Murrey math lines: USD/CHF, XAU/USD

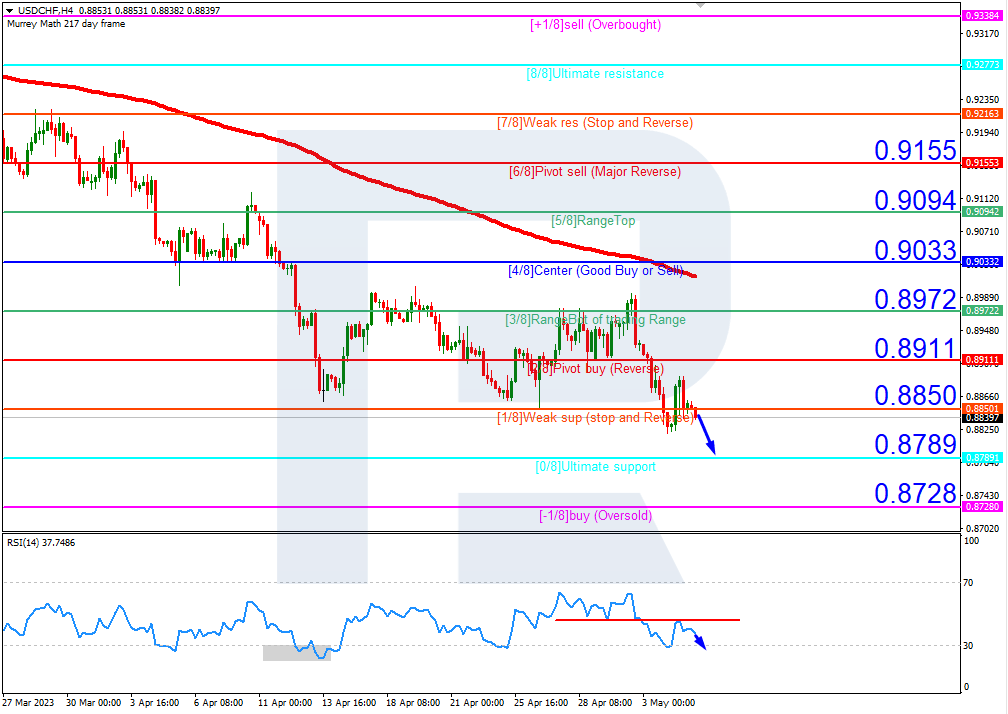

USD/CHF, “US Dollar vs Swiss Franc”

On H4, the quotes are under the 200-day Moving Average, which indicates the prevalence of a downtrend. The RSI has rebounded from the resistance line. In this situation, a further price fall to the nearest support at 0/8 (0.8789) is expected. The scenario can be cancelled by rising above the resistance at 2/8 (0.9033). In this case, the pair could correct to 3/8 (0.9155).

On M15, a breakout of the lower border of the VoltyChannel indicator could serve as an additional signal confirming the drop.

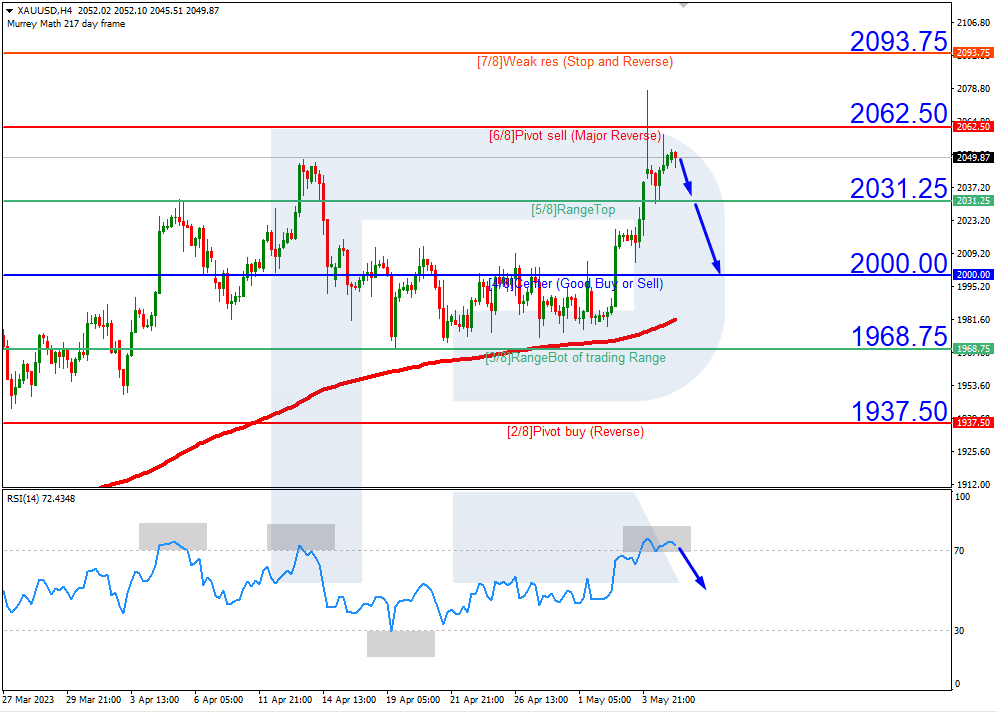

XAU/USD, “Gold vs US Dollar”

On H4, gold quotes are above the 200-day Moving Average, which reveals the prevalence of an uptrend. However, the RSI has reached the overbought area. As a result, in these circumstances, a breakout of 5/8 (2031.25) is expected, followed by a decline to the support level of 4/8 (2000.00). The scenario can be cancelled by rising above the resistance at 6/8 (2062.50). In this case, the quotes could rise to 7/8 (2093.75).

On M15, a breakout of the lower border of the VoltyChannel will increase the probability of a decline to 4/8 (2000.00) on H4.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.