given the Feds December minutes release, Labor data will remain important but the focus may likely shift back to inflation moving forward. This seems to be the key risk at least for the first quarter as President Trump assumes office and markets gauge his policies and their potential implications.

NFP preview: What to expect today?

The January 2025 NFP report is forecast to show 160,000 jobs added, slightly higher than the average for the last four months of 2024 of 150000. The unemployment rate is expected to remain at 4.2%, while average hourly earnings is also expected to remain steady at 4.1% YoY.

However, I would advise caution as surprises are still possible. Seasonal adjustments, delayed layoffs, and fragile consumer sentiment add complexity to forecasting this report.

Potential impact and scenarios

Markets will be eyeing the data which will have a knock on impact across various asset classes. US Yields are of particular interest given their recent rally while the US Dollar index is trading at two-year highs.

In my opinion there does need to be a significant deviation from consensus for any significant change to the rate probabilities for 2025. Without it, I expect rate cut expectations to remain rather steady ahead of the Trump inauguration on January 20, 2025.

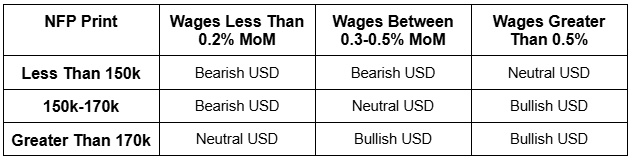

Potential impact on the US Dollar based on the data released

Source: LSEG, TradingEconomics. Table Created by Zain Vawda

Technical analysis US Dollar Index (DXY)

Looking at the US Dollar Index and bulls are definitely in charge. The DXY continues to benefit from fears that US tariff policy will lead to an uptick in inflation, something which was confirmed by the Fed meeting minutes.

The meeting minutes showed that some members openly accepted that potential Trump policies impacted their dot plot decision making.

As things stand, the DXY is hovering around two-year highs with any selloffs off late being met by significant buying pressure.

For now the 109.52 handle appears to holding firm with markets eyeing the NFP as a potential catalyst.

The table above provides potential scenarios for the US Dollar depending on the data.

A strong NFP print and rise is earnings could propel the DXY beyond the 109.52 handle before the psychological 110.00 handle becomes the focus. A break beyond 110.00 and 111.00 may prove to be next key level market participants may keep an eye on.

A weak NFP print and a drop in hourly earnings could facilitate a move lower for the DXY and a test of the ascending trendline. However the issue is whether any such move will be sustainable moving forward. Key levels include 108.50, 108.00 and 107.26.

US Dollar Index (DXY) daily chart, January 10, 2024

Source: TradingView (click to enlarge)

Support

- 108.50

- 108.00

- 107.26

Resistance

- 109.52

- 110.00

- 111.00

Author

Zain Vawda

MarketPulse

Zain is a seasoned financial markets analyst and educator with expertise in retail forex, economics, and market analysis.