Murrey math lines: USD/CHF, XAU/USD

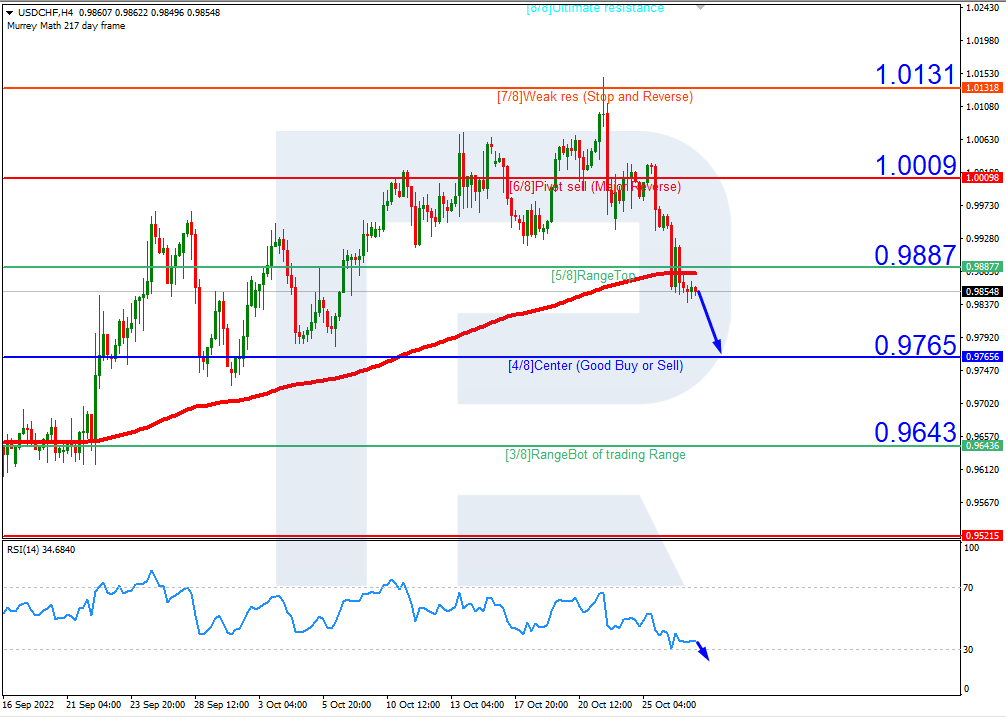

USD/CHF, “US Dollar vs Swiss Franc”

On H4, the quotes have broken through the 200-day Moving Average and are now below it, which indicates possible development of a downtrend. However, the RSI is nearing the oversold area. As a result, we should expect a decline to the nearest support at 4/8 (0.9765), after which correctional growth might begin. The scenario can be cancelled by rising over the resistance level of 5/8 (0.9887). In this case, the quotes may rise to the resistance level of 6/8 (1.0009).

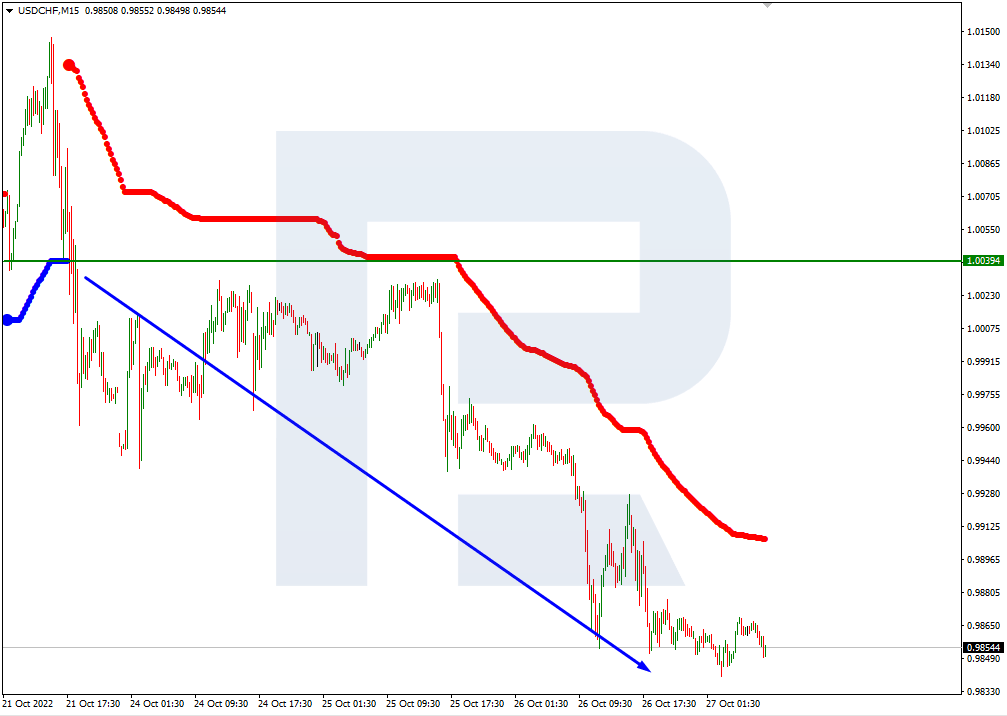

On M15, the lower border of VoltyChannel is broken. This increases the probability of falling to 4/8 (0.9765) on H4.

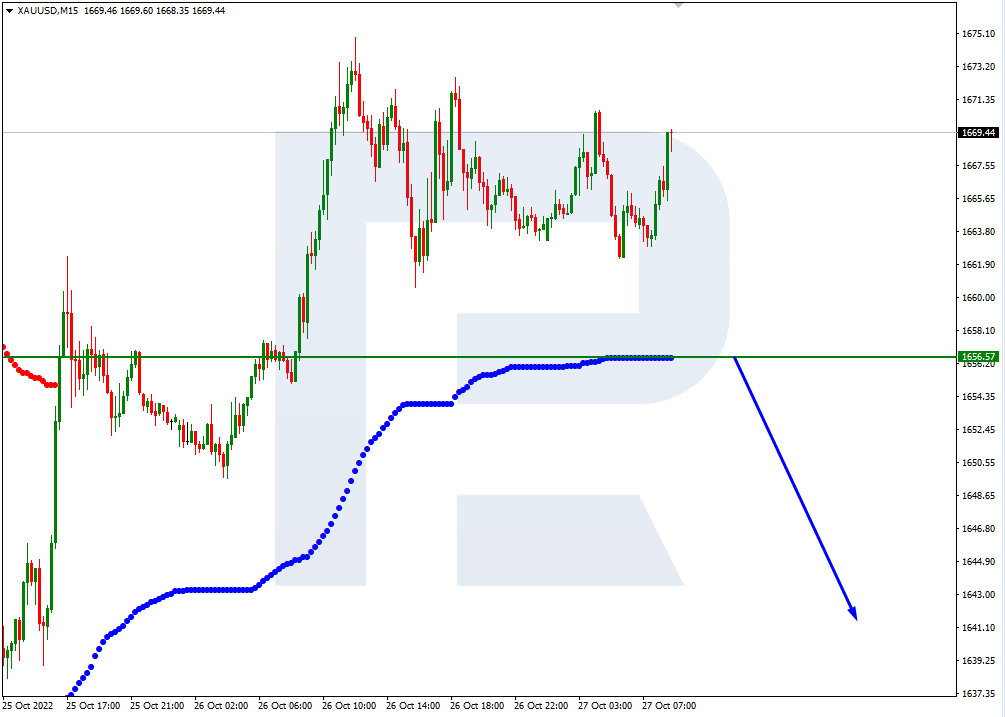

XAU/USD, “Gold vs US Dollar”

On H4, the quotes are under the 200-day Moving Average, which indicates the prevalence of a downtrend. The RSI is nearing the oversold area. In such a situation, we should expect a test of 3/8 (1671.88), a bounce off it, and falling to the support level of 1/8 (1640.62). The scenario can be cancelled by an upward breakaway of the resistance level of 3/8 (1671.88). This event might lead to a trend reversal and growth of the price to 5/8 (1703.12).

On M15, an additional signal confirming the decline will be a breakaway of the lower line of VoltyChannel.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.