Next week is the March Fed policy meeting, with nobody expecting any changes

Outlook

Today we get the latest University of Michigan consumer sentiment survey, with the headline expected down to 63.1 from 64.7, reminding the equity gang conditions are on the verge of getting a whole lot worse.

Next week is the March Fed policy meeting, with nobody expecting any changes. Later in the week we may see some data that foreshadows the recession and/or stagflation. The WSJ has a lengthy article about how things are shaping up to point to recession, complete with graphics.

Forecast

For forecasting purposes, too much depends on the verbal garbage spilling out of the White House. A chance of a peace deal with Russia seems to motivate euro-buyers, or maybe several other factors have also influenced a shift in perception of risk to the downside. We suspect all of it is a snare and a delusion (and wishful thinking) because Trump is addicted to causing disruption, like all 4-year-olds. Whenever we see a suggestion of a pullback, as over the past two days, we need to remind ourselves it can’t be acted upon for the sole reason Trump is in the White House and taking a chainsaw to the economy.

Note that even the peso is recovering. The vertical line is the election.

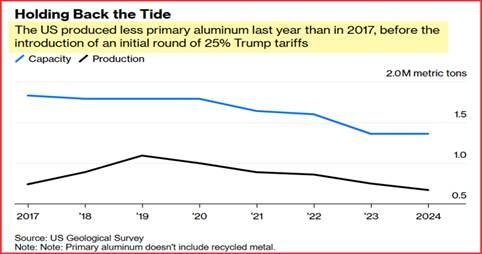

Tidbit: Dyed-in-the-wool Republican Mish has a funny story about aluminum and steel tariffs. They didn’t work last time (2018) and won’t work again. See the chart. Mish is writing to agree with Bloomberg (!) that “ Only a mad king would expect a different result from trying the same thing again.” Especially when the exporters are all friends, like Canada, or used to be.

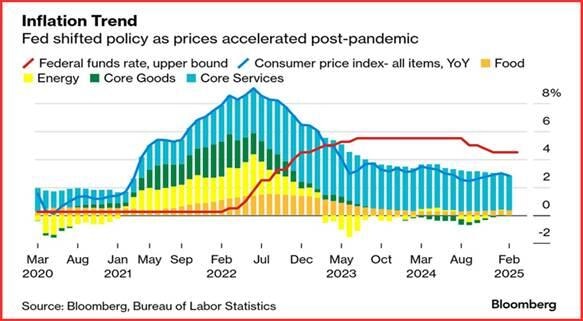

Tidbit: Bloomberg makes the point that now is the 5th anniversary of WHO naming the global pandemic. The only really worthwhile feature in the story is the chart.

Tidbit: Reuters’ Dolan does it again, coming up with a review of a new book from Wharton, The Long Shadow of Default: Britain’s Unpaid War Debts to the United States, 1917-2020 by David James Gill. It turns out the UK never repaid its debt from World War I (yes, one) nor repudiated it, so the US keeps adding interest. The total due is $16,669,221,062.It’s a good thing Trump doesn’t read or he would be asking for the $16.7 trillion.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat