The British Pound soared across the board on Wednesday after the Bank of England (BOE) minutes revealed all members see rate hike as the next likely move over a three-year forecast period. Policy makers are also confident that the wage and price inflation would catch up eventually with the pace of economic growth. The slightly hawkish tone of the minutes pushed the GBP/USD pair to an intraday high of 1.5078. More importantly, the pair managed to finish the day above 1.5 levels for the first time since Mar. 11th. Focus now shifts to the UK retail sales data (exp 5.4%, prev 5.7 yoy) due for release later today. The retail turnover has held up well, contrary to the dip seen in the US economy. Moreover, upbeat retail sales indicate the lower inflation is having a desirable effect of boosting consumption. Consequently, a strong retail sales figure could see the pair test its 100-DMA at 1.51. In case we have big disappointment, the pair could dip to 1.4973, although the pair is likely to bounce back above 1.5 levels.

On the daily chart, we see the pair managed to finish above 1.5 levels in the previous session, thereby opening doors for further gains. The 50% Fib retracement of 1.5550-1.4564 at 1.5057 could act as a resistance, although the bullish daily closing is likely to ensure the pair rises above the same. The immediate gains appear capped at the 100-DMA located at 1.51. Meanwhile, fresh offers could be seen in case the pair fails to rise above 1.5057. In such a case, the losses are likely to be capped around 1.4973 (5-DMA). It remains to be seen if the pair manages to finish the New York session above 1.5 levels. If we have a daily close below 1.5, the bears are likely to regain control from tomorrow.

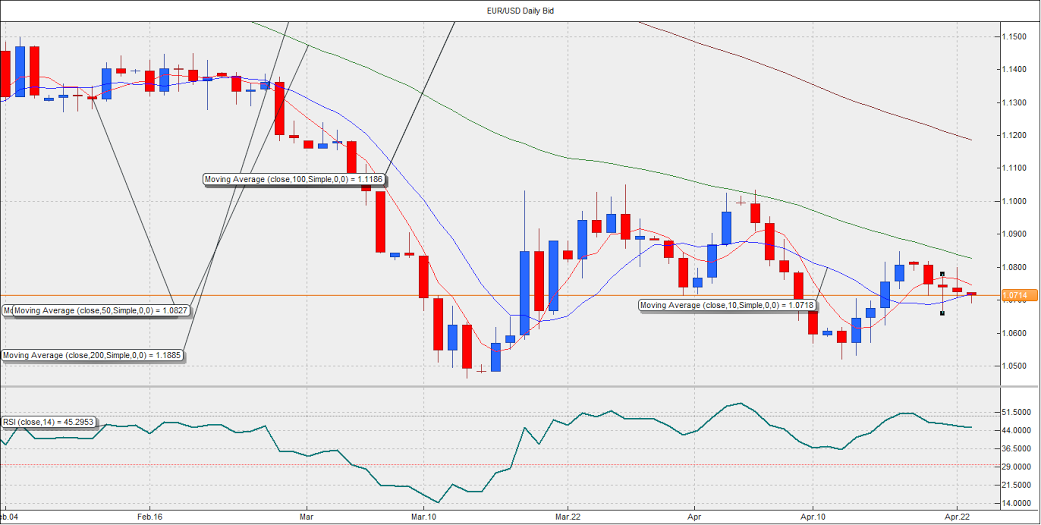

EUR/USD Analysis: Supported by hourly 200-MA ahead of PMI reports

The EUR/USD wavered on Wednesday amid contradicting statements from Greek finance minister Varoufakis, who said there are clear signs of convergence between Greece and its creditors, and state minister Pappas, who said Greece would continue to reject pension cuts. The contradicting statements indicate there is a low possibility of a deal being reached on Apr 24th. As for today, the PMI reports are likely to share the limelight along with Greek issue. The upbeat PMI reports could create lot of problems for EUR bears, as it would provide just enough reason for punters to abandon their shorts. In such a case, I expect the pair to re-test 1.08 levels. On the other hand, disappointing PMI reports could push the pair down to 1.0658 levels.

On the hourly charts, we see the pair was supported by the hourly 100-MA located at 1.0690 levels earlier today. The RSI indicator continues to stay bearish on the daily as well as the hourly time frame. However, the EUR could be bid higher to 1.0770 once the pair manages to recover above its 10-DMA at 1.0718. It remains to be seen if the pair moves closer to 1.08 in anticipation of an upbeat PMI report. In such a case, the pair could either consolidate around 1.08 break lower post the release of PMI reports. Meanwhile, an attempt at 50-DMA located at 1.0827 could be seen if the German and Eurozone PMI beat expectations by a wide margin. The losses appear capped at 1.0658 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.