Murrey math lines: USD/JPY, USD/CAD

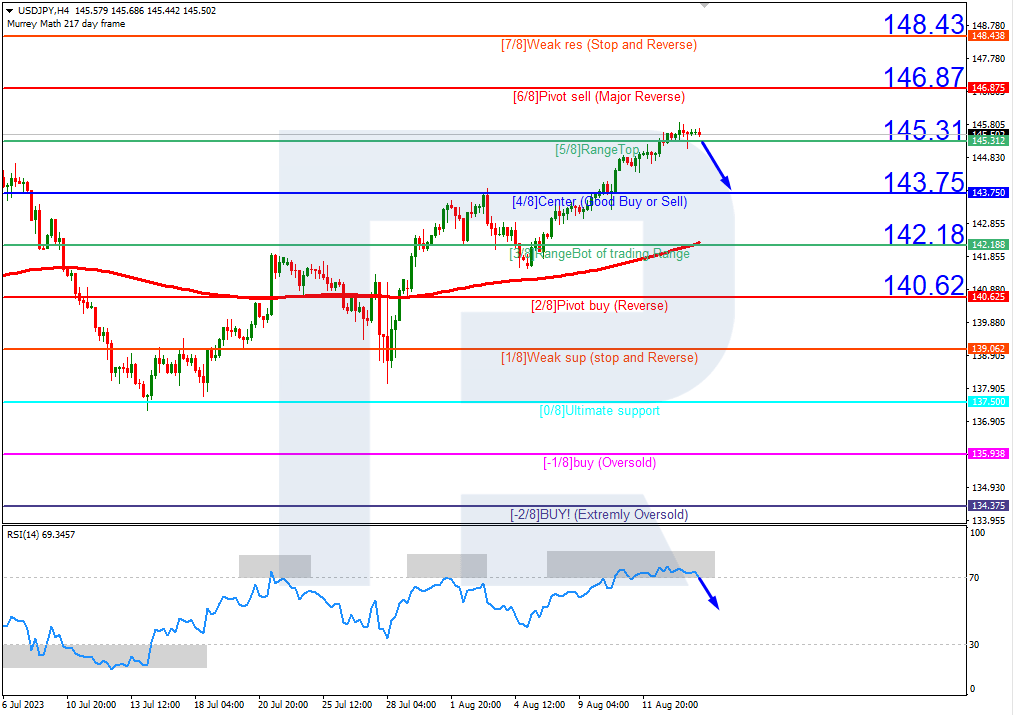

USD/JPY, “US Dollar vs Japanese Yen”

USDJPY quotes are above the 200-day Moving Average on H4, which indicates the prevalence of an uptrend. However, the RSI is in the overbought area, which could be a sign of a probable correction. In this situation, a downward breakout of 5/8 (145.31) is expected, followed by a decline to the support at 4/8 (143.75). The scenario can be cancelled by rising above the resistance at 6/8 (146.87). In this case, the quotes could continue growing and reach 7/8 (148.43).

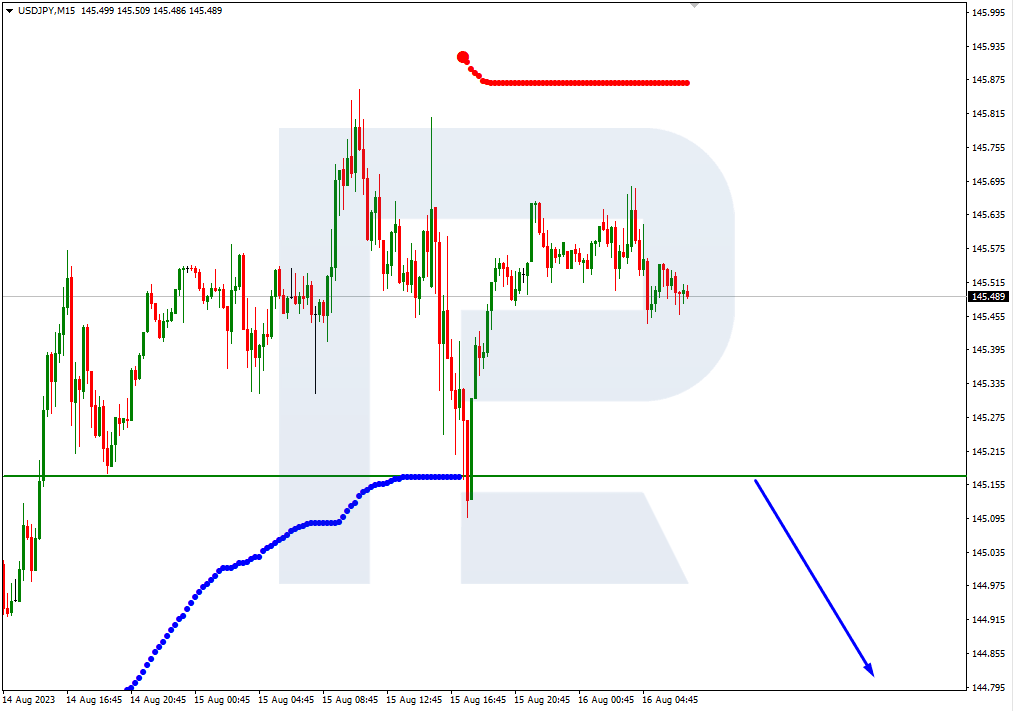

On M15, a further decline of the price might be additionally supported by a breakout of the lower boundary of the VoltyChannel.

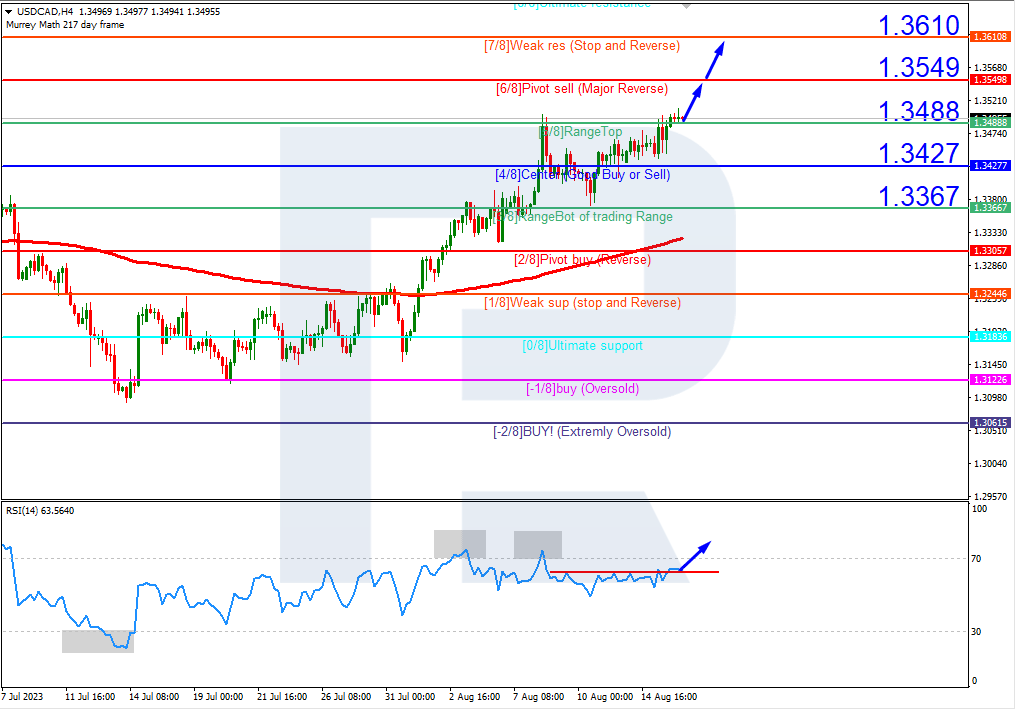

USD/CAD, “US Dollar vs Canadian Dollar”

USDCAD quotes are above the 200-day Moving Average on H4, which indicates the prevalence of an uptrend. The RSI has crossed the resistance line. In these circumstances, a test of 6/8 (1.3549) is expected, followed by its breakout and a rise to the resistance at 7/8 (1.3610). The scenario can be cancelled by a downward breakout of the support at 5/8 (1.3488), in which case the pair might return to 3/8 (1.3367).

On M15, the upper line of the VoltyChannel is broken. This increases the probability of a further price rise.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.