More defence

S&P 500 barely managed to close where it did the day before, and decreasing volume points at little short-term willingness to push prices up. MSFT earnings didn‘t help either, and we‘re set up for more of what I warned you about yesterday – the bulls need to play good defence now.

4,010 didn‘t hold, and today‘s battle lines are to be drawn around 3,990. After that, 3,955 comes into play as more serious support with better odds of holding up on a closing basis.

What we‘re seeing, is dialing back of the excessive soft landing, Fed pivot, Fed pause (whatever you call it) sentiment – the positioning for next week‘s FOMC with 25bp hike and no change in balance sheet shrinking and more hikes ahead reiteration, goes on. Buy the rumor, sell the news – and this rally of laggards (tech, crypto) is going to notice. It‘s happening already – and they say that markets are efficient, see my take.

At the same time, the countdown to recession continues as money supply (M2) is flashing red yet the easy financial conditions index of Chicago Fed doesn‘t reflect that yet. Especially the Europe avoiding recession miracle is going to get proper scrutiny in the months ahead. It‘ll take time to burn through this complacency – stocks haven‘t topped out yet…

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there (or on Telegram if you prefer), but the analyses (whether short or long format, depending on market action) over email are the bedrock. So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open with notifications on so as not to miss a thing, and to benefit from extra intraday calls.

Let‘s move right into the charts.

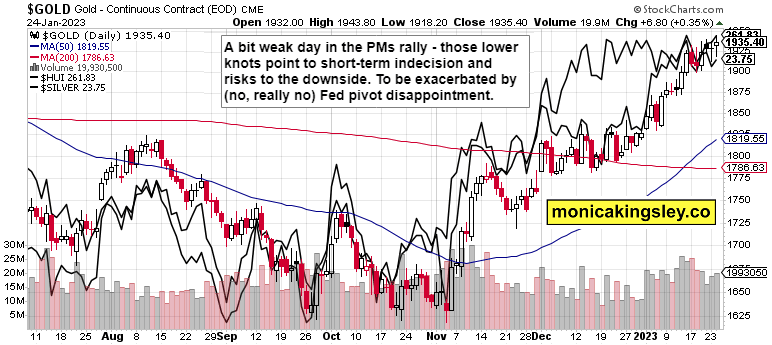

Gold, Silver and miners

Precious metals paint a picture of short-term caution, and I mean the pre-FOMC positioning and reaction to no Fed pivot especially. Buying opportunity ahead for those who missed the boat.

Crude Oil

Crude oil is to put in a higher low – and keep ever so slowly recovering.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.