Nasdaq Drops Dragged by Trade Fears

US stock market futures fell on Wednesday, along with the equity markets of Europe and Asia, dragged by President Trump's latest comments.

Dow Jones contracts descended 0.43% or 119 pts, to 27,544 pts, the S&P 500 fell 0.42% or 13 pts to 3,079 pts, while Nasdaq dropped 0.49% or 40.50 pts to 8,234.50 pts.

This Tuesday, The U.S. President Donald Trump provided little information about the negotiations between the United States and China. President Trump said that an agreement could soon be reached; however, he clarified that in case of not reaching an agreement, an increase in tariffs could be produced.

On the other hand, the chairman of the Federal Reserve (FED) Jerome Powell will testify this Wednesday before the Joint Economic Committee of Congress.

In his testimony, chairman Powell is expected to provide more clues about the direction of the economy and the feeling of risk.

Technical Overview

Nasdaq, in its weekly chart, shows the potential completion of an ending diagonal pattern. The Elliott wave structure could be finished when the index reached a new record high at 8,295 pts on November 12, 2019.

The daily chart of the technologic index reveals the possibility of completion of the fifth wave labeled in black. On the other hand, the RSI oscillator shows a potential breakdown.

A breakdown of this structure could drive to Nasdaq to visit fresh lows as a wave ((A)) labeled in black.

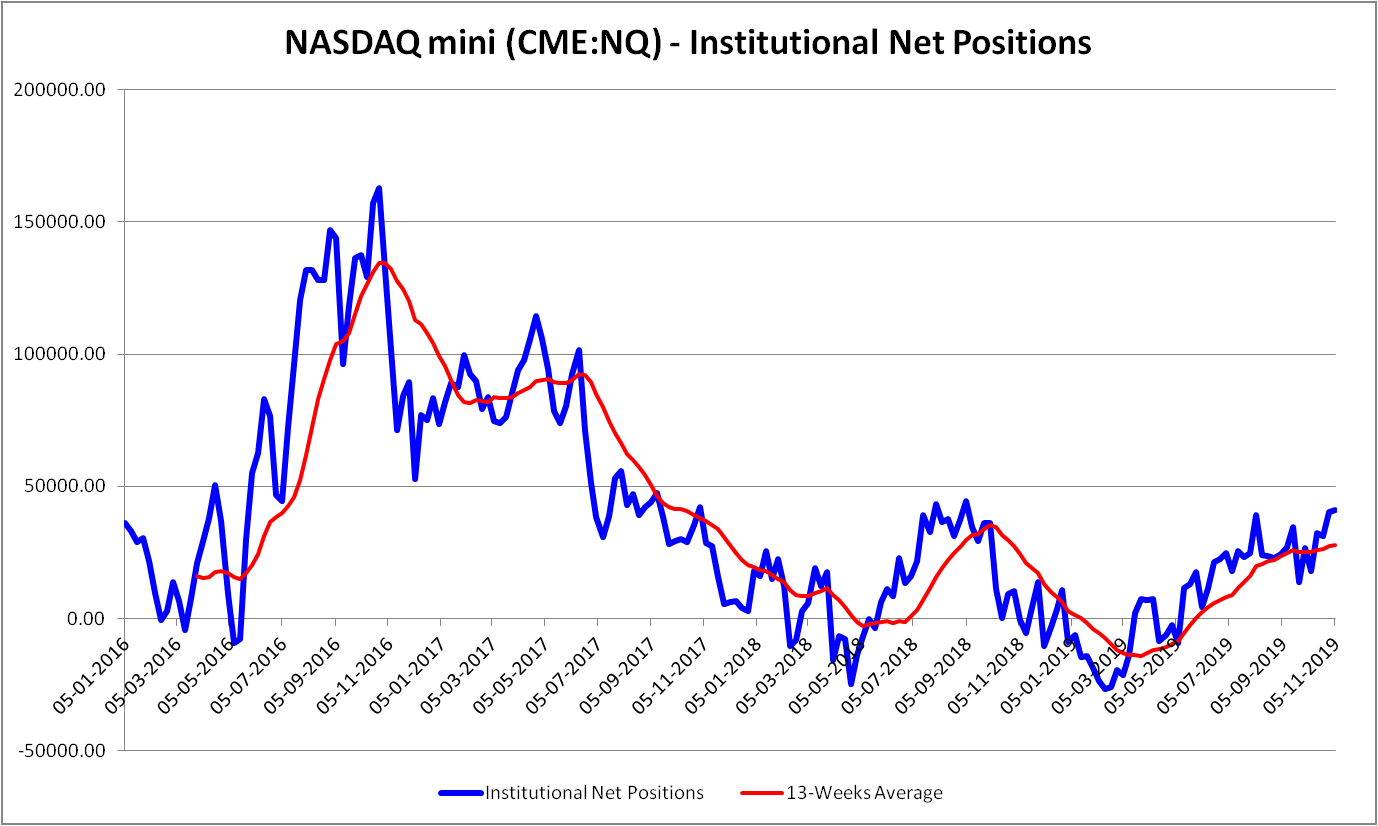

From the latest CFTC report, institutional traders informed a reduction in both market directions. The long-side positioning reported a decrease of 3.74% or 3,454 contracts (WoW), while sell-side positioning dropped on 8.20% or 4,193 contracts (WoW),

In this statement, institutional trades hold 64.35% of long positions and 35.65% on the short side.

The Net Positions analysis reveals that bias continues being mostly bullish. The last net positioning lifted to 41,168 contracts from 40,429 informed on the previous report, being over the 13-weeks average at 27,738 contracts.

As a summary, the reduction in both trading sides makes expect taking profits from bull traders.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and

-637092534703813722.png&w=1536&q=95)

-637092535101476414.png&w=1536&q=95)