Narrowing in trade deficit likely to boost Q3 GDP

Summary

The U.S. trade deficit narrowed in August to the smallest gap in almost three years, as exports of goods rose and imports receded, while the surplus in services trade rose to nearly a record. Barring any sharp widening in September, net exports should tack on at least half a percentage point to Q3 GDP growth.

A mostly goods story, although services surplus large as well

The U.S. trade deficit narrowed in August to its smallest since 2020 (chart). This is a continuation of a narrowing trend back toward something reminiscent of a pre-COVID normal. In the 2015-2019 period, the trade deficit averaged about $44 billion. At its widest point in early 2022, the trade deficit totaled more than $100 billion. Today's reading of a $58.3 billion indicates that the trade gap is more than two thirds of the way back to where it had been in the second half of the prior expansion from 2015-2019.

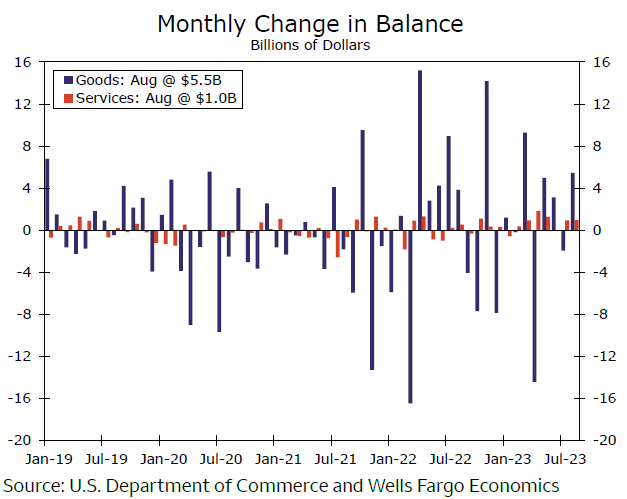

In terms of what happened in this specific month, exports rose and imports fell, resulting in an overall narrowing of $6.4 billion from a July trade deficit that was slightly wider after revisions.

The goods deficit decreased by $5.5 billion to $84.5 billion, while on the services side, the surplus swelled by another $1.0 billion to $26.2 billion, enough to lift the services surplus to its third highest reading on record (chart).

Author

Wells Fargo Research Team

Wells Fargo