Negating BoJ ambush

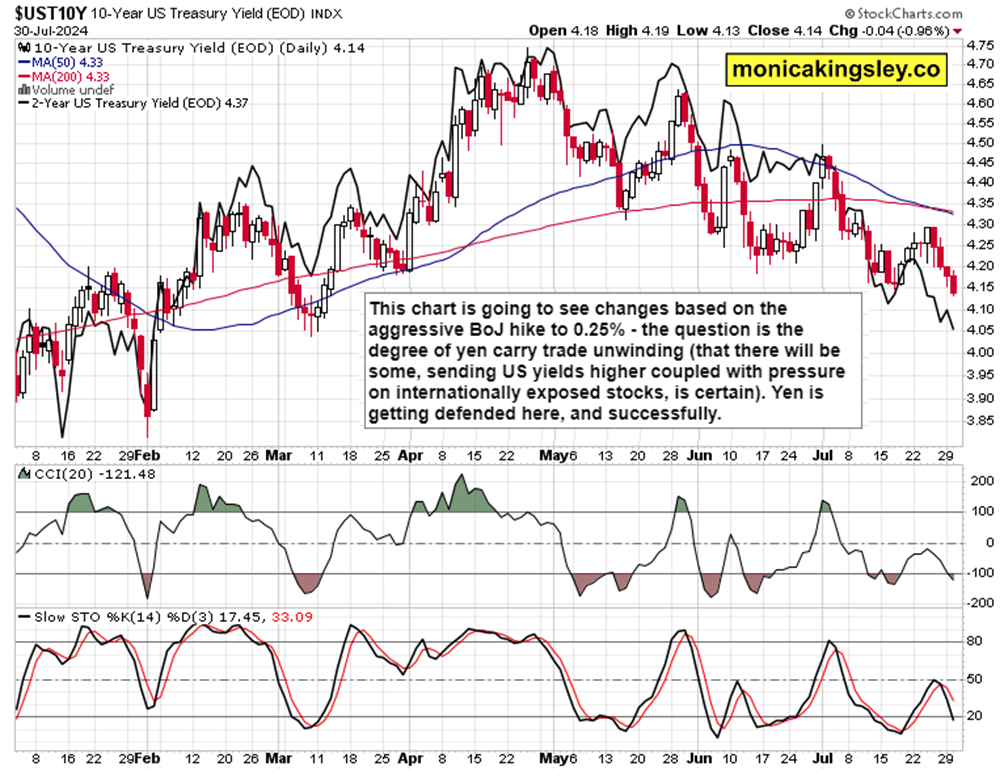

S&P 500 did slide almost right from the opening bell, led by Nasdaq lower – making for profitable intraday shorts. Then though markets stopped declining more on the BoJ discussion of hiking to 0.25% (more aggressive than anticipated). But then inflation in Japan is biting, and US remains in disinflation – thus far, there is no consistent move to yen carry trade unwind that could be seen in rising Treasury yields. The move is playing out chiefly in the dollar for now.

These two charts post FOMC will be crucial – SPY bottoming process goes on, and while I expected the sum of Monday and Tuesday being mildly positive (pre-earnings – MSFT did disappoint, but AMD with SBUX reaction surprised), that has not been the case, and another premarket rise in S&P 500 is remedying that instead. ADP employment change coming in at only 122K is a soft landing supportive figure, underpinning the two main indices. Remember my weekly roadmap for second half of this week?

For all the BoJ macro implications, the run up to FOMC I‘m afraid will be reduced to rate cutting expectations, and on no cut there will be perceived as disappointment. Way more commentary is presented in the individual chart section.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.