Natural Gas Elliott Wave technical analysis [Video]

![Natural Gas Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Energy/Gas/pipeline-18754412_XtraLarge.jpg)

Natural Gas Elliott Wave analysis: A deeper decline expected

Natural Gas saw a brief recovery in early August but is now showing signs of continuing its downtrend, with the potential to reach new August lows. The ongoing decline, which began in June 2024, is likely to extend toward the Q1 2024 low between 1.5 and 1.6. If this trend plays out, Natural Gas could reach its lowest levels since September 2020.

Daily chart analysis

On the daily chart, the long-term downtrend from the $10 peak in August 2022 is unfolding as a corrective pattern labeled as waves a-b-c of the cycle degree. Wave a completed around 4.77, followed by a wave b rally that ended near 7.61. Since November 2022, wave c has been progressing within an ending diagonal pattern, which typically signals the final phase of a corrective structure.

Currently, the market is in the 5th leg (wave 5, circled) of this diagonal pattern. This leg is developing as a three-wave structure and is expected to break below the previous low of wave 3 (circled) at 1.524, suggesting further downside. The anticipated continuation of wave 5 (circled) is likely to form another three-wave move, ultimately completing the larger corrective pattern. Once this structure is finalized, a significant bottom could be in place, potentially leading to a longer-term reversal.

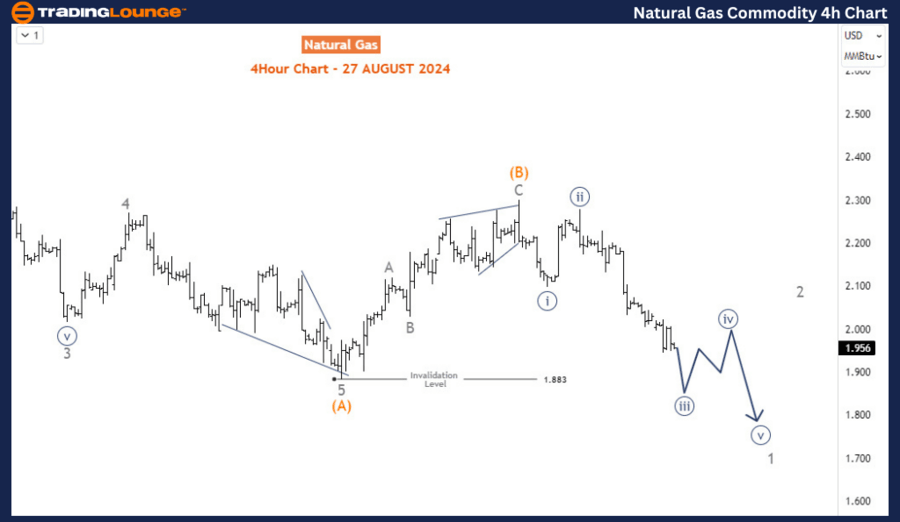

Four-hour chart analysis

The H4 chart provides a closer view of the recent market developments. Wave (A) completed as an impulse sequence at 1.88 in early August 2024, marking the first leg of the current decline. Afterward, wave (B) emerged, ending on August 15th with a shallow retracement. Although wave (B) could extend into a double zigzag rally if support holds above 1.883, the overall bias remains bearish.

The decline from the August 15th high is evolving into an impulsive move, increasing the likelihood of a breach below 1.883. Once this support level breaks, wave (C) is expected to continue the decline, targeting levels below 1.5. Traders should watch for corrective bounces during this phase as potential selling opportunities, aligning with the broader bearish trend.

In summary, Natural Gas remains under pressure, with the technical structure suggesting further downside. The focus should be on selling rallies as the market approaches key support levels, aiming for a potential bottom in the 1.5 to 1.6 region.

Natural Gas Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.