Murrey math lines: EUR/USD, GBP/USD

EUR/USD, “Euro vs US Dollar”

EUR/USD quotes have broken the 200-day Moving Average on H4 and are now below it, which indicates a potential downtrend. The RSI has rebounded from the resistance line. In this situation, a downward breakout of the support at 4/8 (1.0986) is expected, followed by a decline to the level of 2/8 (1.0864). The scenario can be cancelled by a breakout of the resistance at 5/8 (1.1074). In this case, the pair could rise to 6/8 (1.1108).

On M15, the price decline might be additionally supported by a breakout of the lower boundary of the VoltyChannel.

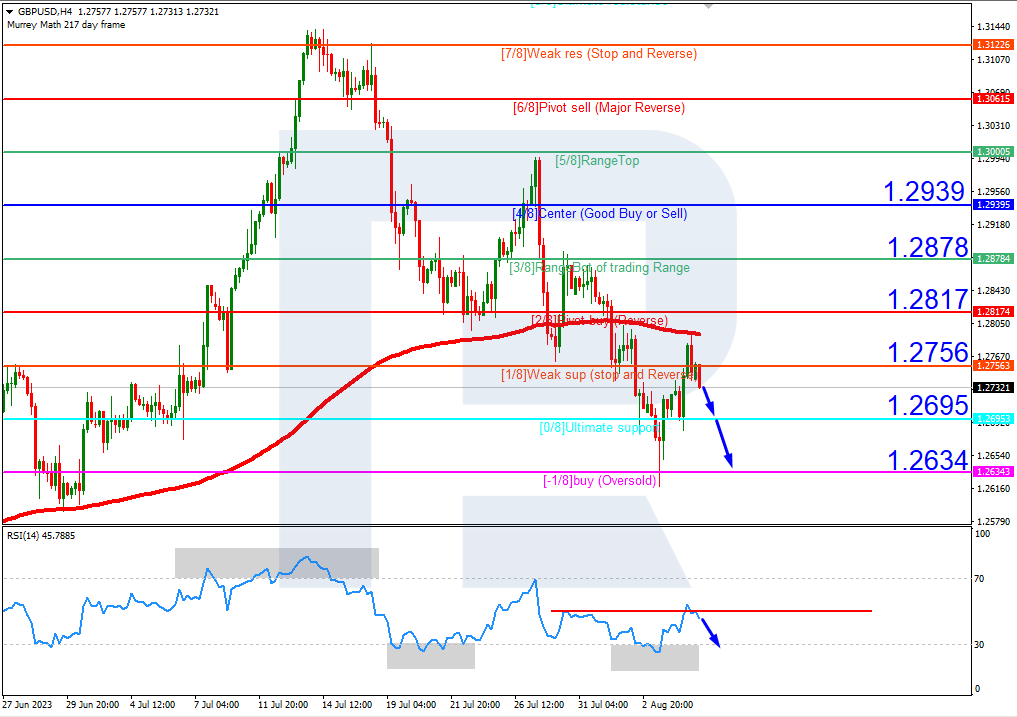

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD quotes are below the 200-day Moving Average on H4, indicating a prevailing downtrend. The RSI has rebounded from the resistance line. In this situation, the price is expected to test the 0/8 (1.2695) level, break it, and fall to the support at -1/8 (1.2634). The scenario can be cancelled by an upward breakout of 1/8 (1.2756), which could help the pair reach the resistance at 2/8 (1.2817).

On M15, a breakout of the lower line of the VoltyChannel could increase the probability of a price drop.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.