May central bank overview

Major central bank rundown

It’s time for your central bank catch up. So, if you have been put off the loop, or just want a quick refresher then grab a coffee and let us get you up to speed. The link to the latest statement is at the bottom of each section, so just click there to read the bank’s central statement. Remember, there is no substitute for actually reading a central bank statement yourself and it will almost certainly be of great benefit to your trading.

Reserve Bank of Australia, Governor Phillip lowe, 0.10%, meets 03 May

The RBA has been holding rates low for three reasons:

-

The new uncertainties around the Ukraine crisis.

-

Secondly, although wages have picked up (see here for why wages are key to the RBA) the RBA sees them still at relatively low rates at the aggregate level. In other words, the data does not accurately reflect the reality of the wage situation due to the way that wages are computed.

-

Inflation is lower than in other countries and the RBA forecasts the core will drop to 2.75% over 2023 as supply-side issues fade.

To hike in 2022? The turning point has been reached

Inflation and wages are the key focus for the RBA notwithstanding the uncertainty of the Russian/Ukraine crisis. So, the RBA is now at the point where it seems that inflation and wages can only move higher over the medium term. For the RBA to have reached a definitive turning point we need to see the next wage data rise. The RBA recognised that wage data had picked up (the last wage price index print was at 2.3% y/y), but the RBA really wants to see a growth of 3% y/y for this box to be ticked. If inflation is more persistent than just being limited to supply chain areas then the RBA will also act.

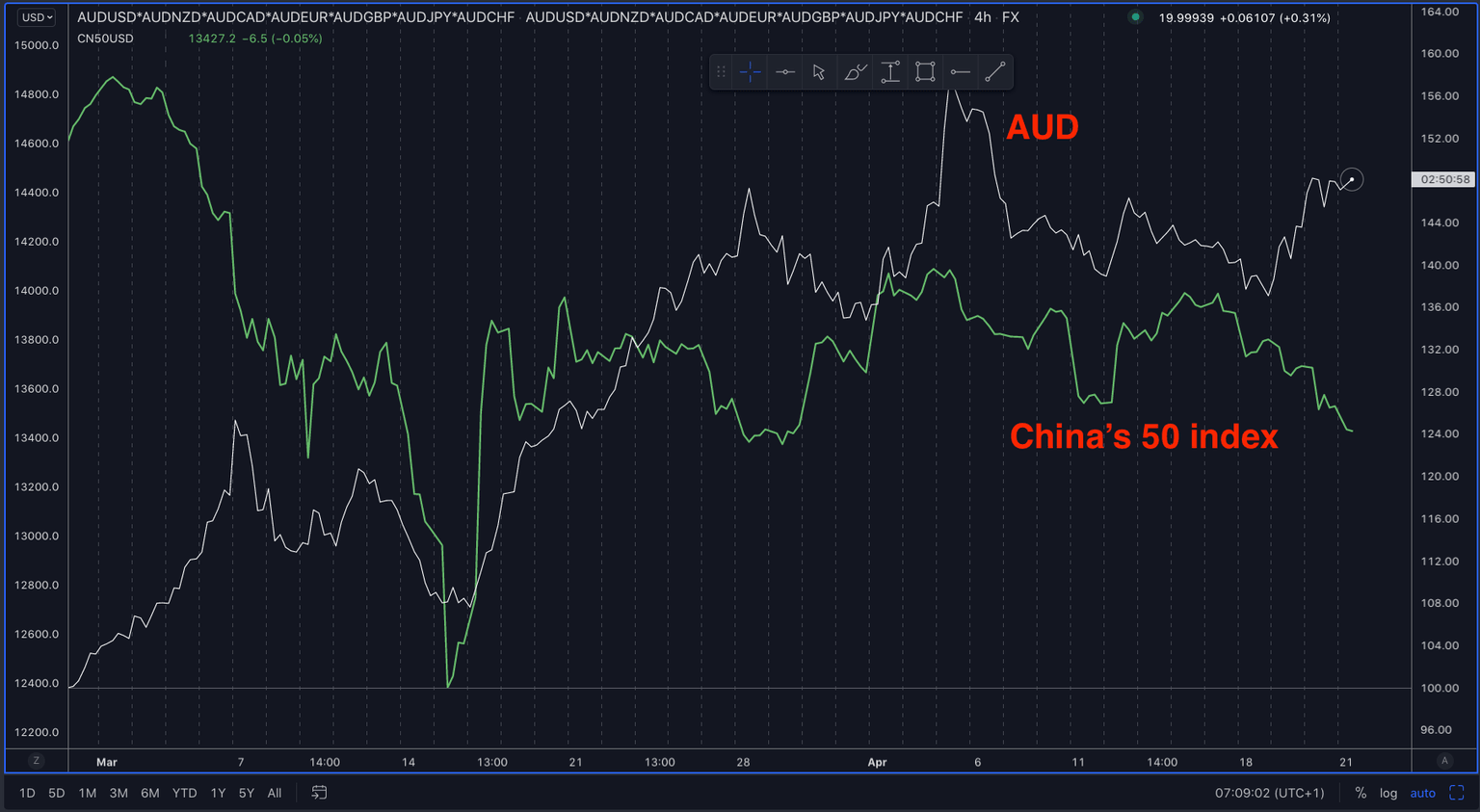

The inflation inflection point seems to be reached now as there are no obvious reasons why wages and prices in Australia will not follow the US, Europe, and the UK higher. So, going forward watch for wages to move higher as this will most likely be the first hint that the RBA will be hiking rates too. Also, the AUD may see some gains as China receives support from the PBOC and fiscal stimulus is due. For now, a reluctance from the PBoC to cut and further COVID lockdowns in China will weigh on sentiment. Look at the relationship between China’s A50 shares and the AUD to see how tight that relationship is.

If the USD reaches peak bullishness soon then AUDUSD gains over the medium term make sense. The AUDUSD should be a buy on dip over the course of Q2.

European Central Bank, President Christine Lagarde, -0.50%, meets 09 June

At the previous ECB meeting, the door was kept open for a 2022 rate hike. This was the ECB showing that inflation pressure trumped Russian risk for now. Ahead of April’s ECB meeting we were looking for a scenario where the ECB acted decisively on inflation and played down slowing eurozone growth. There was nothing really specifically negative about the ECB statement; it was more the lack of an obvious commitment from the ECB to hike rates. In the press statement after the meeting, Christine Lagarde stressed that the eurozone was more vulnerable to the Russian/Ukraine crisis than the US and that the ECB cannot ensure growth. This was a more ‘stagflationary’ outlook painted by the ECB, so it was not a clear indication of faster rate hikes coming due to rising inflation. That would have been the most obviously EUR positive outlook.

Rate hikes still on the table for July

Although the chances of a July rate hike fell post the ECB meeting from 70+% down to 50+% the ECB sources piece on April 14 crucially stated that ECB policymakers still see a July hike as possible after Thursday’s meeting. Policymakers were reportedly unanimous in backing the policy message that the ECB would end its bond-buying program in Q3 and raise rates some time after that. Remember that in every ECB meeting there are three different reactions. Firstly, we have the statement, then the press conference. The press conference offers Christine Lagarde the chance to clarify and/or correct any initial market reactions to the statement. After these two events, there are ECB ‘sources’ reports that offer a third chance for the ECB to set the market in the right direction. Crucially here it was the sources reports that have kept open the possibility of a rate hike for July. Furthermore, on top of this, ECB’s Wunsch, De Guindos, and Kazak’s all affirmed the potential for a July rate hike. So, in balance, it would be reasonable to still expect some EURGBP gains from here. The BoE is more tentative about its hiking progress from this point, so there is potential for some EURGBP upside and risk can be easily managed from this key support around 0.82500 marked on the chart below.

Bank of Canada, Governor Tiff Macklem, 0.50%, meets 01 June

At the last BoC meeting, the BoC delivered a hawkish surprise. It increased rates by 50 bps as expected, but It also increased the neutral rate higher to 2.5% from 2.25%. Like many central banks around the world, the BoC did this in order to show their growing worries about rising inflation. At the last BoC meeting, they announced the start of quantitative tightening too which is effective from April 25, but Governor Macklem said that the bank will not be yet actively selling bonds as part of the QT. BoC’s Governor Macklem stated in the press conference that the BoC may need to take rates modestly above the 2.5% neutral rate for a period of time. However, he also said that if inflation moderates then it could be appropriate to pause hikes once the BoC gets close to neutral. So, the BoC is setting up markets for a flexible and adaptable approach.

Inflation

Inflation data is key. On Wednesday the Canadian inflation print came in hot. The y/y headline print rose from 5.7% to 6.7%. The core y/y reading increased from 4.8% to 5.5%. Now at some point, the bullishness for the CAD will have reached its peak and a retracement for recent CAD gains should not be entirely unexpected.

The takeaway

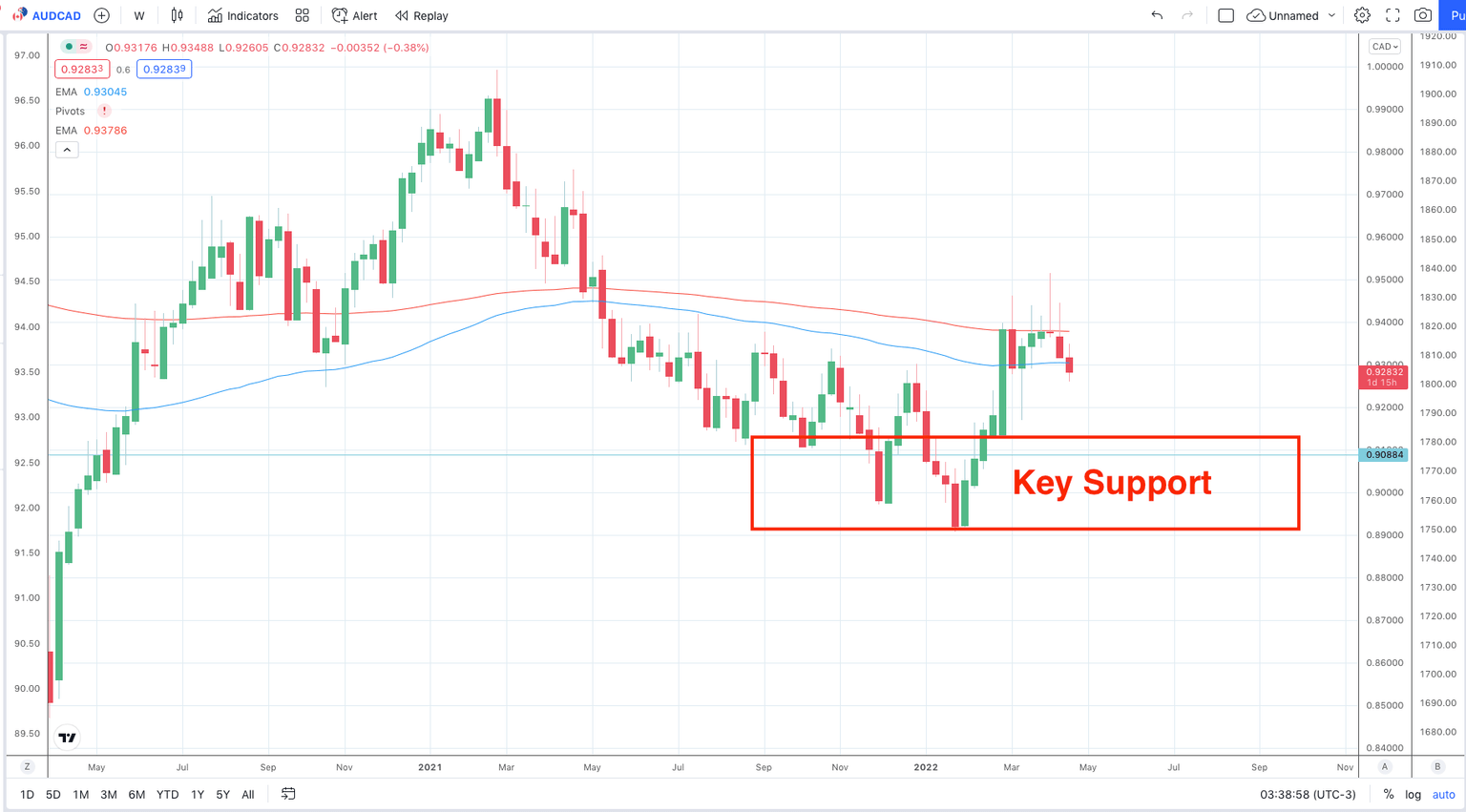

AUDCAD longs from deeper pullbacks could be more appropriate as the RBA look to potentially start hiking rates even as the BoC must be close to peak bullishness.

Federal Reserve, Chair: Jerome Powell, 0.125%, meets 04 May

50 bps hike expected and QT start

The Federal Reserve meets at the start of May and it has widely signaled a 50 bps rate hike and the start of Quantitative Tightening. The Federal Reserve has been forced into action by surging inflation with Short Term Interest Rate markets pricing in nearly 9 interest rate hikes this year. Headline inflation in the US is now over 8% and the Fed is hoping that they can hike interest rates without slowing growth.

USD: Peak bullishness

It is hard to see how the Fed could be even more bullish than it already is. The USD must be close to peak bullishness now and remember that in recent history the USD can lose value after the first rate hike from the Fed. Look at the historical reaction of the USD in previous hiking cycles. In the 6 months after the first rate hike, the USD tends to lose value.

Now there is no guarantee that this will be repeated again this time, especially if global growth slows and this prompts USD buying, but it is hard to see how the USD can keep gaining as peak bullishness seems priced in. Especially when you look at the strong run the USD has had since the start of the year into the Fed’s first rate hike.

This means that going into May’s meeting we have to be mindful that some USD traders may use it to take profit, so we may see a short-term spike higher in the USD only to see it reverse out of the meeting. One chart to keep your eye on is gold. If earnings seasons throw up instances of slowing growth, like we saw with Netflix, then that could mean the Fed is having to hike rates as growth is slowing. This is the textbook stagflationary environment and would be a boost for the gold price, so keep an eye on that.

If growth starts to slow, but the Fed keeps hiking rates then that could be a catalyst for another down leg in stocks. It would also help the USD higher. So, there are still two-way risks here. What the Fed’s actions have told us is that they are very concerned about rising inflation and are prepared to act aggressively to contain it. The path from here for stocks is far from clear, but that in itself is a message for caution.

Bank of England, governor Andrew Bailey, 0.25%, meets 05 May

BoE’s Dovish hike to 0.75%

At the last meeting, the BoE had a dovish hike. It hiked by 25bps with an 8-1 vote split. The dissenter voiced a key concern as BoE’s Cunliffe recognised the inflation risk, but also the cost to households with further rate hikes. The Bank of England picked up on the tensions that UK consumers are now feeling in the statement, “Consumer confidence has, however, fallen in response to the squeeze on real household disposable income.”

Inflation

Inflation expectations have been revised higher to 8% with the recognition that the current Russian/Ukraine crisis could further push up energy prices. As the UK is a net energy importer higher energy prices will mean slower growth. The BoE still expects inflation to fade over the medium term to a little over 2% in two years time.

The BoE now recognises that modest tightening may still be set to come in further months, but that it could end up slowing growth by hiking too fast. In short, the BoE doesn’t want to be the cause of further slowing growth. With medium-term inflation risks still anchored over the medium term, this should be taken as a dovish shift from the BoE. The fact that one member dissented from the 25 bps rate hikes shows there is a real concern that the Bank does not hinder growth by pushing forward too aggressively. The STIR markets are still pricing in five 25 bps rate hikes this year, but that does seem too aggressive. So, in the medium term, the EURGBP should find dip buyers with the GBP likely to correct a little now after the latest BoE meeting.

The main point here is that the BoE is starting to worry about hiking rates too fast and slowing growth. It will be interesting to see how the Bank of England reacts at the May 05 meeting. Will those fears fade or grow? If the BoE is cautious again then the EURGBP could get a nice nudge higher.

Swiss National Bank, Chair: Thomas Jordan, -0.75%, meets December 16

This is interesting as the SNB is showing signs of growing impatience with the strong CHF. The SNB interest rates remain the world’s lowest at-0.75%. This is due to the highly valued franc (CHF) which has seen significant gains over the last few years due to safe-haven demand.

The SNB wants a lower CHF

The SNB repeated its willingness to intervene in the FX market in order to counter upward pressure on the Swiss franc. The SNB hates a strong CHF and its patience is now fractionally thinner. As an export-driven economy (a strong CHF makes its exports more expensive to other countries) it hates a strong CHF and is doing its best to make it as unattractive as possible. The market generally ignores this and keeps buying CHF on risk aversion which has been here in one form or another since around 2008/2009. Also, note that its trade surplus is high, boosting the CHF.

The bottom line and the EURCHF ‘opportunity’

The SNB will continue to intervene in the FX markets. The SNB wants a weaker CHF. The rest of the world wants CHF as a place of safety in a crisis, so we have this constant tug of war going on. Also, note that the SNB is more concerned with the real exchange rate rather than the spot one. So, just looking at the EURHCF is not necessarily the measure the SNB is using. However, also remember that if inflation continues to grow and we see a stagflation environment then the CHF alongside gold should also gain. There are two-way risks for the medium-term direction of CHF. However, the CHF is still a funding currency due to the very low-interest rates of the SNB.

Bank of Japan, governor Haruhiko Kuroda, -0.10%, meets 27 April

The Bank of Japan still remains a very bearish bank and there is no sign of it exiting from its easy monetary policy. Once again the latest meeting saw no surprises and everything was as expected. Interest rates remain at -0.10%. The Yield Curve Control (YCC) was maintained to target 10-year JGB yields at around 0.0%. The vote on YCC was made by 8-1 votes. The only dissenter was once again Mr Katoaka. The BoJ expects current rates to stay at present, or at lower levels.

Will JPY weakness worry the BoJ?

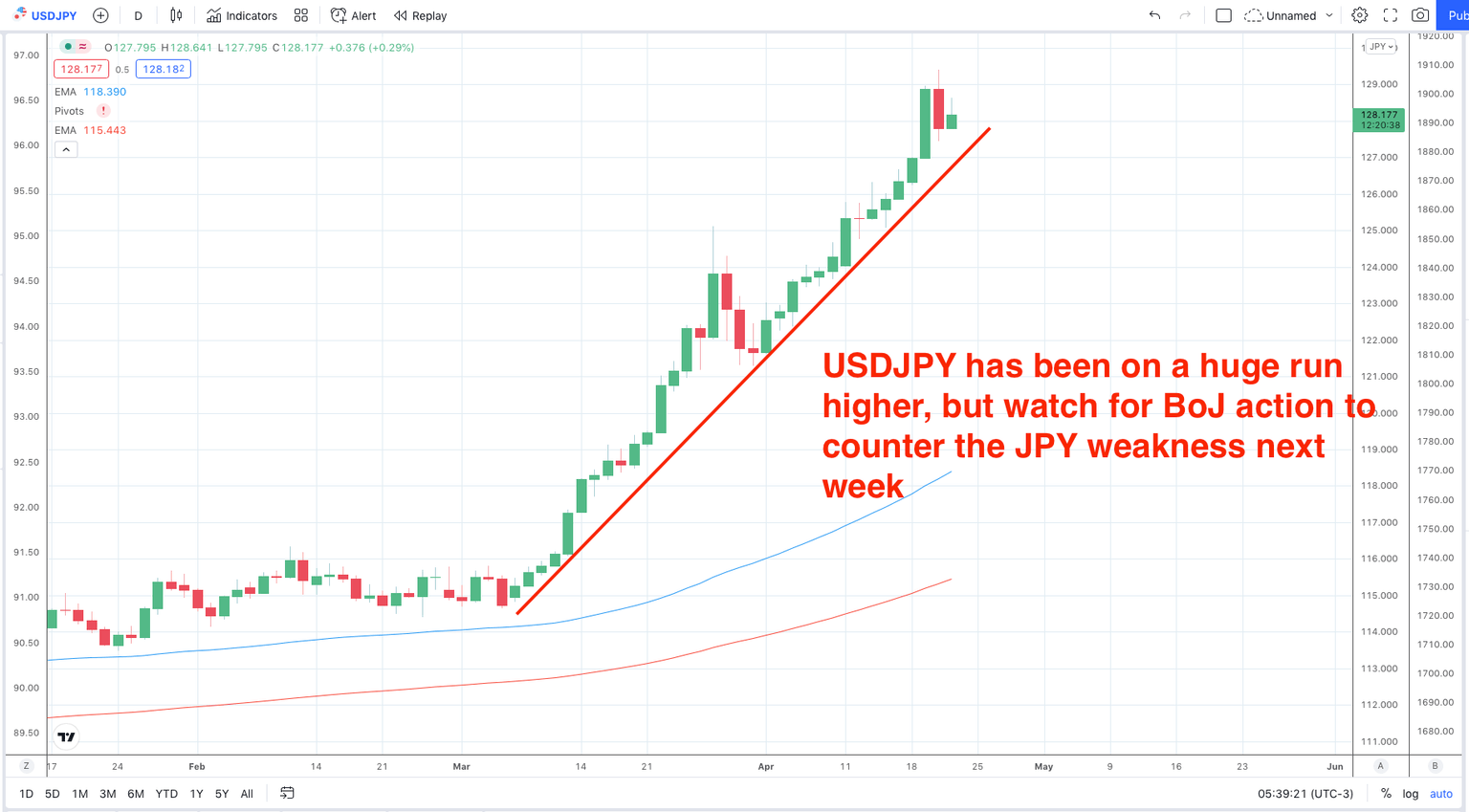

Going into next week’s meeting the obvious concern will be the JPY weakness. JPY weakness has been extreme recently.

There have been growing concerns about the weakness of the JPY from Japan’s officials, but the key aspect of this is whether there will be action from the BoJ. Crucial clue traders show watch for would be if the BoJ ended their yields curve control on the 10-year JGB’s. If they remove this control it will be an early sign that the BoJ is starting to act to counter the weakness of the JPY. Generally, a weaker yen is welcomed by the BoJ as it makes Japanese exports more attractive (cheaper) to foreign buyers. However, if the yen becomes too weak it can weigh on domestic imports.

For years Japan has struggled to see any inflation, so with inflation rising around the world, it was interesting to see that the BoJ now does expect consumer inflation to rise. However, not by much and the latest inflation metrics for this year were lower than expected. Core CPI was down to 0.0% vs 0.6% expected and GDP growth was down as well to 3.4% vs 3.8% previous. However, the 2022 forecast for inflation is 0.9%, and 1.0% for 2023. This is reflecting that Japan’s wholesale inflation hit a 13-year high (which puts a squeeze on industry profits) as the BoJ expects costlier input prices to be passed on to consumers.

The bottom line

The USDJPY pair has been very extended. If we see an end to yield curve control at the next BoJ meeting then a sharp sell of in the USDJPY could be expected, so that is a key chart to watch over May, especially through the Fed’s meeting.

Reserve Bank of New Zealand, Governor Adrian Orr, 0.25%, meets 25 May

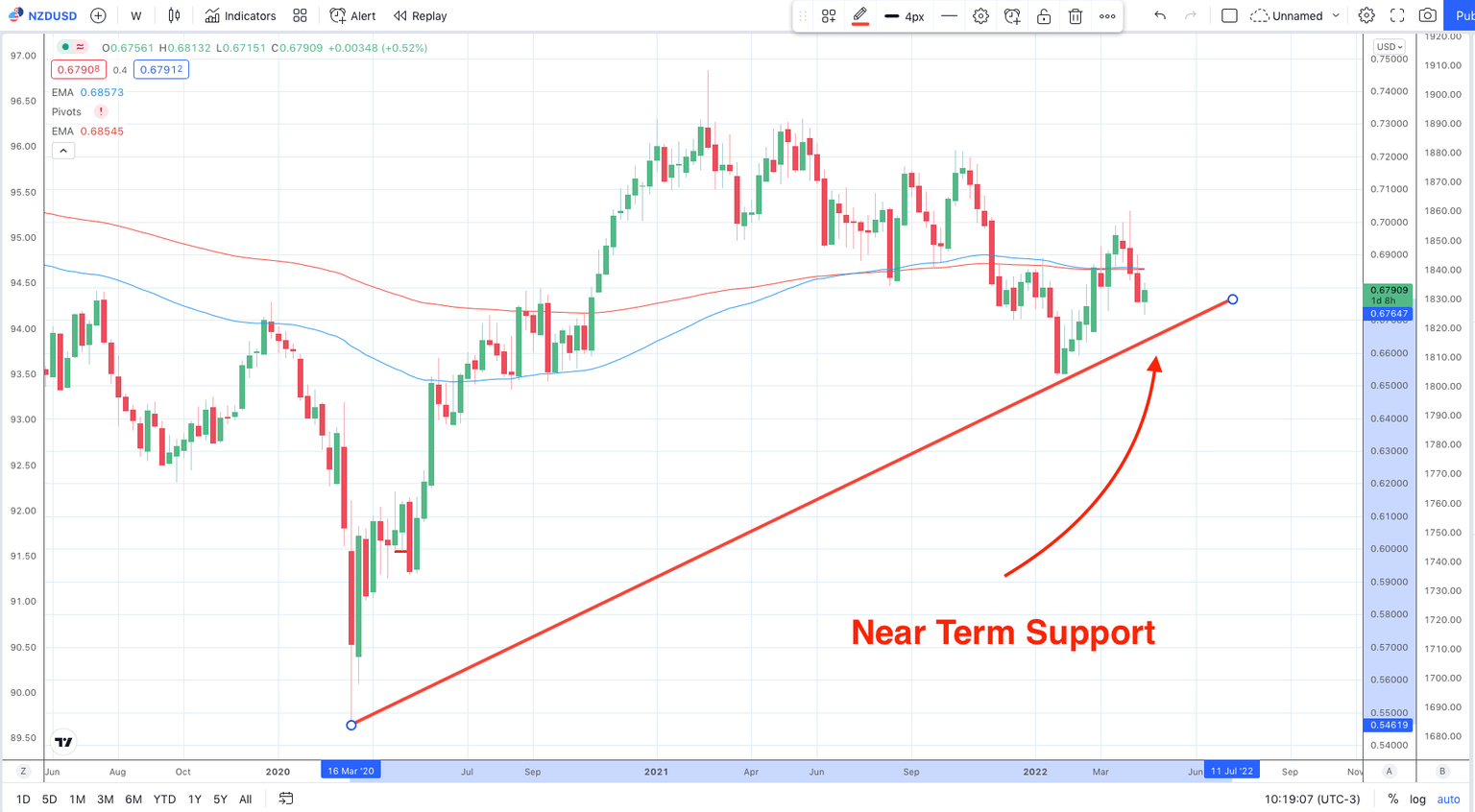

At the start of the year, the NZD was primed for gains, especially against the JPY. See here, here, and here for our coverage. However, a lot of hawkishness is now priced in for the NZD with its terminal rate at over 3%. The April meeting illustrated the point well with the RBNZ hiking by 50bps, but the NZD selling off shortly afterwards. Why? Yes, a 50 bps was a surprise for economists, but the STIR markets had already priced in 7 hikes this year, so all the RBNZ did was deliver some expected hikes slightly earlier. The RBNZ continues to see itself on a steeper path in order to control inflation, but it did not fundamentally change its terminal rate expectations. So, there was nothing in terms of an extra bullish surprise to push the NZD higher. On top of this, the latest inflation reading on April 20 came in lower than expectations at 6.9% y/y and 1.8% q/q vs 7.1% and 2% expected. On face value the inflation reading was high, a 30+ year high in fact, but not as high as expected and this keeps some pressure off the RBNZ to keep hiking aggressively.

The takeaway

The RBNZ does have a hawkish bias, but a lot of this is priced in. The NZDJPY pair should still be a bid on dips as there is a central bank divergence now in place between the RBNZ and the BoJ, but only deep pullbacks should be considered for NZD longs. NZDUSD looks attractive too as the USD reached peak bullishness, but make sure risk is carefully managed. There is no point buying at the highs only to see the price retrace heavily. Of course, if the RBNZ starts to take a dovish position then the NZD has some considerable strength to unwind. The next meeting is on May 22.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.