US Markit Purchasing Managers Indexes March Preview: How bad is bad?

- US Markit services and manufacturing PMI’s expected to fall to series lows in March.

- First important data predicted to show Coronavirus impact.

- Comparison with ISM manufacturing statistics across 72 years.

Markit Economics of the United Kingdom will release its preliminary US purchasing managers’ indexes for March at 9:45 EDT, 13:45 GMT on Tuesday, March 24. Final figures for manufacturing PMI will be issued on April 1, for services on April 3.

Forecast

US Manufacturing PMI is predicted to drop to 43 in March from 50.7 in February. Services is projected to fall to 42 from 49.4. The composite PMI was 49.6 in February and 53.3 in January.

US business reaction

The first US business data from March, the relatively new series from the English firm Markit Economics, is expected to show the weakest ever reading in the seven-year-old set. Previous lows were 50.3 in manufacturing in August 2019 at the height of the US-China trade war and in services, it was the surprise January reading of 49.4.

Markit manufacturing PMI

Constructed along the same lines as the much older indexes from the Institute for Supply Management (ISM) in the United States which began in 1948, reading above 50 denote that more than 50% of the survey’s respondents said their business activity in that area was expanding. Scores below 50 mean a majority said that area was contracting.

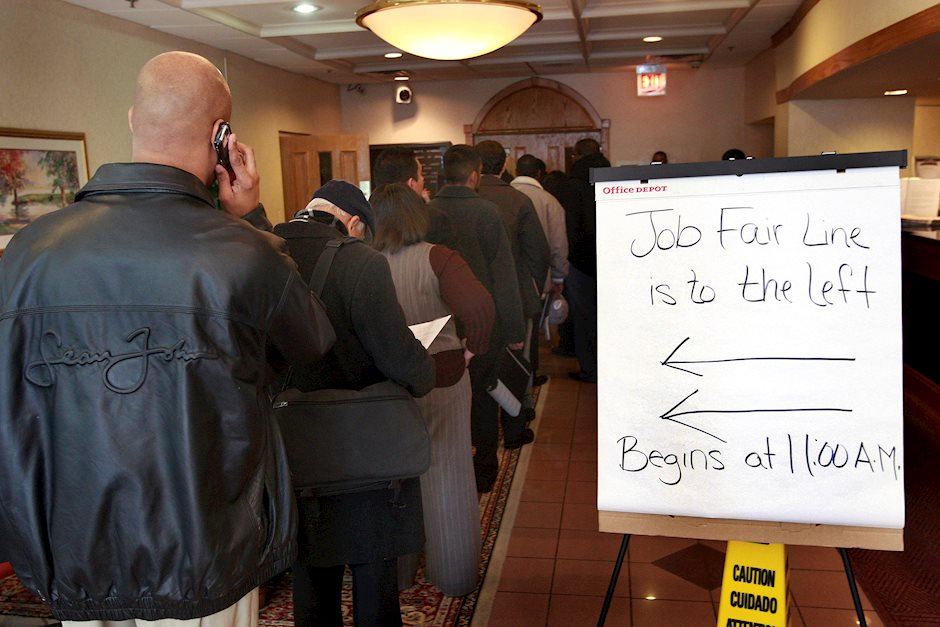

Layoffs are the major economic concern as businesses across the country close or restrict their activities with many hourly workers in the retail, restaurant and hospitality sectors being placed on leave or being fired.

Initial jobless claims for the week of March 13, the last reported, jumped from 211,000 to 281,000 the highest in two-and-a-half years and the biggest one month spike since November 2012.

Predictions for the week of March 20, to be released this Thursday at 8:30 am EDT, range from a low of 250,000 to a high of 4 million with a consensus forecast of 750,000 in the Reuters poll. If accurate this would be by far the largest one week total on record, far surpassing the 665,000 peak of the recession and financial crisis in February 2009.

Initial jobless claims

German sentiment

Sentiment in the German investor class in the ZEW survey collapsed to -49.5 in March from 8.7 in February for the largest single drop on record. It had been forecast to fall to -26.4. Though stunning it is only the fifth-lowest score in the 29-year history of the series. The all-time low was -63.9 in July 2008.

ISM manufacturing comparison

The long history of the Institute’s survey helps to put the potential plunge in sentiment in perspective. If the expected result of 44 in the ISM manufacturing PMI for March is accurate it would only be the 14th lowest score in the 72-year series. Those previous 13 scores averaged 36.3. The record was set in the first part of the double-dip recession of early 1980 and 1981 with a reading of 29.4 in May 1980.

Conclusion

A decline in business sentiment deep into contraction is almost a foregone event for March. Though a dismal result is expected PMI readings are not hard data, they do not measure sales, revenues jobs and the like and they tend to have limited market effect. The unemployment claims numbers coming on Thursday and non-farm payrolls arriving next week are the current focus.

If things are as bad as some of the sentiment polls indicate markets could be in for another round of panic selling, particularly if there is still no stimulus and support package from Washington.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.