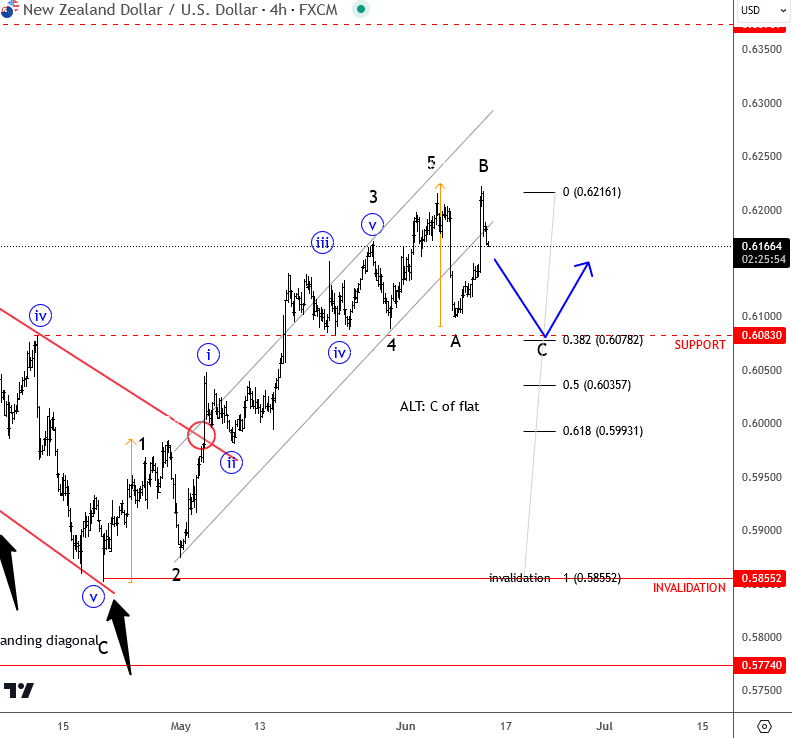

More upside for Kiwi after a pause: Elliott Wave analysis

New Zealand dollar (NZD) is declining against the US dollar (USD) since the end of last week when the US dollar surged following strong and unexpected jobs data, despite the US unemployment rate rising to 4%. Analyzing the updated wave structure, we observe that the price is trading outside of the upward channel, indicating that a correction is taking place. This is totaly normaly and expected as we can count a completed five-wave rise from April lows to June highs. Ideally, this current move is a temporary pause, forming a three-wave correction (ABC). Therefore, we expect a new upward resumption after this setback. The support levels to watch are the 50% retracement at 0.6035 and the 61.8% retracement at 0.6000, which also aligns with psychological and technical support levels from April's swing highs and May's swing lows.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.