Murrey math lines: USD/JPY, USD/CAD

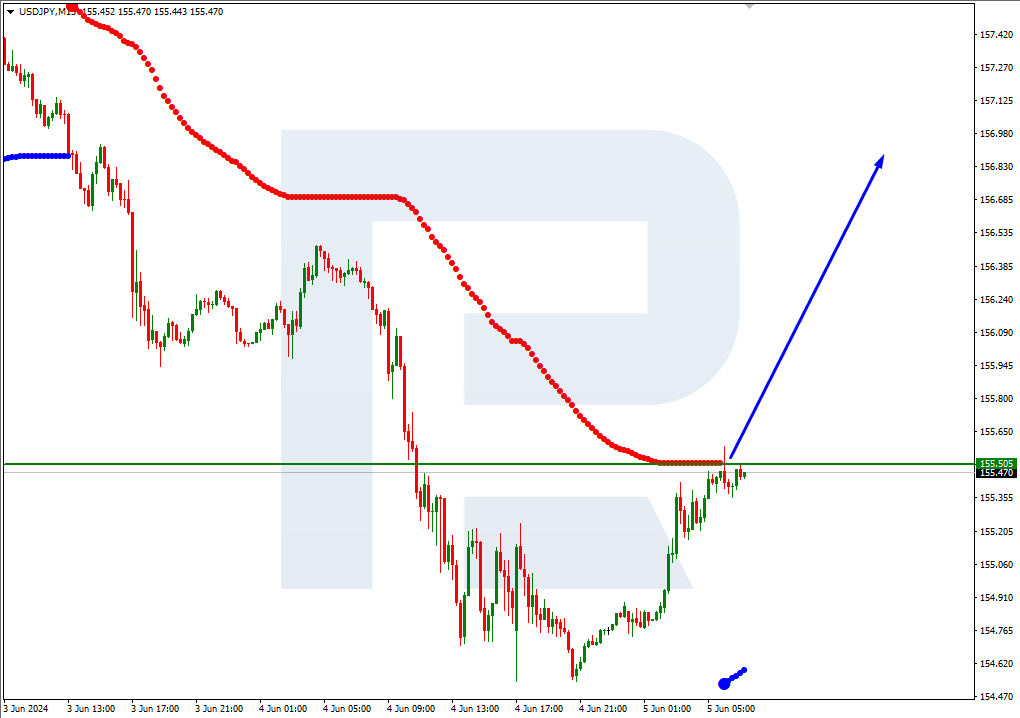

USD/JPY, “US Dollar vs Japanese Yen”

USD/JPY quotes are above the 200-day Moving Average on D1, indicating a prevailing uptrend. The RSI is testing the support line. In this situation, the price is expected to surpass the 6/8 (156.25) level and rise to the resistance at 7/8 (159.37). A breakout below the 5/8 (153.12) support level could cancel this scenario, leading to a potential decline to 4/8 (150.00).

On M15, the price rise might be additionally supported by a breakout of the VoltyChannel upper line.

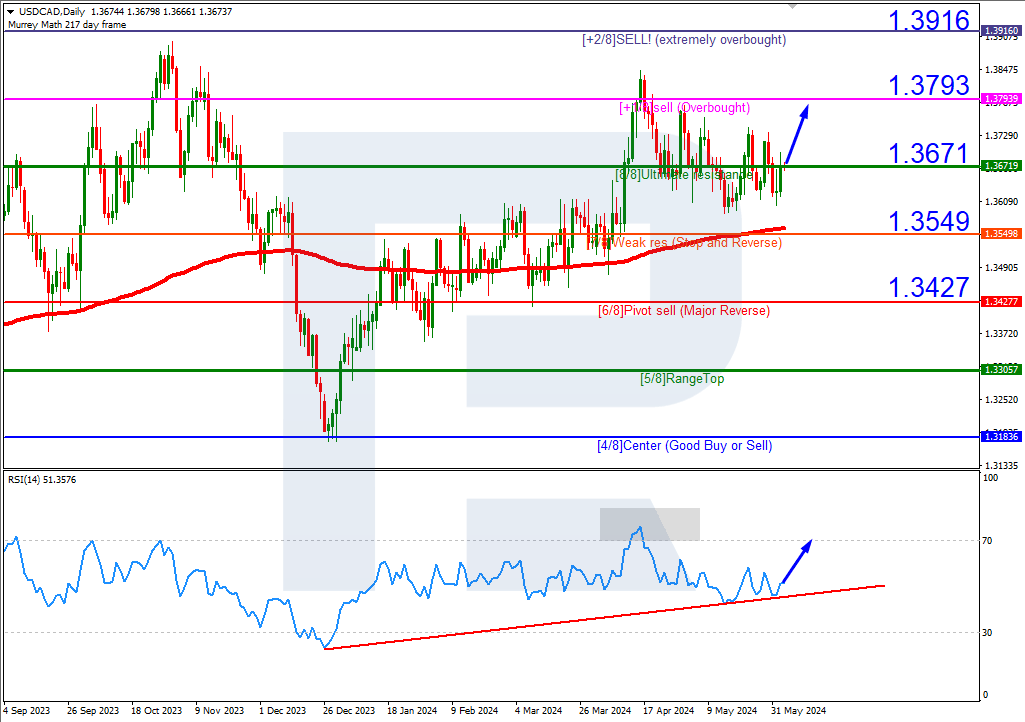

USD/CAD, “US Dollar vs Canadian Dollar”

USD/CAD quotes are above the 200-day Moving Average on D1, indicating a prevailing uptrend. The RSI has rebounded from the support line. In this situation, the price is expected to rise further to the nearest resistance at +1/8 (1.3793). A breakout below the 7/8 (1.3549) level could cancel this scenario, leading to a potential decline to the 6/8 (1.3427) support level.

On M15, the upper line of the VoltyChannel is broken, which increases the probability of price growth.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.