Michigan Consumer Sentiment Index Preview: Good news for the dollar but not for households

- The Consumer Sentiment is expected to have improved further in August.

- Market players turned optimistic amid signs of receding US inflation.

- USD will likely react to sentiment instead of to the Michigan report.

The Michigan Consumer Sentiment Index is expected to have improved further in August after plummeting to a record low of 50 in June 2022. It managed to bounce to 51.1 in July, a figure later revised to 51.5. Market analysts are expecting this August’s preliminary estimate to print at 52.5. Such an improvement should add to the ongoing relief brought by US inflation figures.

Inflation eases, optimism raises

Last month, and according to the aforementioned survey, consumers were worried about the falling standard of living due to continued price pressures. At the same time, inflation expectations cooled in July, somehow confirmed by the Consumer Price Index, which remained flat in the month, and increased by 8.5% YoY, much better than the previous 9.5%.

Expectations that inflation has begun subsiding will likely boost consumption, moreover considering that the Federal Reserve is now seen decelerating its pace of quantitative tightening. The downside is that inflation would need to shrink at least for two more months in a row to confirm a top and that the US is technically in a recession. The fact that the Fed may no longer need to hike rates aggressively takes some steam off growth pressures.

Possible USD reactions to the news

The effects of upbeat US data would take some time to show in households, but it is quickly reflected in financial markets. Upbeat confidence will do more good than the bad a soft number can do. Still, the report will affect sentiment, with the latter providing direction to the greenback.

A better-than-expected reading should further underpin Wall Street and weigh on the American currency, particularly against high-yielding rivals. The opposite case scenario has a few chances of hitting equities but could force some profit-taking ahead of the weekend. US indexes may then retreat from their highs and help the greenback to trim some of its recent losses.

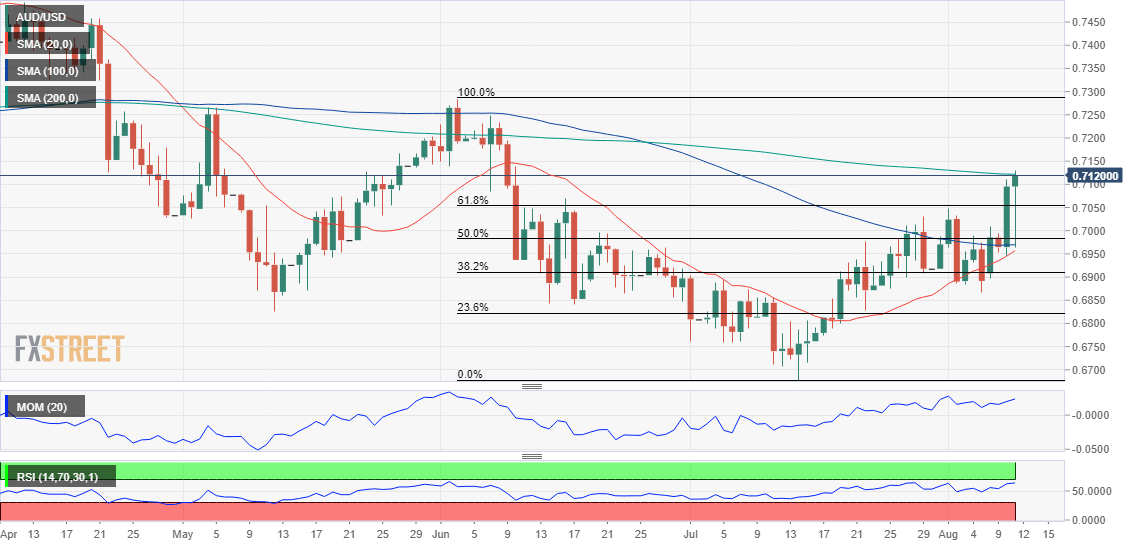

In a weakening dollar scenario, the AUD/USD pair seems to be the one with better chances of rallying. The pair has finally taken over the 61.8% retracement of its June/July decline at 0.7050, and as long as the level holds, there’s room for a complete retracement towards the top of the range at 0.7282. Below the mentioned support, on the other hand, could result in a slide towards the next Fibonacci support at 0.6980.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.