Moderna, COVID vaccine and the market surge

Wall Street seems very convinced that there will be a cure for the COVID-19 in the near future. Markets rallied more than 900 points in the Dow. Not sure if the hands of the plunge protection team were active as well.

Yesterday morning, Moderna Inc. a Massachusetts based biotech firm reported positive phase 1 results for its COVID- 19 vaccine. That was the catalyst for the quick surge in the markets. Will cover specifics of the markets in the asset class section below.

China was quick to impose 80.5% tariff on Australian barley after already suspending beef imports from Down Under, all because Australia publicly requested an international investigation into the origins of the virus.

About 110 countries have signed up for this investigation and China is hopping mad about it. Interesting point is one of the countries that are in this group is Russia who is a close ally of China.

If the standoff with Australia continues, they have much to lose in terms of trade in soft and hard commodities, education, and investments in the country. The time is at hand for Australia to rethink its brand strategy going forward.

Meanwhile, President Trump is making all sorts of ultimatum and threats to WHO in their handling of the pandemic and their partial relationship with China.

In Europe, matters will get really ugly if the European Union bureaucratic machine does not quickly sort out the constitutional standoff with Germany.

According to a new filing, it was surprising to see that Berkshire Hathaway has sold 84% of its stake in Goldman Sachs in Q1. Speaks a lot about Warren Buffett’s view on the banking sector now. Let’s turn to markets.

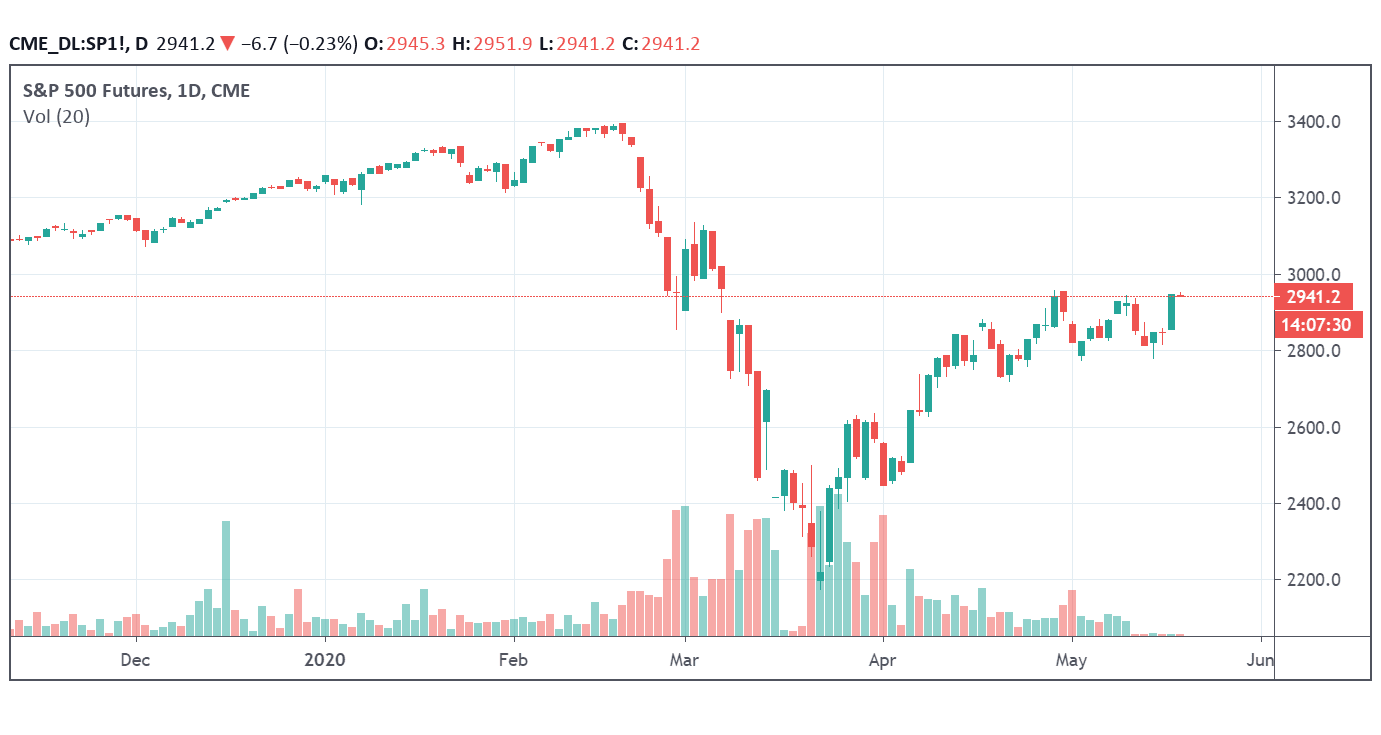

Equities

While we are adamantly bearish on the markets in the bigger picture yesterday’s price action could have slightly changed the short-term technical picture.

So far, the S&P 500 rallied fractionally close to the previous recovery high at 2965. We believe the top could be anywhere between 2975-2985 but now the risk has increased for a move to 3140-3240 before this bearish rally terminates.

The CBOE intraday put/call ratio was around 0.61 very close to the 0.55 level reached before the Feb 19 high. There is no doubt the market is very bulled up. We are looking for a five-wave structure to confirm if a top is close.

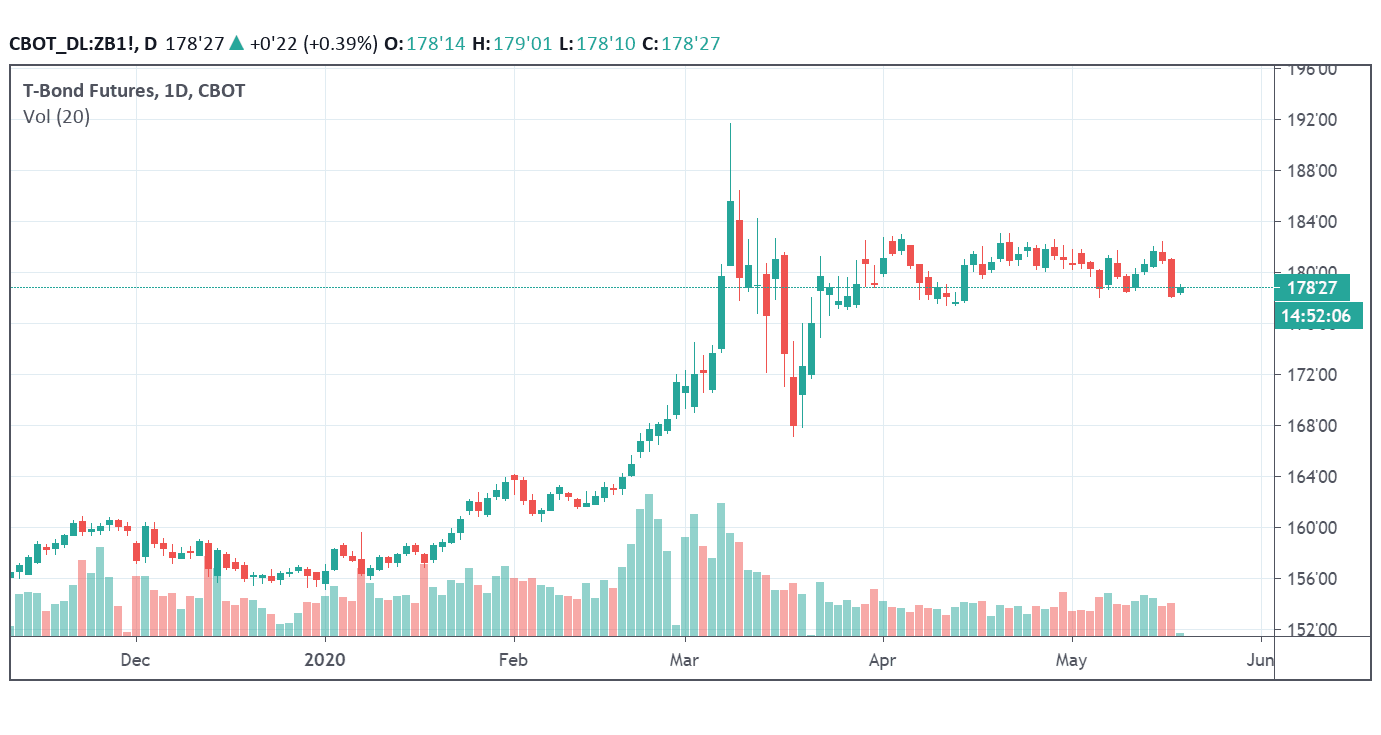

Bonds

The 30-year bonds declined nearly four points from its highs at 182^15 on last Friday. While the pressure is building up for a larger move down, we need to see a clear break below 178 to be more confident.

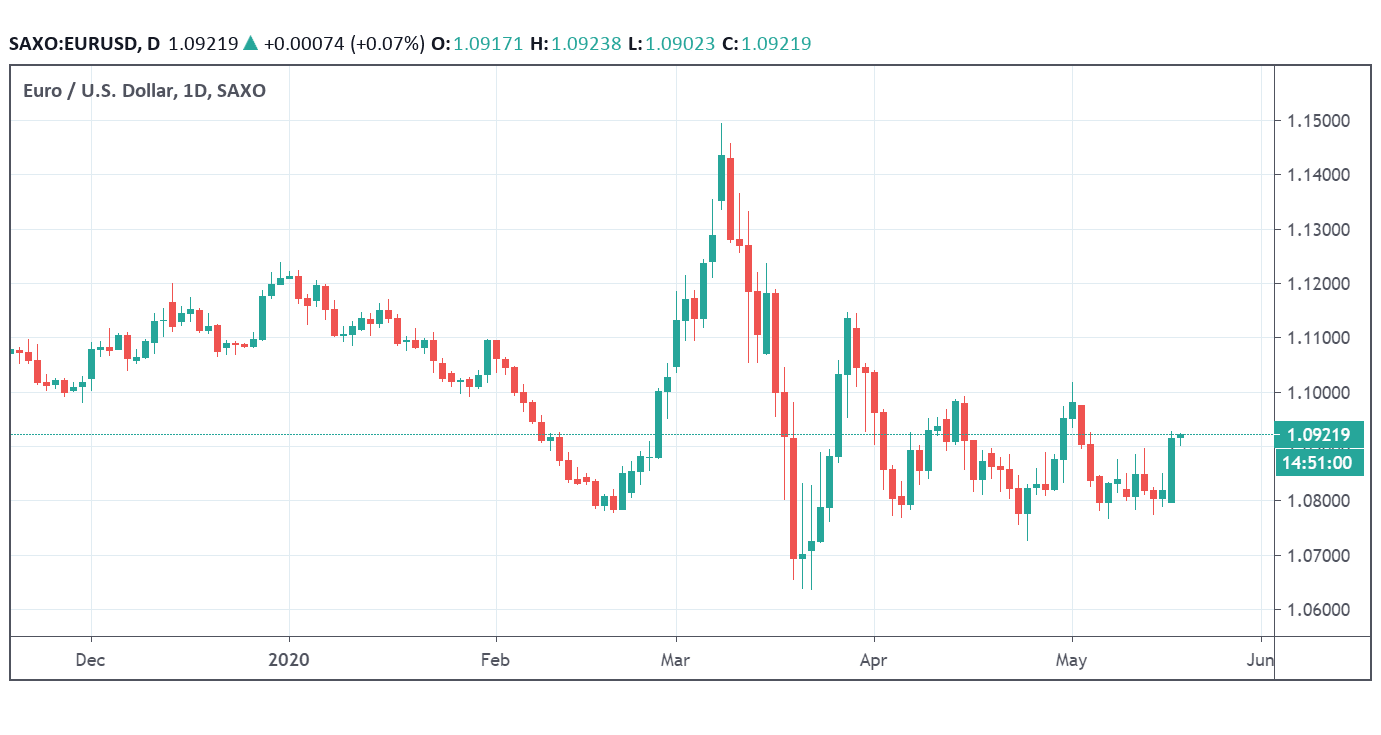

Euro

The Euro rallied strongly from its lows of 1.08 to post a high of 1.0928. Given the circumstances, will wait for more price action to get a better picture.

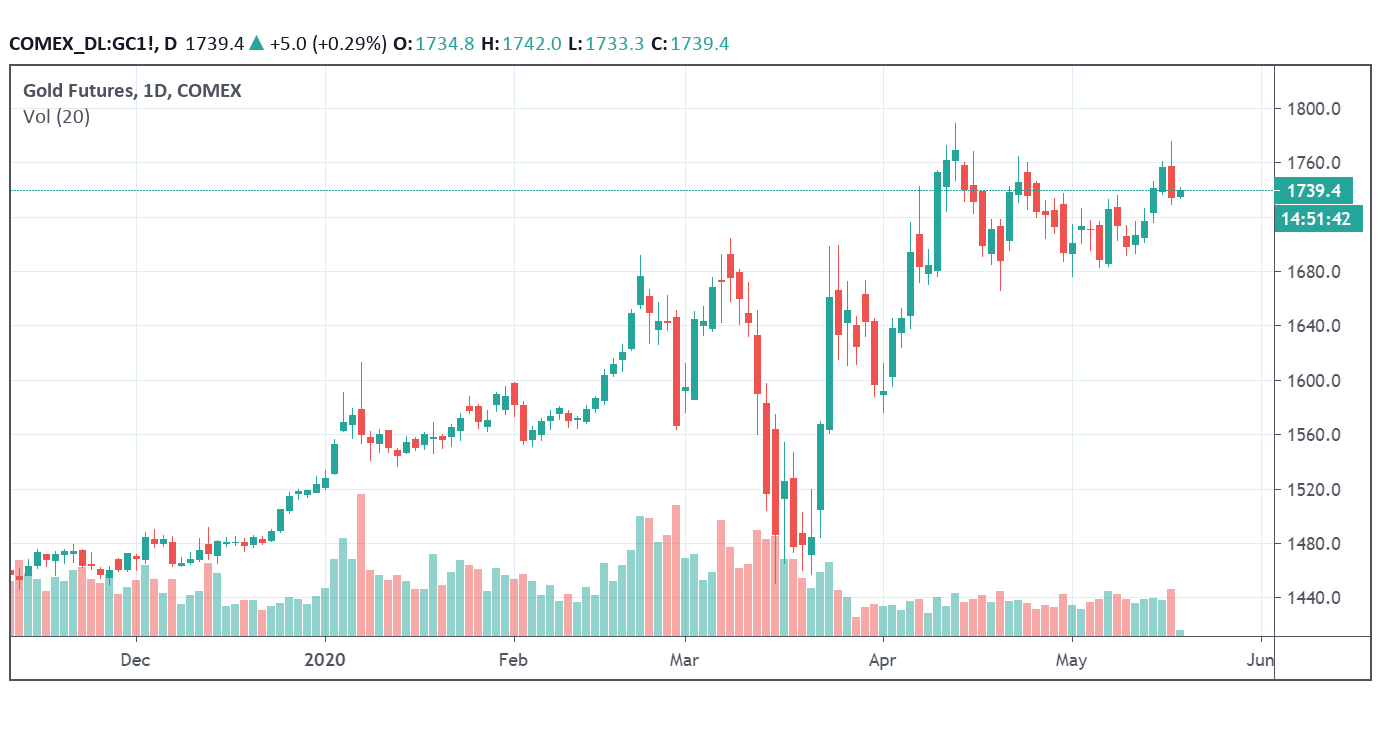

Gold

Gold made that up move we feared all the time. It posted a high of 1766 and reversed sharply. It could be that we have seen the top. A move below 1700 will confirm it. The daily sentiment index has pushed to 91% bullish, the highest reading in three months. Speculators and commercial hedgers are at extreme ends in open interest. So, will be interesting to see how this market will play out in the coming days.

Author

Abraham George

Breezy Briefings

Abraham George is a seasoned investment manager with more than 40 years of experience in trading & investment and portfolio management spanning diverse environments like banks (HSBC, ADCB), sovereign wealth fund (ADIA), a royal fa