NFP Preview: How low can the dollar go? Extremely low expectations point to a greenback comeback

- Weak leading indicators have significantly depressed expectations for August's Nonfarm Payrolls.

- There are reasons to expect a somewhat better outcome.

- The low bar is easier to cross, and overstretched shorts imply a big dollar bounce.

The dollar is data-dependent – and that data has been downbeat, sending the dollar down. Has it gone too far? The most significant statistic for the Federal Reserve's critical September decision is August's Nonfarm Payrolls, and a mix of exaggerated low expectations and overstretched dollar shorts could trigger a big bounce.

Fed Chair Jerome Powell refrained from committing himself to tapering the bank's gargantuan $120 billion/month bond-buying scheme in the upcoming September meeting. His caution – coming despite two excellent leaps in the past two labor market reports.

However, a third consecutive blockbuster NFP could tilt the picture toward kickstarting tapering – or at least making a pre-announcement – in less than weeks. Powell left it up to the NFP, but data coming out ahead of the report looked awful and dealt the dollar another blow.

Red on the screens

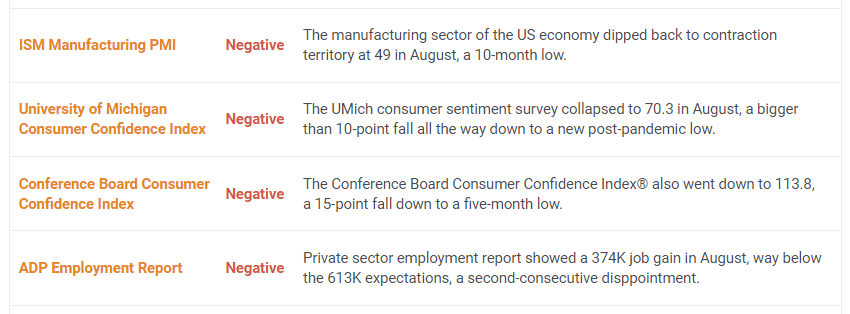

Source: FXStreet

First came the Conference Board's Consumer Confidence gauge for August which tumbled to 113.8 points, far worse than expected. It confirmed a similar fall from the University of Michigan that had already been published before Powell's speech. The weaker sentiment means less consumption and fewer jobs.

Then came ADP's disheartening private-sector jobs report, which showed an increase of only 374,000 positions last month versus estimates of over 600,000. The third blow came shortly afterward from the ISM Manufacturing Purchasing Managers' Index. While the headline beat estimates, the employment component contracted.

This toxic trio sent Nonfarm Payrolls expectations down, and with them the dollar. The economic calendar is pointing to an increase of 750,000 jobs in August, but economists were surveyed before the recent developments and real market expectations – aka "the whisper number" is probably significantly lower. An increase of 500,000 could be the new estimate.

Reasons to expect a better figure

There are counter-arguments to interpret these three downbeat figures. First, consumer confidence statistics are only "soft data" – a survey. They do not necessarily reflect actual consumption and "hard data" can prove otherwise. While retail sales data disappointed in July, Durable Goods Orders beat estimates.

Regarding ADP, America's largest payroll company's figures were out of sync with official Nonfarm Payrolls reports since the pandemic broke out. The company managers around a fifth of all American salaries – a considerable amount, but one that has its limits. The unpredictable nature of the pandemic and the weak correlation between ADP data and the NFP has led some economists to dismiss the company's report. Why should it be different now?

While the ISM surveys' data is more reliable than consumer polls, it is essential to note that the number that knocked down estimates is only for the small manufacturing sector. The heavyweight services sector – responsible for over two-thirds of employment – is released this time only after the NFP. Therefore, the manufacturing PMI had an outsized impact – but not necessarily a justified one.

Overall, the data could be painting a gloomy picture, perhaps too gloomy. Surprises in this all-important jobs report are even more common in the covid era.

Source: FXStreet

Nevertheless, even if Nonfarm Payrolls print a poor number, the dollar seems too pressed to the ropes – and it could be ready to spring back.

GBP/USD is up some 200 pips off the lows and EUR/USD has risen for five consecutive days. They are both due for a correction and so are commodity currencies, which forgot about the previous gloom.

Conclusion

August's NFP is critical due to the open question of Fed tapering. Real estimates are considerably low due to weak leading indicators, and the dollar has already paid the price. A "not that bad" report could trigger a substantial greenback comeback.

More US August Nonfarm Payrolls Preview: Analyzing major pairs' reaction to NFP surprises

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.