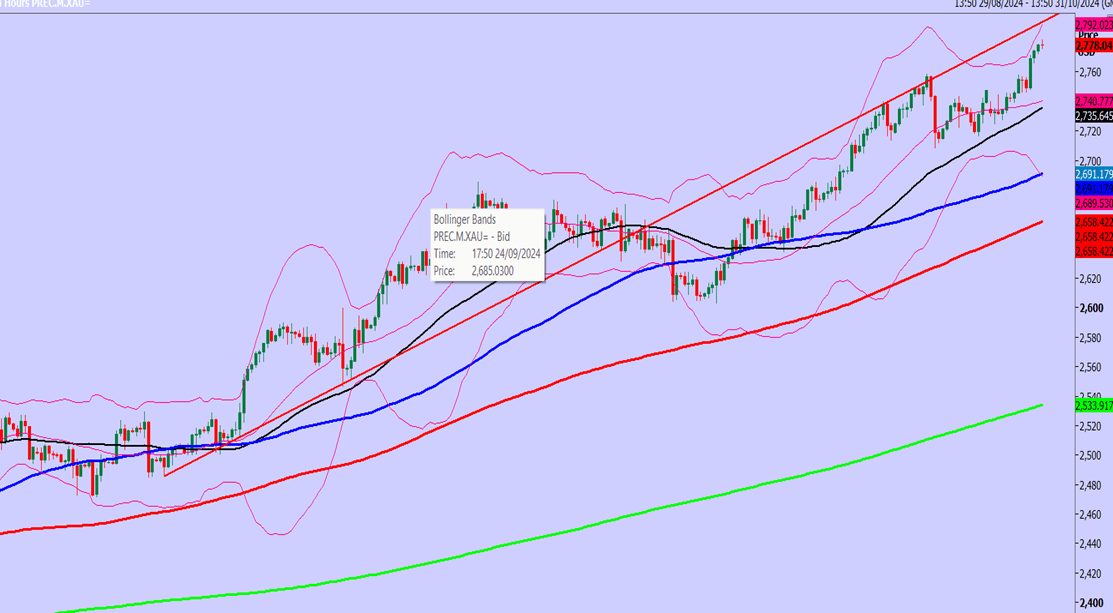

New all time high for Gold again this week

XAU/USD

Gold break above 2760 killed the bearish engulfing candle signal & was our buy signal targeting 2775/77 (hit overnight) then 2785/86 & 2789/90, which could be reached before the release of NFP on Friday.

If we continue higher look for 2797/99.

We should have a buying opportunity at 2760/56 & longs need stops below 2751.

XAG/USD

Silver has not beaten last week's high at 3486, so clearly struggling in comparison to Gold which keeps hitting new all time highs.

The break above 3405 did trigger a further recovery as predicted to 3430/40 & as far as 3455.

If we continue higher (we should do) look for a retest of the October high at 3480/87.

Obviously bulls need a break above here for a buy signal but we run in to 14 year Fibonacci resistance at 3500/10, so it is only a weekly close above here that should trigger significant gains before year end.

First support at 3380/70 & longs need stops below 3355.

Author

Jason Sen

DayTradeIdeas.co.uk