Murrey math lines: EURUSD, GBPUSD

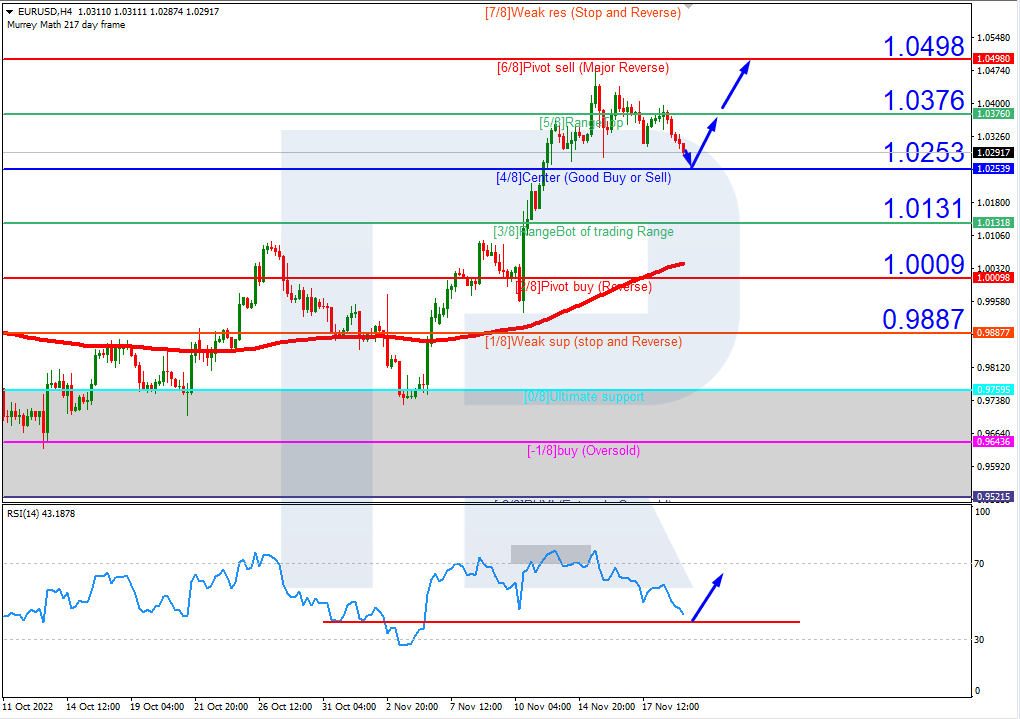

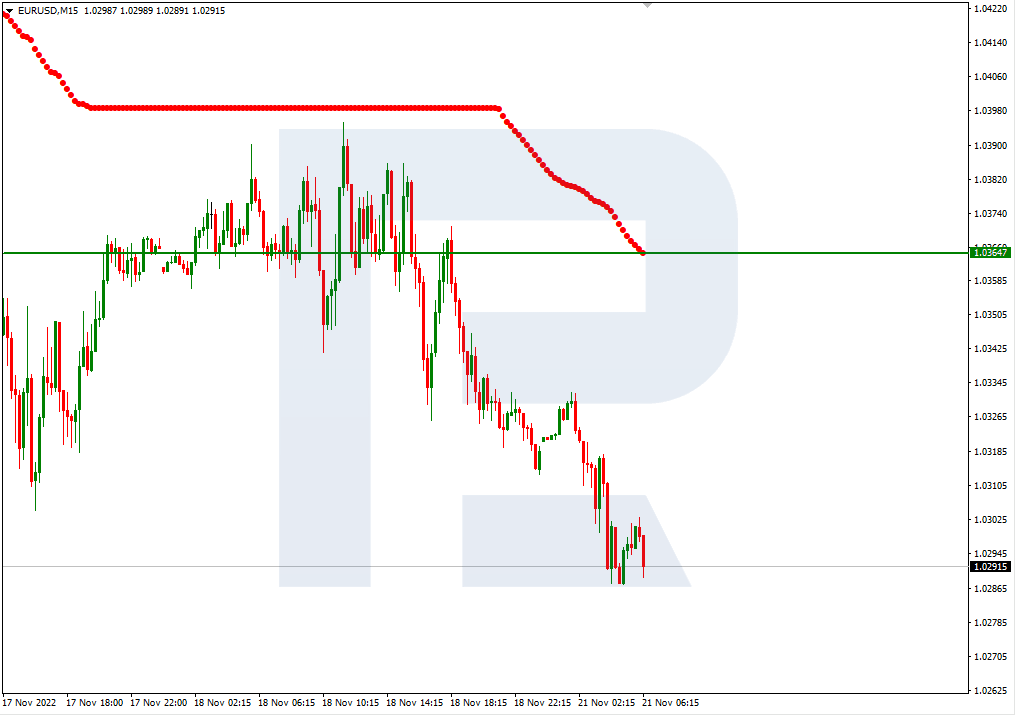

EURUSD, “Euro vs US Dollar”

On H4, the quotes are above the 200-day Moving Average, which means the uptrend is prevailing. The RSI is nearing the support line. A test of 4/8 (1.0253) should be expected, followed by a bounce off it and growth to the resistance level of 6/8 (1.0498). The scenario can be cancelled by a breakaway of the support level at 4/8 (1.0253) downwards. In this case, the pair will go on declining, probably to 2/8 (1.0009).

On M15, The upper line of VoltyChannel is too far away from the current price, which means growth can be signaled only by a bounce off 4/8 on H4.

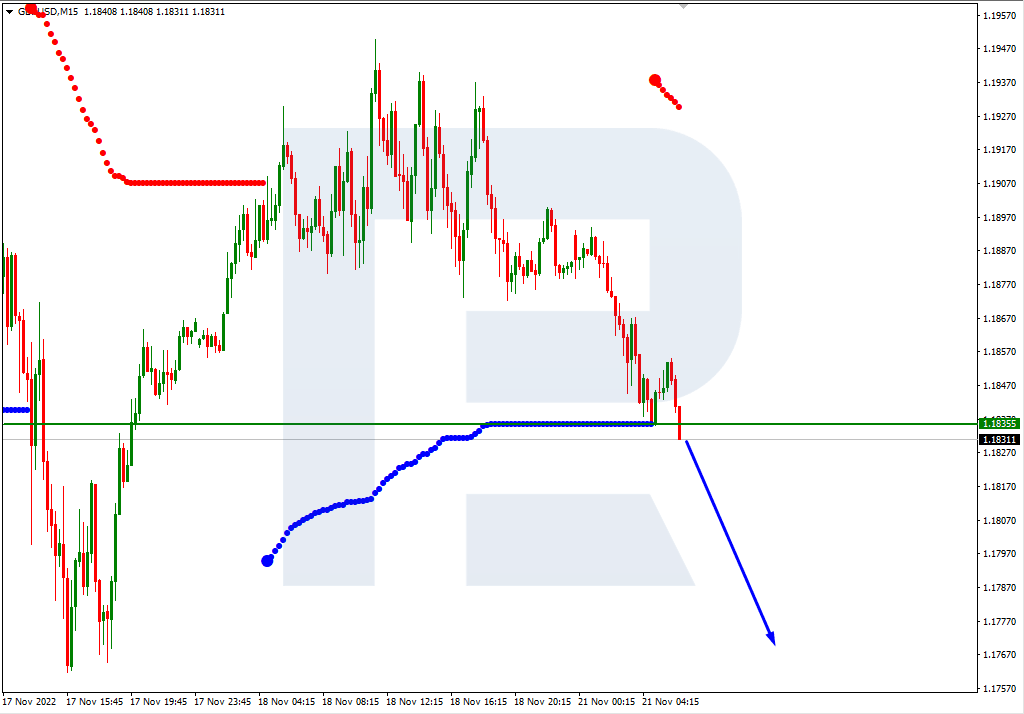

GBPUSD, “Great Britain Pound vs US Dollar”

On H4, the quotes are in the overbought area. The RSI has bounced off the descending trendline. A downward breakaway of the support level of 8/8 (1.1718) is expected, followed by falling to 7/8 (1.1474). The scenario can be cancelled by rising over the resistance level of +1/8 (1.1962). In this case, the pair may rise to +2/8 (1.2207).

On M15, the lower line of VoltyChannel is broken away. This increases the probability of further price falling.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.