Murrey math lines: AUD/USD, NZD/USD

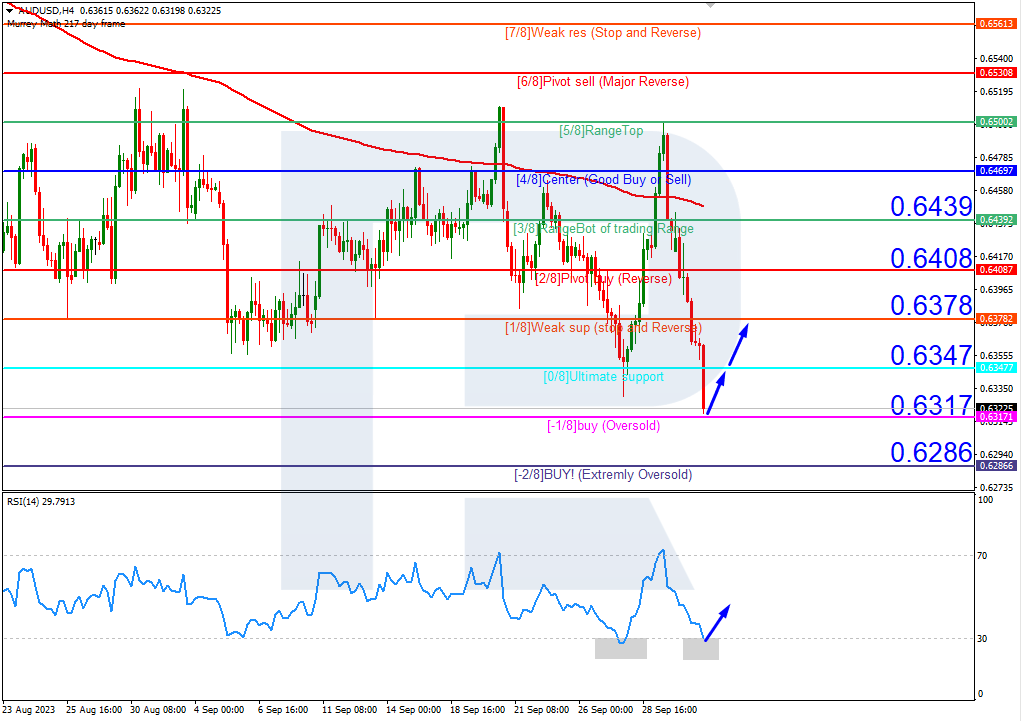

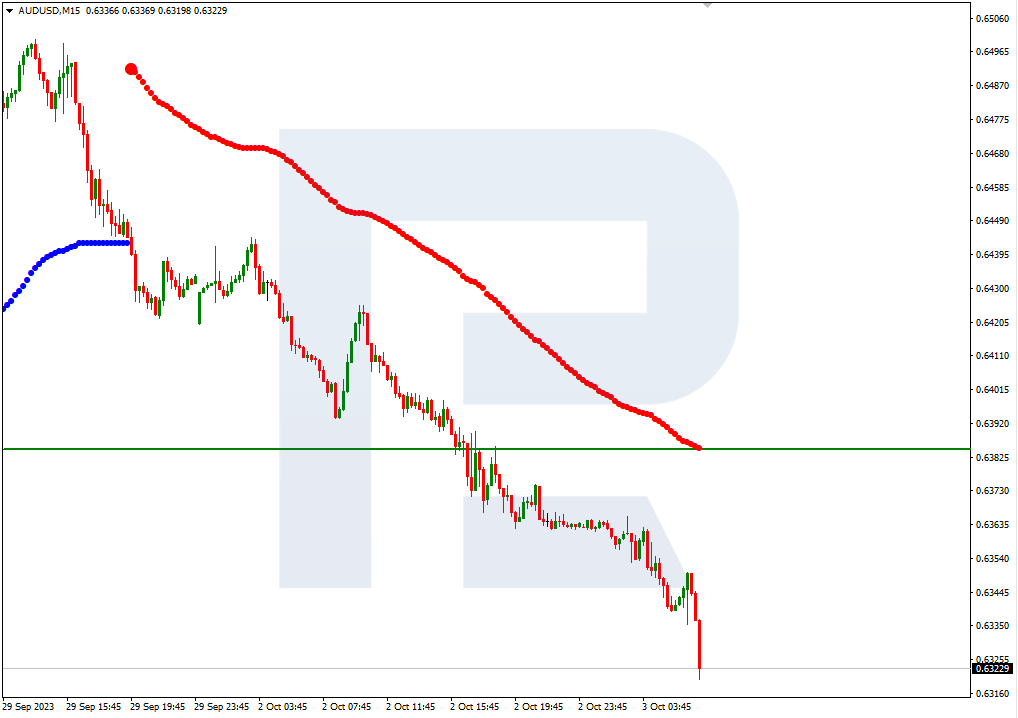

AUD/USD, “Australian Dollar vs US Dollar”

AUD/USD quotes and the RSI on H4 are in their respective oversold areas. In this situation, a rebound from -1/8 (0.6317) could be expected, followed by a rise to the resistance at 1/8 (0.6378). The scenario can be cancelled by a rebound from -1/8 (0.6317). In this case, the quotes might continue falling, probably reaching the support level of -2/8(0.6286).

On M15, the upper boundary of the VoltyChannel is too far away from the current price, which means the growth of the quotes could only be indicated by a rebound from -1/8 (0.6317) on H4.

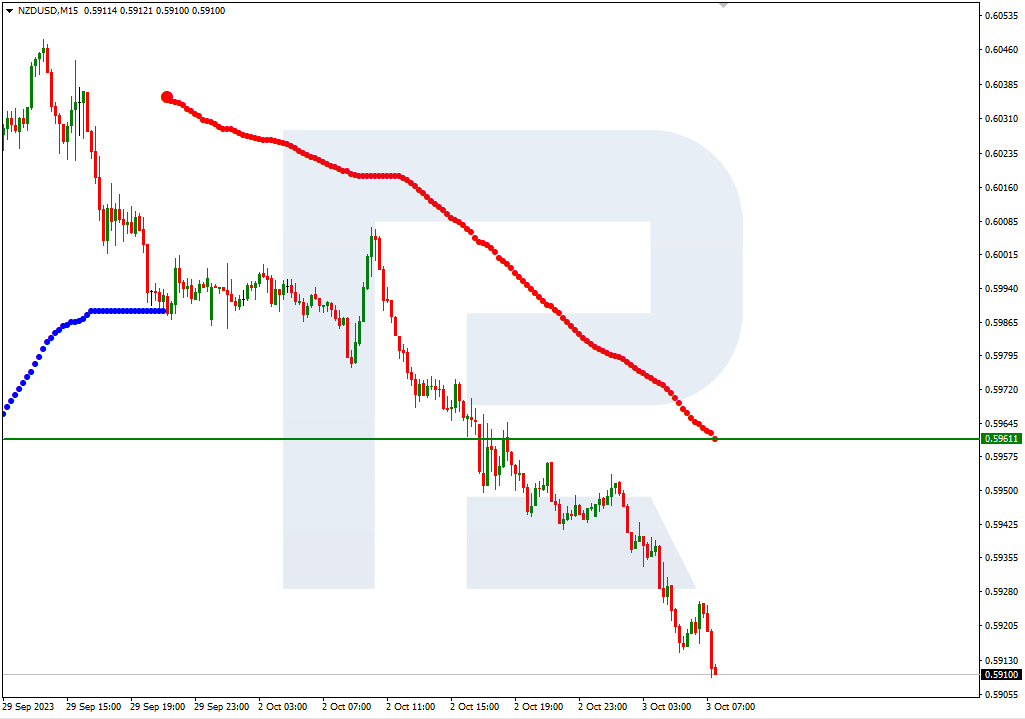

NZD/USD, “New Zealand Dollar vs US Dollar”

NZD/USD quotes have broken the 200-day Moving Average on H4, reaching below it, which reveals the chance for a downtrend to develop. The RSI is nearing the oversold area. As a result, a test of 1/8 (0.5889) is expected, followed by a rebound from it and a rise to the resistance at 3/8 (0.5950). The scenario can be cancelled by a downward breakout of 1/8 (0.5889), in which case the quotes might drop to the support at 0/8 (0.5859).

On M15, the upper boundary of the VoltyChannel is too far away from the current price, which means the growth of the quotes could only be indicated by a rebound from 1/8 (0.5889) on H4.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.