Markets weekly outlook: Fed to extend pause as Trump era begins

- US equities markets rose due to President Trump's pro-business policies and decision to not impose tariffs on major trading partners yet.

- The Bank of Japan raised rates to 0.5%, the highest since 2008.

- The week ahead sees market shift attention toward Central Bank policy with ECB and Fed meeting in focus.

Week in review: Trump effect takes hold as uncertainties rise

Markets had a bit of a roller coaster ride this week thanks to the incoming Trump administration in the US. Markets got some of what they expected while they also received a fair amount of shocks to keep market participants guessing.

US equities got off to a flying start which was not a surprise as President Trump was always seen as pro business and growth. A number of executive orders followed the inauguration and focused on business growth and lowering taxes.

However, the biggest decision this week and one which shows some form of growth and maturity from President Trump as opposed to his first term, was his take on tariffs.

Even though President Trump talked tough about protectionist trade policy during his campaign, he decided not to impose tariffs on major trading partners this week. On Thursday night, he eased tensions with China by saying he'd prefer not to use tariffs against them. This sparked a positive reaction in the markets that pushed the S&P 500 to fresh all-time highs.

The S&P 500 has risen 2% this week (at the time of writing), putting it on course for the best start for a new president since Ronald Reagan took office in 1985.

On the FX front, the US dollar faced challenges because President Trump's tariff strategy wasn't expected to drive inflation as much as immediate tariffs would. This coupled with his pledge to bring the cost of living down has stoked hopes that inflation may continue to fall and rate cuts may arrive at a quicker pace than previously thought.

This is a fluid situation and could change as more data and tariff discussions take place.

The Bank of Japan meanwhile did proceed with the expected rate hike of 25 bps as discussed in last week's market outlook. This brings the policy rate to 0.5%, its highest level since October 2008, during the global financial crisis. The Japanese yen climbed sharply after the decision but was unable to consolidate these gains. For a full breakdown on the decision, read BoJ hikes rates, yen pares gains.

The Euro and the GBP have put in impressive runs at the back end of the week with both breaking out of periods of consolidation and run into key levels of resistance.

The commodities complex saw Gold run toward its all time highs, falling just short at the time of writing with a daily high of 2786.88. The gains in Gold look to be down to concerns around tariffs as despite President Trump holding off on tariffs now he did also mention that Canada, Mexico and China may be hit with tariffs on February 1.

Oil prices struggled and President Trump once again played his part. The US President stated on Thursday and Friday that he wants to see OPEC cut the price of Oil. This as well as the potential of tariffs affecting global growth weighed on Oil prices this week.

The crypto sector like US equities were significant beneficiaries of the incoming administration and its policies. For a full read on the impact and way forward for Bitcoin, read Bitcoin (BTC/USD) Volatility Measures are Tightening Up. Is it Time for Another Major Move?

The week ahead: Central bank meetings to the Fore, ECB and Fed

Asia Pacific markets

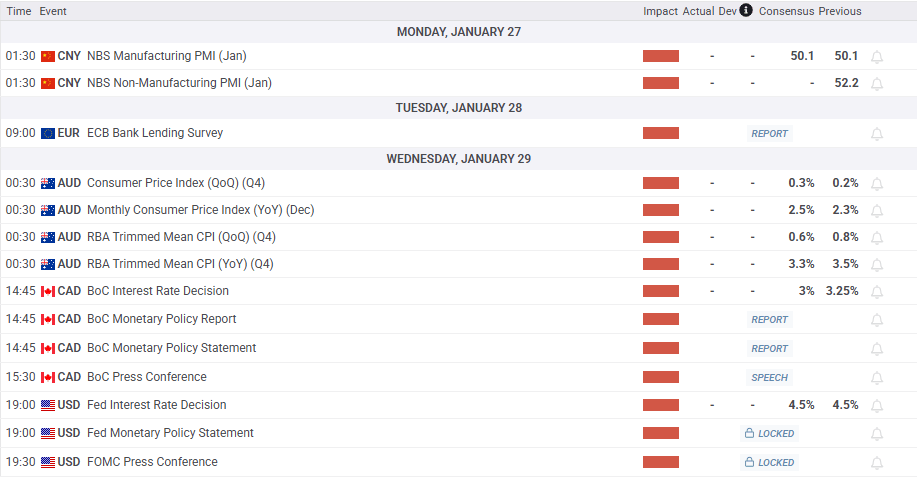

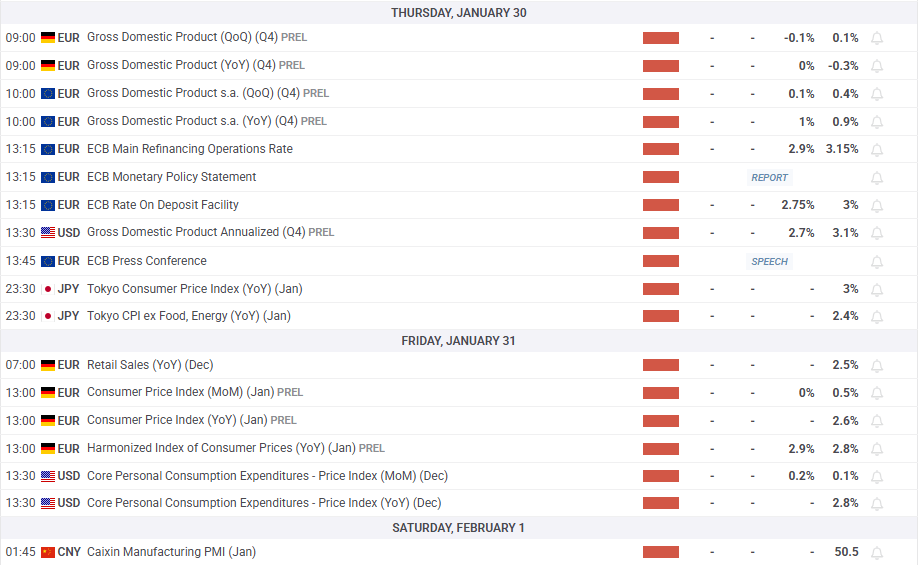

The main focus this week in the Asia Pacific region is month-end data from Japan and another look at China's manufacturing sector with PMI data being released.

From Japan we will be getting the month-end data dump, covering inflation, labor, industrial production, and retail sales. The Tokyo CPI is expected to drop from 3.0% in December to 2.6% in January, thanks to the government's utility subsidies.

The Bank of Japan should watch service prices, which may rise due to better household incomes. The job market remains tight, with unemployment at 2.5%. This will be interesting after the Bank of Japan's rate hike this week, with hope that data continues to trend in a positive direction.

China's Lunar New Year holiday starts next week, so most key data will be released on Monday. Before that, January's PMI data will be out, and I do think a slight increase in the manufacturing PMI to 50.3 from 50.1 in December. Also on Monday, China's December industrial profits are expected to show a year-on-year decline for 2024, and the MLF rate is likely to stay at 2.0%.

Lastly we look at Australia, where we have Q4 inflation data being released with markets expecting a YoY print of 2.5% down from the previous print of 2.8%.

Europe + UK + US

In developed markets, the FOMC and European Central Bank meetings will be the main focus.

The US Fed cut rates by 100 basis points in late 2024 and now wants to see signs of economic weakness and lower inflation before making more cuts. Fed policymakers also remained concerned about the impact of potential tariffs on inflation as indicated by the previous meeting minutes.

The tone adopted by Fed Chair Powell as well as his remarks will no doubt be closely monitored. Any references to slower or more aggressive rate cuts are likely to shake up markets.

In Europe we have the European Central Bank meeting. Unlike the lead-up to the ECB's December meeting, there's been little public discussion before next week's meeting. There's a growing agreement on the need for more rate cuts as growth continues to struggle. ECB President Christine Lagarde hinted that a 25 basis point rate cut next week is almost certain, and more cuts are likely to follow.

GDP data for the Euro Area will also be released which should confirm the sluggish growth mentioned as the reason for further rate cuts. The Euro Area may also be suffering from a weaker winter as well before growth improves which leads me to believe that a rate cut is necessary.

Chart of the week - US Dollar Index (DXY)

This week's focus is on the US Dollar Index (DXY) after it continued its descent from two-year highs.

The Dollar Index struggled this week after breaking below the ascending trendline on Monday in the aftermath of the Presidential Inauguration.

Since then the DXY has extended its losses with a bearish Thursday and Friday.

The index has now bounced off a key area of support at the 107.20 handle which is the upper band of the support zone that stretches till 106.85.

A bounce from here could push the DXY back toward resistance at the 108.00 handle before the 108.50 and 109.00 come into focus.

Now if the DXY is able to break below the support zone between 107.20 106.85 then attention turns to key support areas at 106.13 and 105.63.

US Dollar Index (DXY) Daily Chart - January 24, 2025

Key levels to consider:

Support

- 106.85

- 106.13

- 105.63

Resistance

- 108.00

- 108.49

- 109.00

Author

Zain Vawda

MarketPulse

Zain is a seasoned financial markets analyst and educator with expertise in retail forex, economics, and market analysis.