The GBP/USD pair fell for the third week of the past four due to political uncertainty and a rebound in the USD weighed. The losses, to some extent, were capped by hawkish comments by BOE’s carney and Broadbent. The current week begins with a rather thin economic calendar out of the UK. However, the US is set to report personal income and spending numbers later today. The GBP is likely to remain under pressure during the European session, mainly on account of election uncertainty. The GBP/USD volatility gauge has shot to its highest since the Scottish referendum, while the latest CFTC data shows an increase in the net –short GBP position for the third consecutive week.

Meanwhile, the chart shows, the pair, currently at 1.4857, is flirting with the 23.6% Fib retracement of 1.5550-1.4633 located at 1.4849. Given the bearish daily, hourly and 4-hour RSI, a break below 1.4849 appears likely, post which the pair could drop to 1.48-1.4790. On the other hand, a fresh demand for Pounds can be anticipated above 1.4882, in which case, the pair could rise to 1.4920-1.4950 levels. Moreover, the pair appears stuck in the range of 1.48-1.5 since the last week. Hence, a daily close above/below the said range could open doors for 1.46-1.52. However, with election uncertainty and US payrolls data slated for release this week, we could witness a bearish daily close below 1.48.

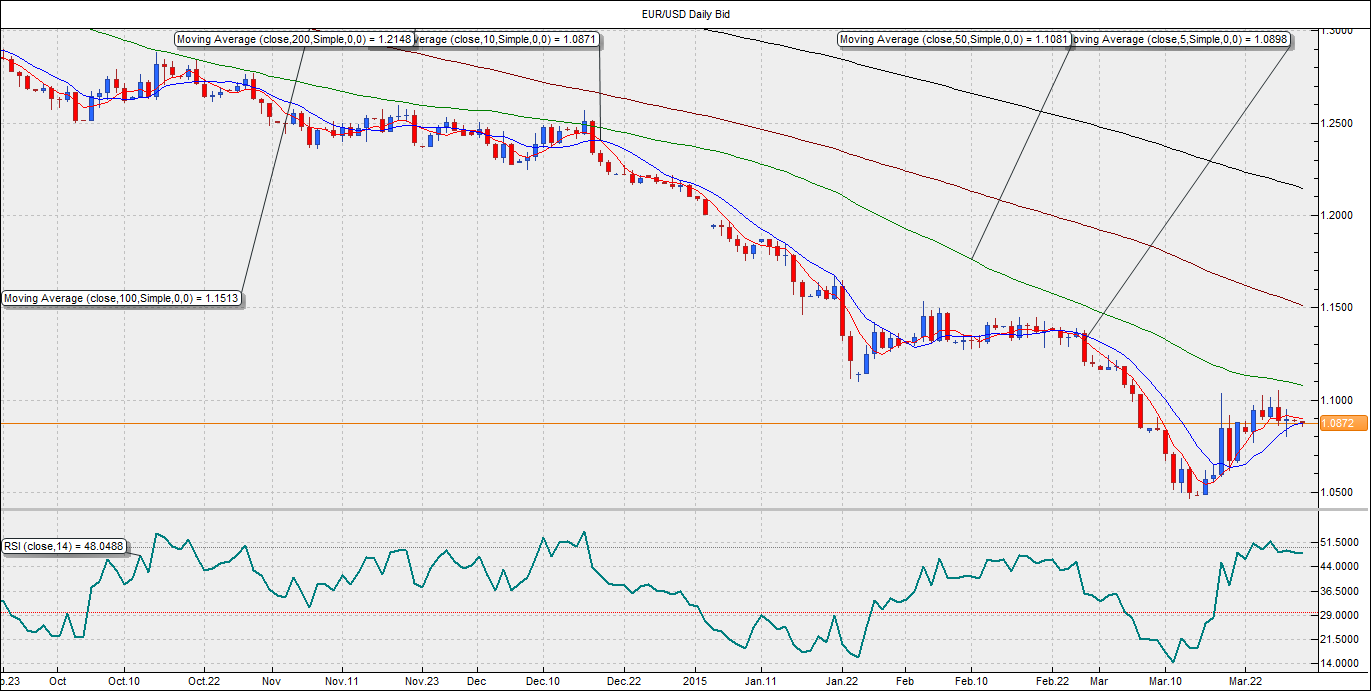

EUR/USD – Gains capped at 1.09, Greece remains a central point

The EUR/USD pair rose to a high of 1.1050 last week, before finishing at 1.0893. The upbeat economic reports out of the Eurozone, coupled with the ECB President Draghi’s upbeat view on the economy supported the shared currency. However, the rebound in the US Treasury yields, and the Greece issue made sure the pair remained below 1.10 levels. Moreover, the markets are likely to look past the German CPI data today and focus on Greece funding woes. Greece’s creditors are expected to deliver a decision on the Greece’s reform plan. If accepted, it shall unlock the next round of bailout funding on Friday. Athens faces EUR 5.8 billion in maturing debt this month in addition to the day-to-day financing needs. An acceptance of the reforms list of Greece’s creditors could see the pair rise back to 1.0950 levels. On the other, the rejection of the reforms list could push the pair back to 1.08.

On the charts, the pair is trading at the 10-DMA located at 1.0870, after having recovered from the low of 1.0853. On Friday, the pair had bounced-back from the hourly 200-MA, although gains were capped at hourly 50-MA. Given, the pair recovered back above 10-DMA, we could see it rise to its 5-DMA and hourly 50-MA located at 1.0898. A break above the same could open doors for 1.0950 levels. On the other hand, failure to rise above 1.09 could see fresh selling pressure in the pair.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.