National debt blows past $35 trillion

"I go on the principle that a Public Debt is a Public curse and in a Rep. Govt. a greater than in any other." - James Madison

On July 26, the national debt blew past $35 trillion for the first time. We are now cursed with a debt of $35,001,278,179,208.67.

This milestone will likely raise some eyebrows, but nobody will do anything about it.

That’s because politicians on both sides of the aisle committed to one thing – spending money to buy votes.

And sadly, most people don't care.

It's hard even to fathom this much debt. To put it in perspective, every American citizen would have to write a check for $103,834 to pay it off. If we limit the funding to taxpayers, your share would be $267,404.

You will find some more perspective on the enormity of the debt HERE.

"I, however, place economy among the first and most important republican virtues, and public debt as the greatest of the dangers to be feared." - Thomas Jefferson

When I saw the news, I thought, 'I feel like I just wrote an article about the debt crossing the $34 trillion mark.'

That's because I did - on Jan. 4.

It only took the Biden administration seven months to add another $1 trillion to the debt.

Going back a little further, when Congress effectively eliminated the debt ceiling on June 5, 2023, the national debt stood at $31.46 trillion. Since then, the Biden administration has added $3.54 trillion to the national debt. That's in one year, for those of you keeping track at home.

This isn't shocking when you realize Uncle Sam is blowing through about half a trillion dollars every single month.

But this isn't just a Biden problem.

Before the pandemic, the U.S. government had only run budget deficits of over $1 trillion four times — all by the Obama administration in the aftermath of the 2008 financial crisis.

The Trump administration almost hit the $1 trillion mark in 2019 and was on pace to run a trillion-dollar deficit in fiscal 2020 before the pandemic, even as the U.S. supposedly enjoyed the “best economy” ever. The economic catastrophe caused by the government’s response to COVID-19 gave policymakers an excuse to spend with no questions asked and we saw record deficits in fiscal 2020 and 2021.

"No pecuniary consideration is more urgent than the regular redemption and discharge of the public debt. On none can delay be more injurious or an economy of time more valuable." - George Washington

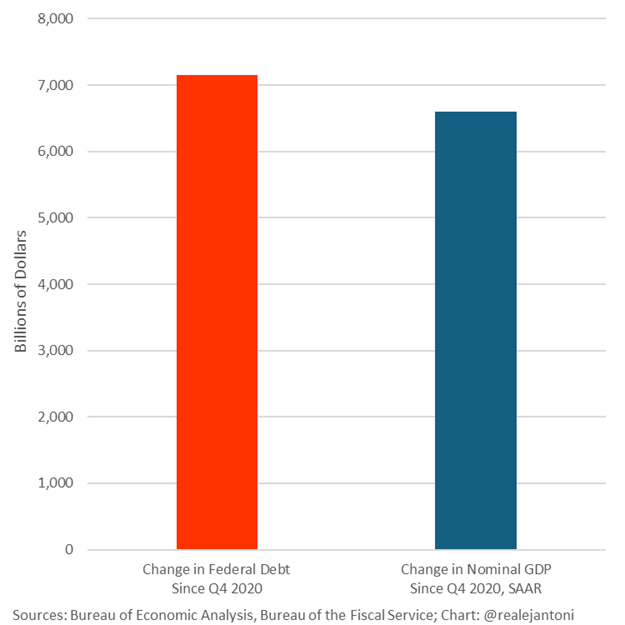

The entire U.S. economy is built on debt. This chart tells you everything you need to know.

According to the National Debt Clock, the debt-to-GDP ratio stands at 122.55 percent. Studies have shown a debt-to-GDP ratio of over 90 percent retards economic growth by about 30 percent.

"The principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.” - Thomas Jefferson

It's a spending problem

Democrats will try to tell you this is a tax problem. Ring a little more out of the billionaires and everything will be fine.

It won't.

To give you an idea of how well the Treasury is doing, in April, Uncle Sam ran a surplus thanks to tax day. Tax receipts came in at $776.2 billion in April, a 22 percent increase over last year.

This blows apart the notion often bandied about that the deficits are because of tax cuts. The real problem is on the spending side of the ledger.

Through eight months of fiscal 2024, the federal government has spent a staggering $5 trillion. That's up 8 percent over the same period last year.

And there is no end to the spending in sight.

Outlays continue to increase despite the [pretend] spending cuts and promises from the Biden administration that it would save “hundreds of billions” with the debt ceiling deal (aka the [misnamed] Fiscal Responsibility Act).

This reveals the ugly truth. No matter what you hear about spending cuts in Washington D.C., the federal government always finds new reasons to spend more and more money. Whether it's a disaster, an emergency, or somebody else's war, the spending train never reaches the station.

“Armies, and debts, and taxes are the known instruments for bringing the many under the domination of the few.” - James Madison

The interest problem

Politicians and pundits will keep kicking the debt can down the road as long as they can. But the road is getting shorter.

Interest on the debt is overwhelming the federal budget.

The federal government spent $140.2 billion paying interest on the national debt in June alone. That was just over 30 percent of the month's total tax receipts.

So far in fiscal 2024 (as of June 30), it paid $867.7 billion in interest expense. That is a 33 percent increase over last year.

So far this year, the federal government has spent more on interest than it has on national defense ($644 billion) or Medicare ($629 billion). The only spending category bigger than interest is Social Security.

And interest expenses will only continue to climb.

Much of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates.

Anybody who says "deficits don't matter" is deluded.

And the only way out of this fiscal death spiral is significant spending cuts and/or major tax hikes.

"I can scarcely contemplate a greater calamity that could befal this country, than to be loaded with a debt exceeding their ability ever to discharge. If this be a just remark, it is unwise and improvident to vest in the general government a power to borrow at discretion, without any limitation or restriction." - Brutus

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.