Murrey math lines: USD/CHF, XAU/USD

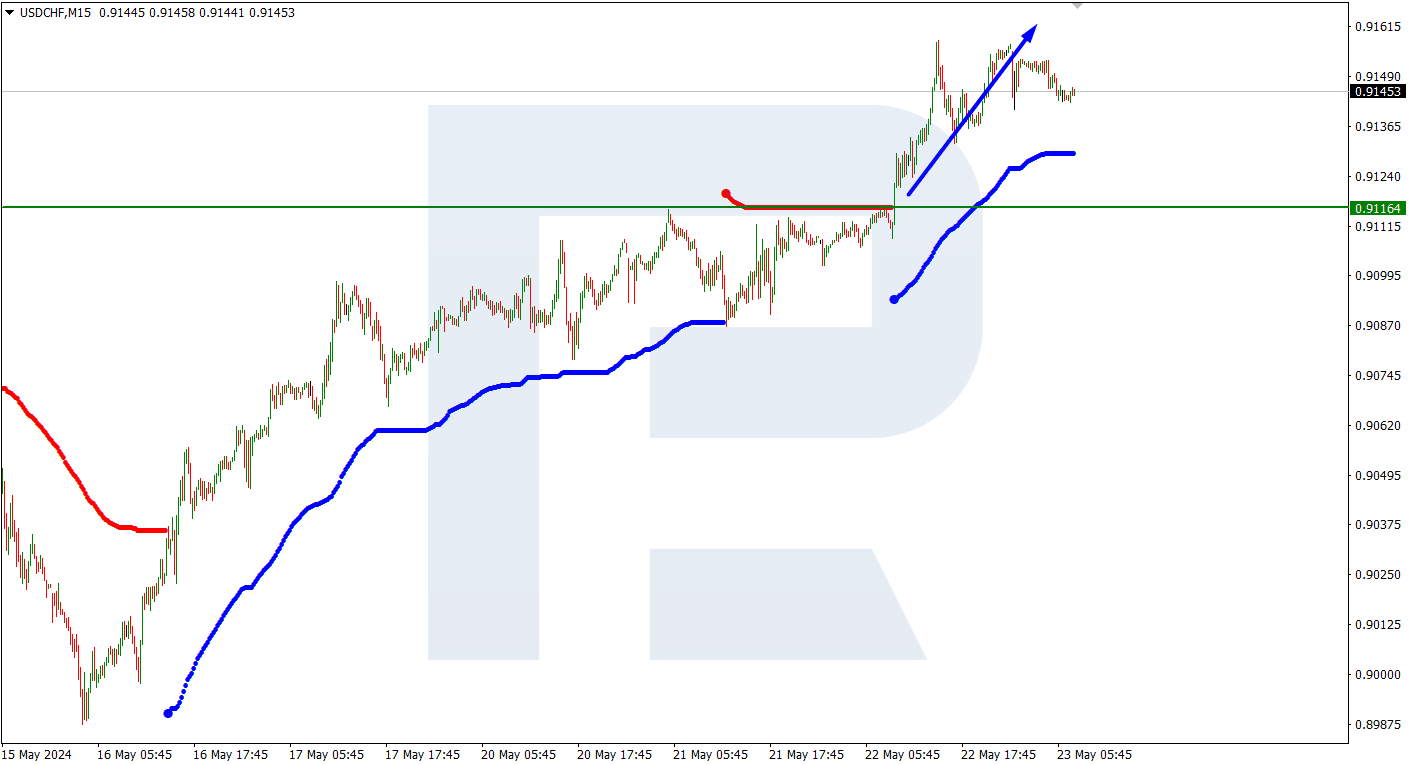

USD/CHF, “US Dollar vs Swiss Franc”

USDCHF quotes on the D1 period are above the 200-day Moving Average, indicating the prevailing upward trend. The Relative Strength Index has overcome the resistance line. In this situation, we expect the 7/8 (0.9155) level to be surpassed, followed by a price increase to the resistance at 8/8 (0.9277). The scenario could be invalidated by a breakout of the 6/8 (0.9033) support level. In this case, the price may decline to 5/8 (0.8911).

In the M15 period, the upper line of the VoltyChannel indicator was breached, confirming the upward trend, and increasing the likelihood of further price growth.

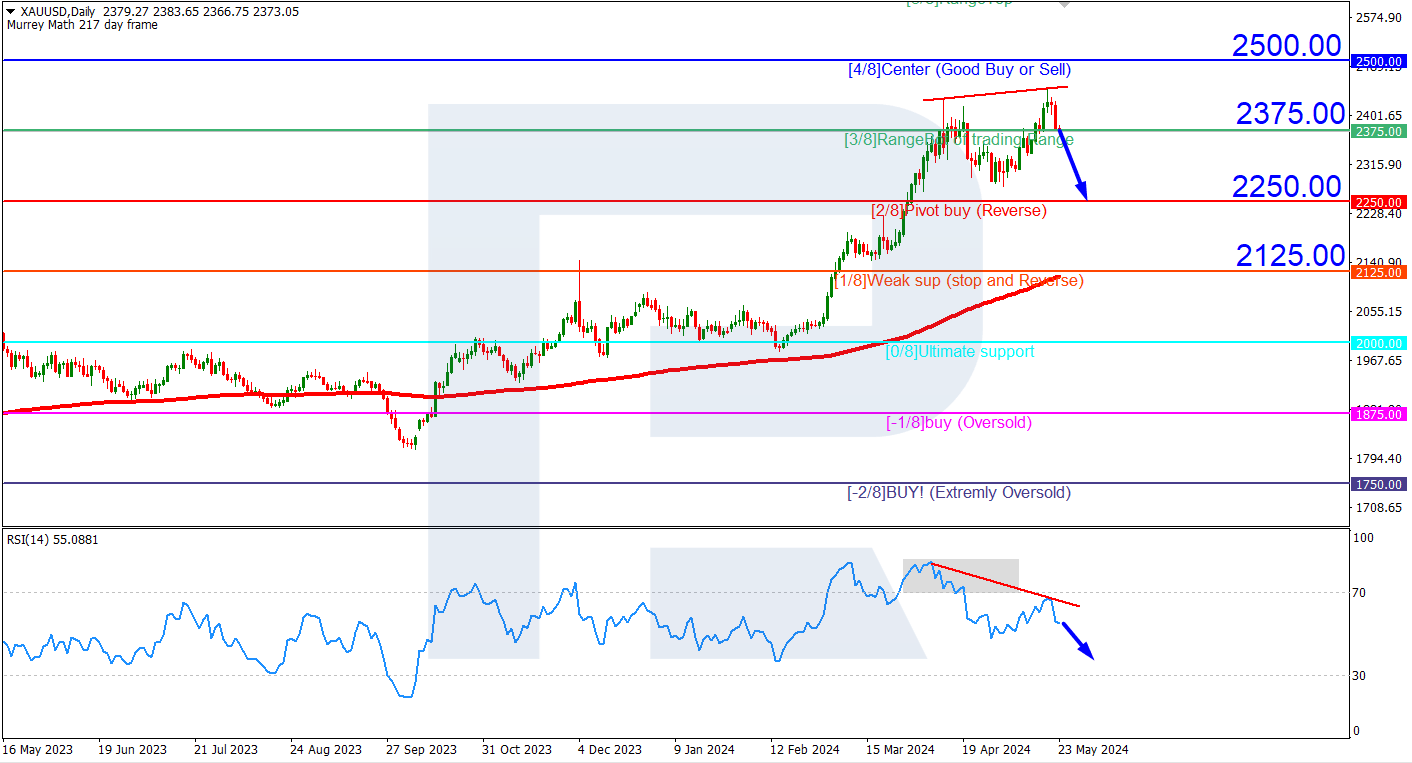

XAU/USD, “Gold vs US Dollar”

XAUUSD quotes on the D1 are above the 200-day Moving Average, indicating the prevailing upward trend. However, there is a divergence in the Relative Strength Index indicator. Consequently, a 3/8 (2375.00) breakout is anticipated in this situation, leading to a subsequent price decline to the support at 2/8 (2250.00). A breakout above the 3/8 (2375.00) could nullify the scenario, with the quotes potentially reaching the 4/8 (2500.00) resistance level.

On M15, a breach of the VoltyChannel lower line will increase the likelihood of a price decline.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.