Murrey math lines: USD/CHF, XAU/USD

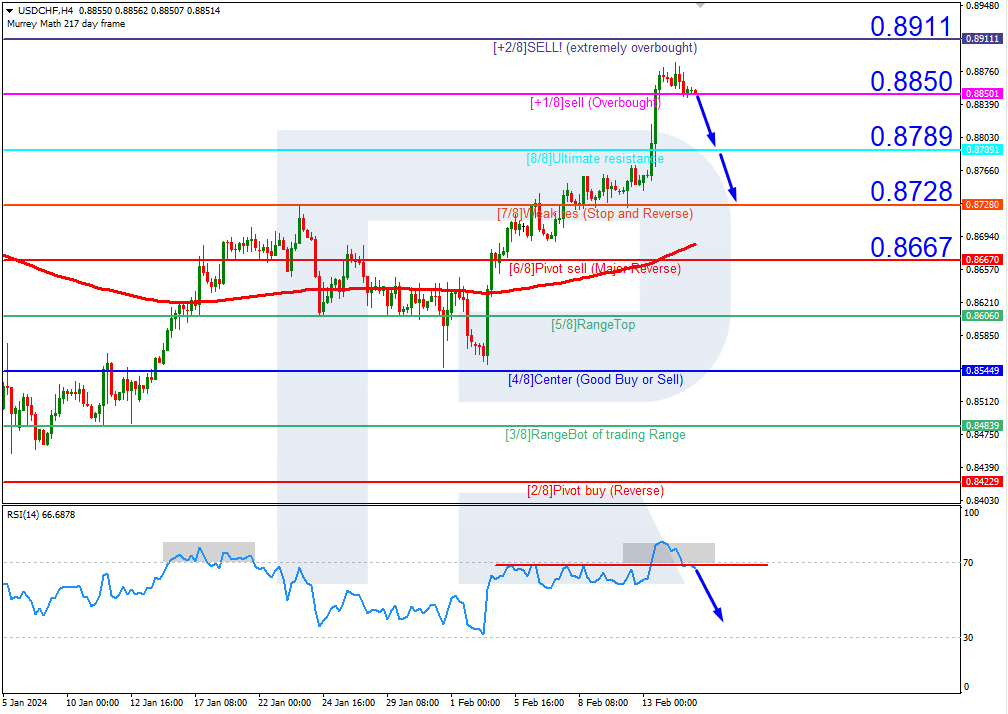

USD/CHF, “US Dollar vs Swiss Franc”

USDCHF quotes are in the overbought area on H4. The RSI has breached the support line. As a result, in this situation, a downward breakout of +1/8 (0.8850) is expected, followed by a decline to the support at 7/8 (0.8728). The scenario could be cancelled by a rise above the resistance at +2/8 (0.8911), which will reshuffle the Murrey indication, after which new price targets will be set.

On M15, the price decline could be additionally supported by a breakout of the lower boundary of the VoltyChannel.

XAU/USD, “Gold vs US Dollar”

Gold quotes are in the oversold area on H4. The RSI has escaped the oversold area and is testing the resistance line. In this situation, the quotes are expected to rise above 0/8 (2000.00) and reach the resistance at 1/8 (2015.62). The scenario could be cancelled by a downward breakout of the support at -1/8 (1984.38). In this case, gold quotes might drop to -2/8 (1968.75).

On M15, a breakout of the upper boundary of the VoltyChannel could increase the probability of the price increase.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.