New Zealand slides after Fed rate cut, NZ GDP next

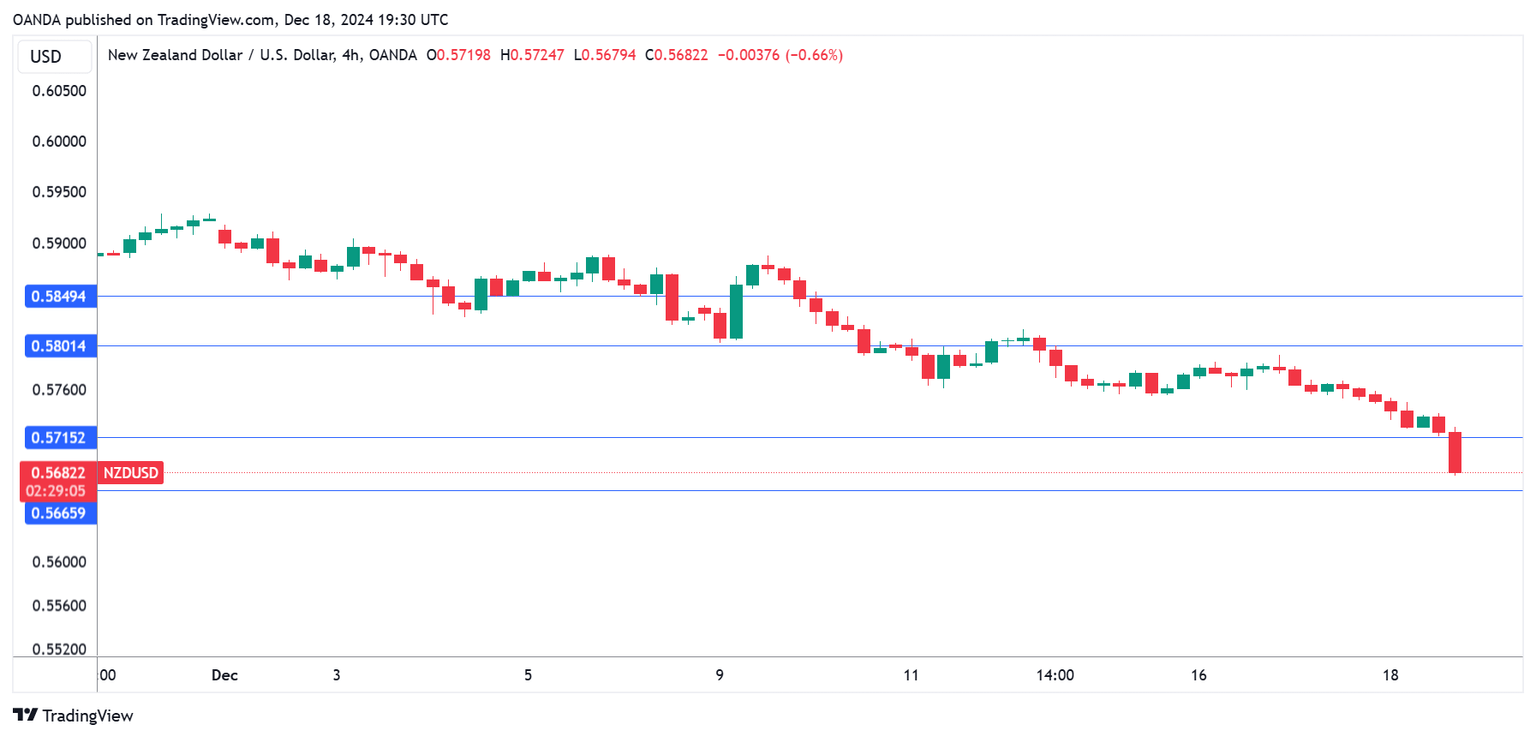

The New Zealand dollar has declined sharply on Wednesday. In the North American session, NZD/USD is trading at 0.5685, down 1.2% on the day. The New Zealand dollar has been in freefall, plunging 11.6% since Oct. 1.

New Zealand GDP expected to decline

New Zealand’s economy is expected to contract in the third quarter by 0.4% q/q, after a 0.2% decline in Q2. If the economy contracted for back-to-back quarters as expected, it would mean that the economy is in a technical recession. Construction and manufacturing activity declined in the third quarter and a severe power crisis led to a decrease exports, all of which dampened GDP.

The Reserve Bank of New Zealand slashed rates by 50 basis points last month, lowering the cash rate to 4.25%. The central bank has trimmed rates by 125 bp since August but the economy is clearly in need of further cuts. Inflation is back within the target of 1% to 3% and we can expect another cut at the next meeting in February barring a surprise jump in inflation.

Fed rate cut sends NZ Dollar tumbling

There wasn’t much excitement around today’s Federal Reserve meeting, as the market had priced in a quarter-point cut at close to 100%. This is exactly what happened, as the Fed cut rates for a third time this year. The Fed signaled that it expected to cut rates only two times in 2025, lower than previous projections of four rate cuts. With the US economy in solid shape and the downswing in inflation stalled, the Fed can afford to take its time before the next rate cut.

The market will hear from Fed Chair Powell shortly. Powell could reiterate that the Fed plans to cut rates “gradually”, which means modest cuts of 25 basis points.

NZD/USD technical

- NZD/USD is testing support at 0.5715. Next, there is support at 0.5665. There is resistance at 0.5801 and 0.5849

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.